«Für uns ist Technologie kein Trend, sondern ein Wettbewerbsvorteil. Wir stehen an der Spitze der Integration von künstlicher Intelligenz», sagt Laura Geiger-Pancera, Country Head J.P. Morgan Asset Management Schweiz im Interview.

Read More »J.P. Morgan mit aktiven ETFs auf Aktien und Anleihen von Schwellenländern

Laut Mitteilung von J.P. Morgan Asset Management erweitert der erste aktive ETF für Lokalwährungsanleihen das Angebot auf 14 aktiv gemanagte Anleihen-ETFs.

Read More »Gold is money – everything else is credit!

What physical precious metals investors can expect 2023 and beyond Throughout the better part of 2022 there has been one question that has consistently, and predictably, popped up in conversations with my friends, clients and readers. Those who know me and are familiar with my ideas are well aware of my position on precious metals and the multiple roles they serve, so I can’t blame them for them for being curious whether I still “stick to my guns” in this era of irrationality in...

Read More »“Kein Grund, sich von Aktien abzuwenden”

Regional betrachtet gib es bei den Anlegern momentan keine besonderen Präferenzen. (Bild: Phokawattana/Shutterstock.com) Value- oder Growth-Aktien? J.P. Morgan stellt in ihrer Analyse der globalen Aktienmärkte fest, dass Anleger in diesem Jahr erneut sowohl auf langfristige Gewinner als auch auf defensive Aktien setzten.Trotz schwacher Konjunkturdaten und Unternehmensgewinne verlief die erste Jahreshälfte gemäss Paul Quinsee, Managing Director und Global Head of Equities bei J.P....

Read More »J.P. Morgan AM: Anleger müssen den Horizont erweitern

Statt Geld in den klassischen Anlagehäfen zu parkieren, sollten Anleger nach Alternativen suchen. Im anhaltenden Niedrigzinsumfeld müssen Anleger jenseits klassischer Anlagehäfen nach Ertragsquellen suchen, meint Tilmann Galler, globaler Kapitalmarktstratege bei J.P. Morgan Asset Management.Die klassische Diversifizierung über Aktien und Anleihen kann im anhaltenden Niedrigzinsumfeld nur bedingt helfen. „Der Spielraum für Kursgewinne von Staatsanleihen zum Ausgleich eines...

Read More »Dear Jamie Dimon: Predict the Crash that Takes Down Your Produces-Nothing, Parasitic Bank and We’ll Listen to your Bitcoin “Prediction”

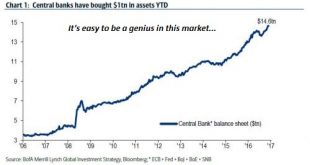

This is the begging-for-the-overthrow-of-a-corrupt-status-quo economy we have thanks to the Federal Reserve giving the J.P. Morgans and Jamie Dimons of the world the means to skim and scam the bottom 95%. Dear Jamie Dimon: quick quiz: which words/phrases are associated with you and your employer, J.P. Morgan? Looting, pillage, rapacious, exploitive, only saved from collapse by massive intervention by the Federal...

Read More »Currency Risk That Isn’t About Exchange Values (Eurodollar University)

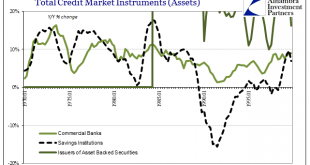

This week the Bureau of Economic Analysis will release updated estimates for Q2 GDP as well as Personal Consumption Expenditures (PCE) and Personal Incomes for July. Accompanying those latter two accounts is the currently preferred inflation standard for the US economy. The PCE Deflator finally hit 2% and in two consecutive months, after revisions, earlier this year. - Click to enlarge The inability of consumer...

Read More »We Need To Define The ‘Shadows’, And All Parts of Them; or, ‘Rising Dollar’ Kills Another Recovery Narrative

JP Morgan’s CEO Jamie Dimon caused a stir yesterday with his 45-page annual letter to shareholders. The phrase that gained him so much widespread attention was, “there is something wrong with the US.” Dimon mentioned secular stagnation and correctly surmised it was the right idea if for the wrong reasons. He then gave his own which included a litany of globalist agenda items, including not enough access to mortgages. I...

Read More »The Donald Versus Killary: War or Peace?

[unable to retrieve full-text content]War: A Warning from the Past. Although history does not exactly repeat itself, it does provide parallels and sometimes quite ominous ones. Such is the case with the current U.S. Presidential election and the one which occurred one hundred years earlier.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org