What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Biden’s parting deluge of deceit deserves damning

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Kamala Harris is awful

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »United in economic stagnation and false fears

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »What Project 2025 says about the Fed

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »No exceptions, please!

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »The new Iranian president sets the stage for negotiations

From Mullah to ProgressiveOn May 19, 2024, the president of Iran, Ebrahim Raisi, was killed in a helicopter crash in the mountains of Iran. He was a Shi’ite cleric and lawyer who won the presidency in 2021. After his death, a man by the name of Masoud Pezeshkian won the following presidential election. Pezeshkian is a polar opposite of the previous president Raisi; he has been called a reformist by Western and Middle Eastern media outlets.The New York Times has...

Read More »A Fed rate cut will not solve our economic problems

Last Friday, the Bureau of Labor Statistics reported that the unemployment rate had jumped to 4.3% in July. The pace at which unemployment is rising matches the speed often found in the early stages of a recession — an indicator known as the Sahm Rule. The triggering of the Sahm Rule sparked a panic in the stock market that only grew at the start of this week after other economies, especially in East Asia, experienced even sharper downturns.Many...

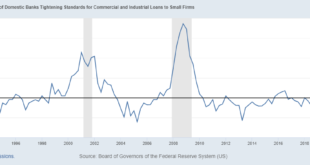

Read More »Market Morsel: SLOOSing

The Senior Loan Officer Survey came out yesterday and I’m sure you’ve been waiting on pins and needles, as I have, to see the results. Okay, maybe you had better things to do. I sure hope so because it isn’t exactly riveting. Here’s the description from the Fed’s website: Survey of up to eighty large domestic banks and twenty-four U.S. branches and agencies of foreign banks. The Federal Reserve generally conducts the survey quarterly, timing it so that results are...

Read More »Pound Sterling slumps to near 1.2700 on global risk-aversion

The Pound Sterling falls against the US Dollar below 1.2700 amid weak appeal for risk-sensitive currencies. Investors worry that the US economy could enter a recession. The British currency will be guided by market speculation for BoE rate cuts. The Pound Sterling (GBP) extends its downside below 1.2700 against the US Dollar (USD) in Tuesday’s New York session. The GBP/USD pair weakens as the US Dollar steadies after rebounding from fresh...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org