U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There US Treasury Secretary Steve Mnuchin visits Fort Knox Gold Later tweeted ‘Glad gold is safe!’ Only the third Treasury Secretary to visit the fortified vault, last visit was 1948 Last Congressional visit was 1974 Speculation over existence of gold in Fort Knox is rife Concerns over Federal Reserves lack of interest in carrying to an audit on gold Gold was last counted in 1953, nine years before Mnuchin was born Mnuchin may be...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

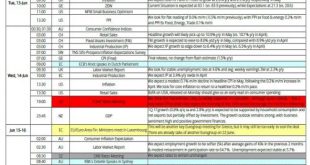

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »History of Gold – Interesting Facts and Changes Over 50 Years

History of Gold - How the gold industry has changed over 50 years Thomson Reuters GFMS have compiled an interesting high level history of the gold industry in the last fifty years. Topics covered and interesting historical facts to note include: - Gold market size- Gold mine production "peaked in 2015"- South African production collapse from 1,000 tonnes- South African gold was flown to London and Zurich and an airliner had its own designated...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

Read More »As Central Bankers Spin

Posted with permission and written by Tim Taschler, Sprott Global I know that I resemble the old guy in this cartoon, standing by helplessly as I watch central bankers experiment with the global economy. Bubbles are blown, again, in several asset classes. Negative interest rates have become an acceptable concept, as if they are just words and have no real economic meaning. Stock markets trade based on the next set...

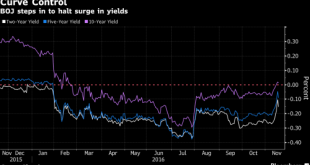

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

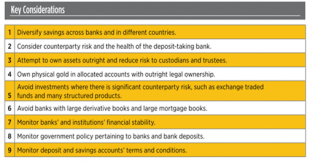

Read More »Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland's largest insurance companies, have been moving cash out of Irish bank deposits and into bonds. Revelations regarding deposit bail-in risks came in the wake of warnings of a new property crash centred on the housing market in Ireland. The former deputy governor of the Central Bank warned in an op-ed in a leading international financial publication, Project...

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

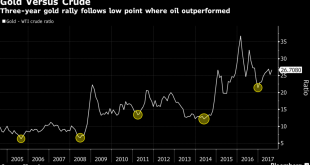

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

Read More »Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and concentrated than before the financial crisis, energy loans being an accident waiting to happen, the markets having veto power over the Fed, and gold having more room to run. * * * Mr. Bianco, negative interest are causing a lot of stir at the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org