Overview: The market continues to resist the Fed's signal that another 50 bp of hikes may be necessary to ensure inflation is headed toward its target. Previously, the market had rate cuts priced in, and it took some time for the Fed's push back to be accepted. The market converged with the Fed, and this helped the dollar recover. We suspect a similar pattern to play out again. The market does not have even one of the two Fed hikes discounted. As it moves in this...

Read More »More Federal Debt Means More Taxes, Less Growth, and Weaker Real Wages

Since 1960, Congress has raised the debt ceiling 78 times, according to Bloomberg. The process of increasing the debt limit has become so regular that markets barely worry about it. Furthermore, as the 2011 debt ceiling crisis showed, the impact on asset prices happened mostly in emerging economies. In 2011, Turkish and Indian debt were the most negatively impacted, while Treasuries rose. Politicians believe that raising the debt ceiling is a social policy and that...

Read More »The Market Process Is Not a Knowledge Problem

While F.A. Hayek's famous 1945 essay effectively critiques the "perfect information" hypothesis, it is an inadequate explanation of the issue of economic calculation. Original Article: "The Market Process Is Not a Knowledge Problem" [embedded content] Tags: Featured,newsletter

Read More »Why Do We Act against Our Self-Interest?

After reading a few blog entries (see the Defending the Republic series), I have wondered why people who do not seem to benefit from social justice efforts support and endorse them. Why would a male push an agenda designed to deny his rights? Why do companies embrace the environmental, social, and governance agenda when it potentially makes them less competitive through lowered standards, higher costs, and policies that prevent talent from reaching its highest state?...

Read More »Rise of the Effete Authoritarians

Political leaders of the so-called liberal Western regimes are engaging in authoritarian tactics to quell legitimate dissent. But leftists who riot and burn get a free pass. Original Article: "Rise of the Effete Authoritarians" [embedded content] Tags: Featured,newsletter

Read More »Myth #3: Tax Increases Are a Cure for Deficits

Recorded by the Mises Institute in the mid-1980s, The Mises Report provided radio commentary from leading non-interventionists, economists, and political scientists. In this program, we present another part of "Ten Great Economic Myths". This material was prepared by Murray N. Rothbard. Those people who are properly worried about the deficit unfortunately offer an unacceptable solution: increasing taxes. Curing deficits by raising taxes is equivalent to...

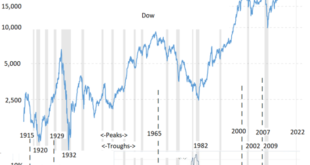

Read More »The Fed Has Rigged the Stock Markets to Crash

The conditions have now aligned for a repeat of the major stock market crashes that have occurred since the founding of the US Federal Reserve Bank (Fed) in 1913. Considering their vast experience and resources, the Fed has to know that their plan to control inflation by raising interest rates rapidly and significantly since 2022, and also tightening credit this year, will likely result in another major crash. Although the Fed has issued vague warnings about the...

Read More »Biden Wants Sanctions for Uganda Because Its Government Passed Anti-LGBT Laws

Just in case you wrongly thought sanctions had anything to do with national security: Biden wants to sanction the people of a small African country over anti-LGBT laws. Original Article: "Biden Wants Sanctions for Uganda Because Its Government Passed Anti-LGBT Laws" [embedded content] Tags: Featured,newsletter

Read More »Opposing Critical Race Theory Doesn’t Make You a “White Supremacist”

Much of critical race theory and “antiracism” is aimed at pulling people apart, not bringing them together. To oppose such theories and practices is not racist in itself. Original Article: "Opposing Critical Race Theory Doesn't Make You a 'White Supremacist'" [embedded content] Tags: Featured,newsletter

Read More »Coto Mixto: Anarchy in Galicia

People commonly believe that a society without central political authority will dissolve into chaos. But a small kingdom within Spain existed peacefully for seven hundred years under what we would call anarchy. Original Article: "Coto Mixto: Anarchy in Galicia" [embedded content] Tags: Featured,newsletter

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org