FOMC Strategy Revisited As readers know, investment and trading decisions can be optimized with the help of statistics. One way of doing so is offered by the FOMC meeting strategy. The rate hikes are actually leading somewhere – after the Wile E. Coyote moment, the FOMC meeting strategy is especially useful - Click to enlarge A study published by the Federal Reserve Bank of New York in 2011 examined the effect of...

Read More »FX Daily, January 29: A Brief Word

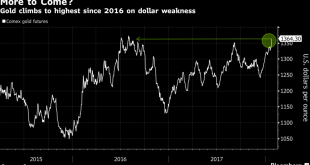

Swiss Franc The Euro has fallen by 0.33% to 1.1559 CHF. EUR/CHF and USD/CHF, January 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is modestly firmer, but nothing to suggest a outright correction rather than consolidation. However, have a dramatic drop over the past month, much more than we think is justified by macroeconomic developments and interest...

Read More »Swiss fact: nearly half of Swiss rental properties owned by individuals

If you rent a home in Switzerland it is more likely to belong to an individual than a big real estate company or pension fund. © Kevkhiev Yury | Dreamstime.com - Click to enlarge In 2017, 49% of residential rental properties in Switzerland were owned by individuals, according to Statistics published by the Swiss Federal Statistical Office. The highest rate of rental home ownership by individuals was in the...

Read More »Silver Bullion: Once and Future Money

Silver Bullion: Once and Future Money – “Silver is as much a monetary metal as gold” – Rickards – U.S. following footsteps of Roman Empire which collapsed due to currency debasement (must see table) – Silver bullion is set to rally due to a combination of supply/demand fundamentals, geopolitical pressures creating safe haven demand, and increasing inflation expectations as confidence in central banking and fiat money...

Read More »December Durable Goods

Durable and capital goods orders and shipments all increased in December by growth rates consistent with those registered in the months leading up to the big storms Harvey and Irma. We continue to find evidence that accelerated growth in October and November was nothing more than the anticipated after-effects cleaning up after those hurricanes. New orders for durable goods (excluding transportation orders) had...

Read More »FX Daily, January 25: And Now, a Word from Draghi

Swiss Franc The Euro has fallen by 0.59% to 1.1656 CHF. EUR/CHF and USD/CHF, January 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates With a backdrop of concern about US protectionism and a possible abandonment of the 23-year old strong dollar policy, and among the weakest sentiment toward the dollar in at least a decade, the ECB takes center stage. What a turn of events...

Read More »Switzerland still competitive despite US tax reforms, says economics minister

The economics minister said the relaunch of its own tax reform plans could help Switzerland stay competitive with the US. (Keystone) - Click to enlarge Swiss Economics Minister Johann Schneider-Ammann says he does not think sweeping US tax reforms will drive American firms from Switzerland. In an interview with the Schweiz am Wochenende newspaper on Saturday, he said Switzerland also has competitive...

Read More »New poll on vote to axe Swiss broadcast fee suggests rejection

A poll run by the media group Tamedia shows a clear majority in favour of rejecting the initiative, dubbed “No Billag”, which aims to end Switzerland’s broadcasting fee. This poll follows one done in December 2017, which showed a majority in favour of the initiative. © Jakkapan Jabjainai | Dreamstime.com - Click to enlarge In December 57% were either fully or quite in favour of voting yes. This time the same percentage...

Read More »Is This The Greatest Stock Market Bubble In History? Goldnomics Podcast

GoldNomics Podcast (Episode 2) Is This The Greatest Stock Market Bubble In History? In our second GoldNomics podcast, we take a look at one of the important financial questions of our day – is this the greatest stock market bubble in history? Listen on iTunes, SoundCloud and BlubrryWatch on YouTube below [embedded content] GoldCore CEO Stephen Flood and GoldCore’s Research Director and world renowned precious metals...

Read More »The Dismal Boom

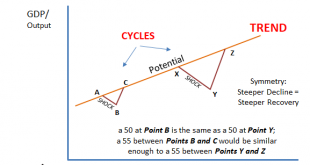

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction. But is every 50 the same? That’s ultimately at...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org