Bernanke Redux Somehow, former Federal Reserve Chairman Ben Bernanke found time from his busy hedge fund advisory duties last week to tell his ex-employer how to do its job. Namely, he recommended to his former cohorts at the Fed how much they should reduce the Fed’s balance sheet by. In other words, he told them how to go about cleaning up his mess. Praise the Lord! The Hero is back to tell us what to do! Why, oh...

Read More »Swiss-German ‘spy’ drama raises hackles – and questions

The arrest of a suspected Swiss spy in Germany has raised questions about what roles the Swiss secret service, the state public prosecutor and UBS bank played in the affair. The 54-year-old man, known as Daniel M, is accused of spying on the German tax authorities to find out who sold stolen Swiss banking data. His arrest more than a week ago has prompted a diplomatic...

Read More »FX Weekly Review, May 08-13: Euro rises far above 1.09 CHF, for how long?

Swiss Franc The Swiss franc was the weakest of the majors. Its 1.7% fall was the largest in six months. Over the past month, the euro has rallied strongly against the Swiss franc. The 3.2% rally has seen the euro reach heights not see since last September. Thanks to the win of the pro-euro Macro, FX traders went long Euro and short CHF. The euro rose up to 1.0980. How long this momentum will last is still the question,...

Read More »FX Daily, May 12: Markets Becalmed Ahead of US data and Weekend

Swiss Franc EUR/CHF - Euro Swiss Franc, May 12(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc rate has broken 1.30 this week as sterling has risen and investors confidence over the outlook for politics in the Eurozone increased. The election of Emmanuel Macron has removed the uncertainty over the increase in Europe of right-wing parties which could have threatened the...

Read More »SocGen: Beware The Ghost Of 1993

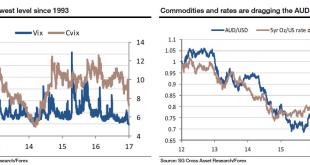

With Monday’s financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen’s Kit Juckes with his overnight note,...

Read More »Swiss happy with chemical controls in Geneva

Asbestos being removed from a Zurich tower block in 2003 (Keystone) Despite a lack of progress to limit products such as asbestos and the herbicide paraquat, Switzerland is largely pleased with the results of a summit on chemicals and hazardous waste held in Geneva. “We obtained much more than we expected,” Franz Perrez, the head of international affairs at the Federal Environment Office, told the Swiss News Agency on...

Read More »The Triumph of Hope over Experience

The Guessers Convocation On Wednesday the socialist central planning agency that has bedeviled the market economy for more than a century held one of its regular meetings. Thereafter it informed us about its reading of the bird entrails via statement (one could call this a verbose form of groping in the dark). A number of people have wondered why the Fed seems so uncommonly eager all of a sudden to keep hiking rates...

Read More »The Wrong People Have An Innate Tendency To Stand Out

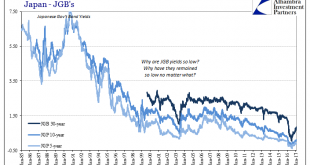

I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of...

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

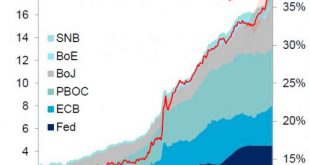

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More »FX Daily, May 11: Canadian and New Zealand Dollars Get Whacked, While Greenback Consolidates

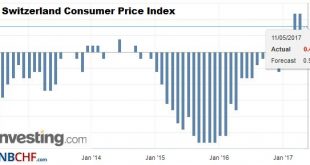

Swiss Franc Switzerland Consumer Price Index (CPI) YoY, April 2017(see more posts on Switzerland Consumer Price Index, ) Source: investing.com - Click to enlarge FX Rates The US dollar has been mostly confined to about a 30 pip range against the euro and yen in Asia and the European morning. Sterling is under a little pressure after a series of poor data, including larger than expected falls in manufacturing and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org