Peculiar Behavior In the last issue of Seasonal Insights I have shown that the gold price behaves quite peculiarly in the course of the trading week. On average, prices rise almost exclusively on Friday. It is as though investors in this market were mired in deep sleep for most of the week. Upon this I received a plethora of inquiries from readers regarding the corresponding moves in silver. In response examine the behavior of the silver market on individual days of the week in this issue of Seasonal Insights. The title of this blog post is a play of words on the title of an early Wim Wender movie, The Goalkeeper’s Fear of the Penalty, which in turn is based on a famous novel by Peter Handke (sometimes the

Topics:

Dimitri Speck considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy, Precious Metals, silver

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Peculiar BehaviorIn the last issue of Seasonal Insights I have shown that the gold price behaves quite peculiarly in the course of the trading week. On average, prices rise almost exclusively on Friday. It is as though investors in this market were mired in deep sleep for most of the week. Upon this I received a plethora of inquiries from readers regarding the corresponding moves in silver. In response examine the behavior of the silver market on individual days of the week in this issue of Seasonal Insights. |

|

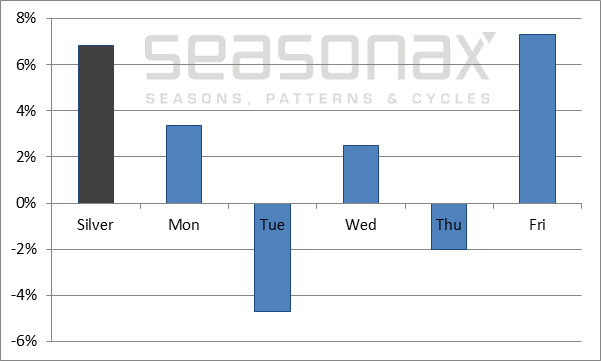

The Pattern in Silver by Days of the WeekFirst let us explore the performance of silver by days of the week. The black bar in the illustration below shows the annualized performance of silver in USD since 2000, the blue bars show its annualized performance on individual days of the week over the same time period. I have measured the daily returns from one daily closing price to the next during COMEX trading hours; e.g. the Tuesday performance shows the average percentage change from the close on Monday to the close on Tuesday. As you can see, Friday stands out quite positively in silver as well. It achieved an average annualized gain of 7.32%, which was even stronger than the corresponding 6.83% gain in gold! In contrast to the gold market, the average moves in the remaining days of the week were greater as well, especially on Tuesdays, which generated an average decline of 4.69%. In short, anomalies related to individual days of the week are quite pronounced in the silver market as well. These patterns were measured over a span of 4,585 trading days, which suggests that they are not random occurrences. |

Silver Perfomance, 2000 - 2017(see more posts on silver, ) |

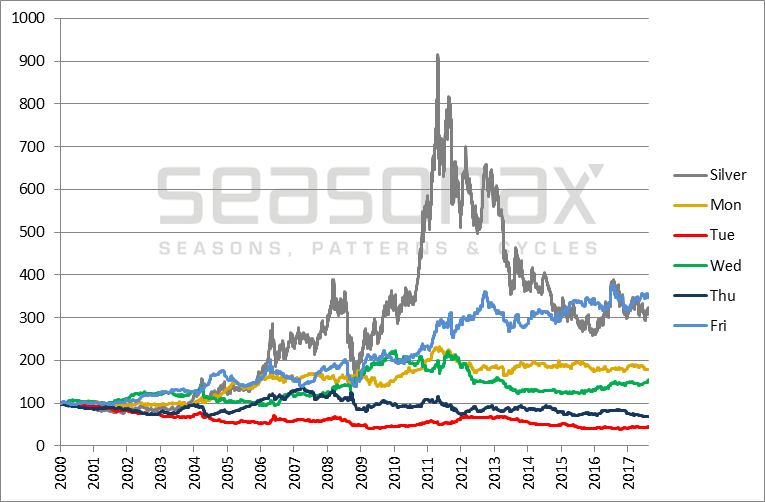

The Days of the Week Under the Magnifying GlassHow exactly did these patterns evolve over time? The next chart shows the indexed returns on silver since the turn of the millennium in gray, and the cumulative returns achieved on specific days of the week in other colors. |

Silver Performance, 2000 - 2017(see more posts on silver, ) |

As the chart illustrates, the blue line that depicts the cumulative performance on Fridays has risen quite steadily over almost the entire 17 year span. By contrast, the remaining days of the week were a mixed bag, generating sizable losses in quite a few years. The main conclusion is that a potentially exploitable intra-week pattern exists in the silver market as well.

It is worth noting in this context that the relative uniformity of the patterns in precious metals on individual days of the week is in stark contrast with their annual seasonality. As can be easily ascertained with Seasonax, the annual seasonal trend in gold differs significantly from that in silver.

[ed note by PT: The above mentioned phenomenon was previously discussed here. A study of the 45-year seasonal patterns in gold and silver shows that the seasonally strongest periods of the two metals are situated at different time periods of the year. Most people are probably not aware of these differences, as gold and silver tend to correlate very closely in the short term, but they are actually quite significant. Obviously, this information is quite useful for anyone trading precious metals].

Take Advantage of Statistical Anomalies in Gold and Silver

As this study clearly shows: anomalous patterns in the performance of precious metals on individual days of the week are very pronounced. The corresponding anomalies in the gold market and the HUI Index, were discussed in the previous issue of Seasonal Insights. Traders, investors and dealers alike can take advantage of these patterns and quickly find statistical anomalies in other markets with the Seasonax app available on Bloomberg and Thomson-Reuters. While nothing is ever guaranteed in the markets, you can definitely let probabilities work in your favor.

Tags: Featured,newsletter,On Economy,Precious Metals,silver