We’ve got to change our ornithological nomenclature. Hawks become doves because they are chickens underneath. Doves became hawks for reasons they don’t really understand. A fingers-crossed policy isn’t a robust one, so there really was no reason to expect the economy to be that way. In January 2019, especially the past few days, there are so many examples of flighty birds. Here’s an especially obvious, egregious one...

Read More »Living In The Present

The secret of health for both mind and body is not to mourn for the past, nor to worry about the future, but to live in the present moment wisely and earnestly. Buddha Review It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable...

Read More »Why Do Investors Tolerate It, Report 17 Dec 2018

For the first time since we began publishing this Report, it is a day late. We apologize. Keith has just returned Saturday from two months on the road. Unlike the rest of the world, we define inflation as monetary counterfeiting. We do not put the emphasis on quantity (and the dollar is not money, it’s a currency). We focus on the quality. An awful lot of our monetary counterfeiting occurs to fuel consumption spending....

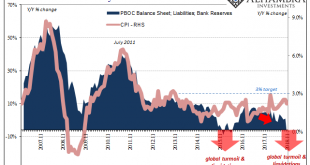

Read More »China Going Back To 2011

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of...

Read More »Inflation, Report 2 Dec 2018

What is inflation? Any layman can tell you—and nearly everyone uses it this way in informal speech—that inflation is rising prices. Some will say “due to devaluation of the money.” Economists will say, no it’s not rising prices per se. That is everywhere and always the effect. The cause, the inflation as such, is an increase in the quantity of money. Which is the same thing as saying devaluation. It is assumed that each...

Read More »Monthly Macro Monitor – November 2018

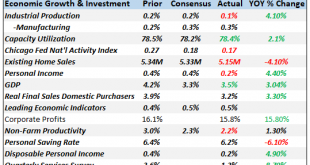

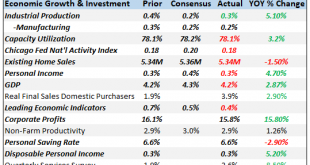

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral. Clarida last week said the FF rate was close to neutral and that future hikes should be “data...

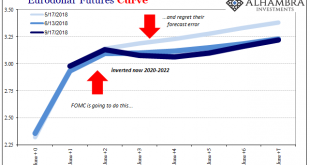

Read More »Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword. Way back in 2012, under Bernanke’s direction officials would...

Read More »Another ‘Highest In Ten Years’

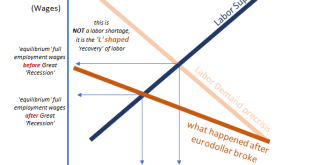

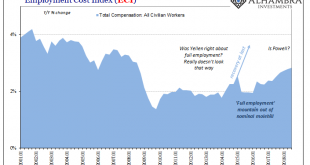

Upon the precipice of the Great “Recession”, US workers were cushioned to some extent by what economists call sticky wages. Before the Great Depression, as well as during it, companies would attempt to deal with looming economic contraction by cutting pay rates before workers. Nowadays, the intent is reversed; businesses will try to keep core workers by keeping pay rates as steady as possible while instead shedding...

Read More »Monthly Macro Monitor – October 2018

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly. The most common explanation for the pullback in stocks – 6% doesn’t even qualify as a correction – is rising interest rates but I think it is a...

Read More »Textbook Falling Interest Behavior

Costco This is a textbook case. Well, it would be if there was a textbook that presented the dynamics of the rising and falling interest rate cycles. Costco is spending over a quarter billion dollars, to make a capital investment in chicken processing. This is not the typical entrepreneurial investment, which seeks to increase margins by serving an unserved or underserved demand. This is an investment made with...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org