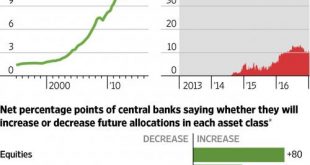

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »“This Is Total Chaos” – Venezuela Shuts Colombia Border To Stop “Mafia” Currency Smuggling

As if things were not already chaotic enough in the socialist utopia of Venezuela, following President Nicolas Maduro’s decision to follow Indian PM Modi’s playbook and announce that the nation’s largest denomination bill (100-Bolivars – worth around 3c) will be pulled from circulation in 72 hours, he has tonight closed the border to Colombia to crackdown on currency smuggling by so-called “mafias”. As AP reports,...

Read More »European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

Submitted by Ronan Manly, BullionStar.com The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB...

Read More »Risk Happens Fast

By Chris at www.CapitalistExploits.at As a teenager brimming with testosterone my reptilian brain loved action movies. Top of my list were Steven Seagal movies. Clearly it wasn’t for his acting skills, which are only marginally better than Barney the dinosaur. What I loved about Seagal was that he was both deadly and terribly fast. His opponents had mere seconds before their arms, legs, or other bones were snapped like...

Read More »Jim Grant Puzzled by the actions of the SNB

Retaken from Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold. From multi-billion bond buying programs to negative interest rates and probably soon helicopter money: Around the globe, central bankers are...

Read More »Cashless Society – Is The War On Cash Set To Benefit Gold?

Submitted by Jan Skoyles via GoldCore.com, Introduction Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society. The Presidential campaign has been dominated for months and again this week by the...

Read More »Financial Repression Is Now “In Play”

Submitted by Gordon T Long via FinancialRepressionAuthority.com, A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and...

Read More »Forget ‘Great, Again’; Make America Switzerland?

from Dilbert Creator Scott Adams’ blog, Following an excellent post-mortem on the debate (read here), Adams changes tack quite interestingly… I talked to a Swiss local yesterday about American politics. He says everyone in Switzerland is following the race closely. He favors Trump because he thinks Trump would be better for the global economy. I asked if anyone he knows in Switzerland is worried about...

Read More »Why Krugman, Roubini, Rogoff And Buffett Hate Gold

Why Krugman, Roubini, Rogoff And Buffett Dislike Gold By Jan Skoyles Edited by Mark O’Byrne A couple of weeks ago an article appeared on Bitcoin Magazine entitled ‘Some economists really hate bitcoin’. I read it with a sigh of nostalgia. As someone who has been writing about gold for a few years, I am used to reading similar criticisms as those bitcoin receives from mainstream economists, about gold. As with...

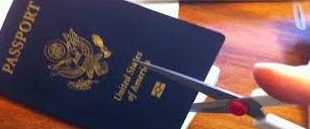

Read More »Un-Becoming American – One Man’s Painful Journey To Renouncing Citizenship

Submitted by ‘Kevnice’ via ForeignByNature.com, In April 2012, I returned to Switzerland – my country of birth – to commence a new phase of my adult life. Naturally, one of the first steps to undertake when establishing oneself in a new country is to open a bank account. I went down to the local Raiffeisen bank branch in the village of Aesch, Luzern, where my relatives and ancestors had lived and worked as farmers for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org