On Monday morning, investors woke up to plunging stock markets as the “Yen Carry Trade” blew up. While media headlines suggested the sell-off was due to fears of a recession, slowing employment growth, or fears over Israel and Iran, such is not the case. As previously noted, headline events like the economy, employment, or geopolitical conflict are quickly evaluated and hedged by market participants. However, as we saw on Monday, what sparks a global sell-off is...

Read More »The Bull Market – Could It Just Be Getting Started?

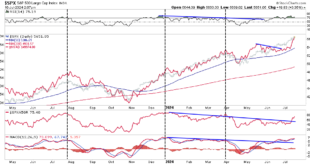

We noted last Friday that over the previous few years, a handful of “Mega-Capitalization” (mega-market capitalization) stocks have dominated market returns and driven the bull market. In that article, we questioned whether the dominance of just a handful of stocks can continue to drive the bull market. Furthermore, the breadth of the bull market rally has remained a vital concern of the bulls. We discussed that issue in detail in “Bad Breadth Keeps Getting Worse,”...

Read More »Deviations From Long-Term Growth Trends Back To Extremes

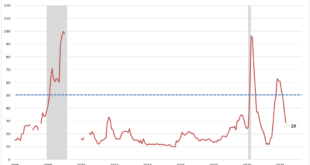

In 2022, we discussed the market’s deviations from long-term growth trends. That discussion centered on Jeremy Grantham’s commentary about market bubbles. To wit: “All 2-sigma equity bubbles in developed countries have broken back to trend. But before they did, a handful went on to become superbubbles of 3-sigma or greater: in the U.S. in 1929 and 2000 and in Japan in 1989. There were also superbubbles in housing in the U.S. in 2006 and Japan in 1989. All five...

Read More »Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year. To wit: “It has been two years since forecasters felt this good about the economic outlook. In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the chances of a recession within the next year to 29% from 39% in the January survey. That was the lowest probability...

Read More »Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border. Concurrently, many young college graduates continue to complain about the inability to receive a job offer. As noted recently by CNBC: The job market looks solid on paper. According to government data, U.S. employers added 2.7...

Read More »Blackout Of Buybacks Threatens Bullish Run

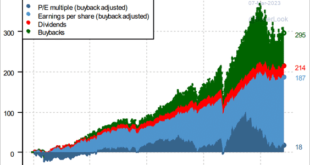

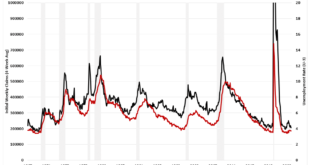

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote. “The chart below via Pavilion Global Markets shows the impact stock buybacks have had on the market over the last decade. The decomposition of returns for the...

Read More »Digital Currency And Gold As Speculative Warnings

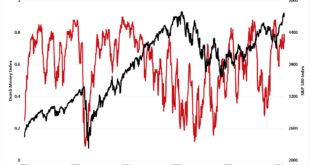

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites. “Such is unsurprising, given that retail investors often fall victim to the psychological behavior of the “fear of missing out.” The chart below shows the “dumb money index” versus the S&P...

Read More »Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies. From a portfolio management perspective, we must understand what happens during election years concerning the stock market and investor returns. Since 1833, the S&P 500 index has...

Read More »Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average American as follows. “New...

Read More »Rethinking “safe” investments

Part I of II by Claudio Grass, Hünenberg See, Switzerland To most observant citizens and diligent investors it is surely quite obvious that the current monetary, fiscal and banking system is inherently flawed, hopelessly unjust, corrupt, unsustainable and simply destined to collapse sooner or later. With every (predictable) recession and every (foreseeable) crisis, this structure gets weaker; its very own architects increasingly second-guess it, mistrust and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org