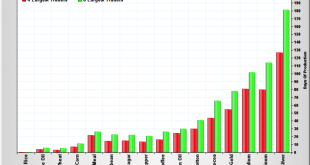

Opportunities in the Junior Mining Sector Maurice Jackson of Proven and Probable has recently interviewed Jayant Bandari, the publisher of Capitalism and Morality and a frequent contributor to this site. The topics discussed include currencies, bitcoin, gold and above all junior gold stocks (i.e., small producers and explorers). Jayant shares some of his best ideas in the segment, including arbitrage opportunities...

Read More »“Strong Dollar”, “Weak Dollar” – What About a Gold-Backed Dollar?

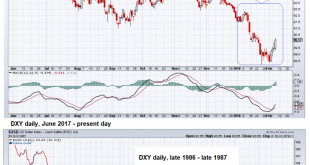

Contradictory Palaver The recent hullabaloo among President Trump’s top monetary officials about the Administration’s “dollar policy” is just the start of what will likely be the first of many contradictory pronouncements and reversals which will take place in the coming months and years as the world’s reserve currency continues to be compromised. So far, the Greenback has had its worst start since 1987, the year of...

Read More »Monetary Metals Brief 2018

Short and Long Term Forecasts Predicting the likely path of the prices of the metals in the near term is easy. Just look at the fundamentals. We have invested many man-years in developing the theory, model, and software to calculate it. Every week we publish charts and our calculated fundamental prices. However, predicting the outlook for a longer period of time is much harder. The fundamental shows the relative...

Read More »Quantum Change in Gold Demand Continues – Precious Metals Supply-Demand Report

Beginning of Post: See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments In this New Year’s holiday shortened week, the price of gold moved up again, another $16 and silver another 29 cents. Or we should rather say the dollar moved down 0.03mg gold and 0.03 grams silver. It will make those who borrow to short the dollar happy… Let’s take a look at...

Read More »Gold and Gold Stocks – Patterns, Cycles and Insider Activity, Part 2

Cycles and Sentiment Another recurring pattern consists of the seasonally strong period in gold around the turn of the year, which is bisected by a mid to late December interim low in the gold price. An additional boost can be expected in January and Feburary from the strong seasonal uptrend in silver and platinum group metals as well (to see the seasonal PGM charts, scroll down to our addendum to this recent article...

Read More »Gold and Gold Stocks – Patterns, Cycles and Insider Activity, Part 1

Repeating Patterns and Positioning A noteworthy confluence of patterns in gold and gold stocks is in evidence this year. At the close of trading on December 26, the HUI Index has given a (tentative) buy signal by completing a unique chart pattern, which is why we decided to briefly discuss the situation. As usual, things are not as straightforward and simple as they would ideally be, but there is always an element of...

Read More »Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

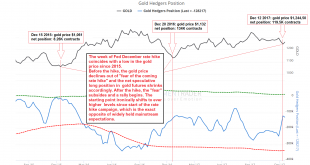

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts – Gold and silver COT suggests bottoming and price rally coming– Speculators cut way back on long positions and added to short bets– Commercials/banks significantly reduced short positions– Commercial net short position saw biggest one-week decline in COMEX history– ‘Big 4’ commercial traders decreased their short positions by 28,800...

Read More »What’s the Point? Precious Metals Supply and Demand Report

Beginning of Post: See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Questions and Answers A reader emailed us, to ask a few pointed questions. Paraphrasing, they are: Who cares if dollars are calculated in gold or gold is calculated in dollars? People care only if their purchasing power has grown. What is the basis good for? Is it just mathematical play for gold...

Read More »Precious Metals Supply and Demand – Thanksgiving Week

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Grain of Salt Required The price of gold fell $7, and that of silver 24 cents. This was a holiday shortened week, due to Thanksgiving on Thursday in the US (and likely thin trading and poor liquidity on Wednesday and Friday). So take the numbers this week, including the basis, with a grain of that once-monetary commodity,...

Read More »The Precious Metals Bears’ Fear of Fridays

Peculiar Behavior In the last issue of Seasonal Insights I have shown that the gold price behaves quite peculiarly in the course of the trading week. On average, prices rise almost exclusively on Friday. It is as though investors in this market were mired in deep sleep for most of the week. Upon this I received a plethora of inquiries from readers regarding the corresponding moves in silver. In response examine the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org