Die Probleme dieser Welt – es sind nicht wenige – scheinen an der Börse abzutropfen. Der US-Index S&P 500 zum Beispiel hat seit Anfang Jahr rund 9 Prozent an Wert gewonnen. Woher diese Stärke? Asset Manager Pimco liefert Antworten.

Read More »Wie in stürmischen Märkten Stabilität wahren

In der ersten Jahreshälfte 2025 konnten Anleger in allen wichtigen Anlageklassen deutliche Gewinne verbuchen – indes unter teils erheblichen Marktschwankungen. Für den weiteren Jahresverlauf erwartet Anleihen-Spezialist Pimco ein ähnliches Bild.

Read More »«Fed dürfte Zinsen erst im Herbst senken»

Tiffany Wilding, Ökonomin bei PIMCO, rechnet im Jahresverlauf mit einer Abschwächung des US-Arbeitsmarkts. Dieser ist für Wilding ein entscheidender Faktor für die US-Geldpolitik. Erste Reaktionen der Fed erwartet sie jedoch frühestens im Juli, wahrscheinlicher im September. Der nächste Zinsentscheid des Fed steht am Mittwoch 7. Mai an.

Read More »PIMCO lanciert «Diversified Private Credit Fund»

Ziel des neuen Fonds ist es laut Mitteilung, vermögenden Investoren in Europa Zugang zu einem breiten Anlageuniversum im Private-Credit-Segment zu bieten. Dabei handelt es sich um eine Evergreen-Strategie mit Fokus auf sektorübergreifende Kreditvergabe im privaten Marktsegment.

Read More »Im US-Schuldenstreit zeichnet sich eine Lösung ab

In die Verhandlungen über die US-Schuldenobergrenze kommt offenbar Bewegung. Im Streit, der seit Tagen die Finanzmärkte belastet, seien «stetige Fortschritte» zu verzeichnen, wie die Regierung und Vertreter im Parlament verlauten. Die Märkte reagierten erleichtert, zusätzlich getrieben durch gute Konjunkturdaten.

Read More »Nobelpreisträger wird Berater bei Pimco

Richard Thaler ist neuer Senior Advisor Retirement and Behavioral Economics bei Pimco. Der Nobelpreisträger soll Pimco zu einem besseren Verständnis des menschlichen Verhaltens in Bezug auf Entscheidungsfindungen verhelfen. Dadurch erhoffen sich die Investmentmanager neue Anlagemöglichkeiten zu konzipieren.Pimco hat Richard Thaler zum Senior Advisor Retirement and Behavioral Economics ernannt. Der renommierte Wirtschaftsexperte und Charles R. Walgreen, Distinguished Service...

Read More »Risk Off: Global Stocks Slide As “Fire And Fury” Results In “Selling And Fear”

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday’s sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained...

Read More »Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Negative Consumer Financing Rates in Germany Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one’s means. Curiously, it was just a month ago when an...

Read More »Japan Banks May Soon Pay Borrowers To Take Out Loans

Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one's means. Curiously, it was just a month ago when an offer was spotted in Germany offering a negative -1% rate on small consumer loans issued by Santander Bank. ...

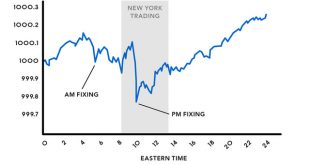

Read More »Every Single Bloody Market Is Manipulated … See For Yourself

Gold and Silver Are Manipulated Deutsche Bank admitted today that it participated with other big banks in manipulating gold and silver prices. In 2014, Switzerland’s financial regulator (FINMA) found “serious misconduct” and a “clear attempt to manipulate precious metals benchmarks” by UBS employees in precious metals trading, particularly with silver. Reuters reported: Swiss regulator FINMA said on Wednesday that it found a “clear attempt” to manipulate precious metals benchmarks during...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org