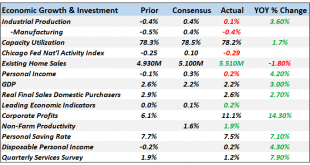

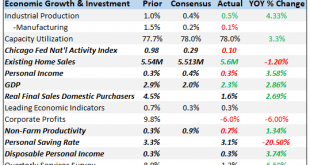

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed. On a more positive note, housing seems to have found its footing with lower rates and employment is still fairly robust....

Read More »Bi-Weekly Economic Review:

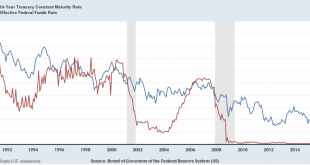

Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility. There has been for some time now a large short position held by speculators in the futures market for Treasuries. Speculators have been making large and consistent bets that Treasury prices would fall....

Read More »Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy. As I said last month, despite the recent run up in rates, the...

Read More »Sources of Low Real Interest Rates

In a (December 2015) Bank of England Staff Working Paper, Lukasz Rachel and Thomas Smith dissect the global decline in long-term real interest rates over the last thirty years. A summary of their executive summary: Market measures of long-term risk-free real interest rates have declined by around 450bps. Absent signs of overheating this suggests that the global neutral rate fell. Expected trend growth as well as other factors affecting desired savings and investment determine the neutral...

Read More »High Labor Productivity in France and Germany

On his (Le Monde) blog, Thomas Piketty emphasizes that labor productivity in France and Germany is as high as in the US, and much higher than in Italy or the UK (his figures here and here).

Read More »Toward A New World Order, part III

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the...

Read More »Secular Stagnation Skepticism

I was asked to play devil’s advocate in a debate about “secular stagnation.” Here we go: Alvin Hansen, the “American Keynes” predicted the end of US growth in the late 1930s—just before the economy started to boom because of America’s entry into WWII. Soon, nobody talked about “secular stagnation” any more. 75 years later, Larry Summers has revived the argument. Many academics have reacted skeptically; at the 2015 ASSA meetings, Greg Mankiw predicted that nobody would talk about secular...

Read More »US Labor Market and Monetary Policy

In a blog post, Stephen Williamson argues that the US labor market is doing just fine. Given recent productivity growth, and the prospects for employment growth, output growth is going to be low. I’ll say 1.0%-2.0%. And that’s if nothing extraordinary happens. Though we can expect poor performance – low output and employment growth – relative to post-WWII time series for the United States, there is nothing currently in sight that represents an inefficiency that monetary policy could...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org