One year ago, when it was still widely accepted conventional wisdom that NIRP would “work” to draw out money from savers who are loathe to collect nothing (or in some cases negative interest) from keeping their deposits at the bank, and would proceed to spend their savings, either boosting the stock market or the economy, we showed research from Bank of America demonstrating that far from promoting dis-saving, those...

Read More »US To Seize $1 Billion In Embezzled Malaysian Assets Which Goldman Sachs Helped Buy

The last time we wrote about the long-running saga of the scandalous collapse and constant corruption at the Malaysian state wealth fund, 1MDB, which also happened to be an unconfirmed slush fund for president Najib, was a month ago when we learned that the NY bank regulator was looking into fundraising by the fund’s favorite bank, Goldman Sachs. Then overnight, the story which already seemed like it has every possible...

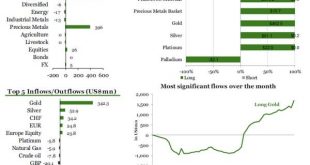

Read More »ETF Securities Reports Biggest One-Day Gold Inflow Since Financial Crisis

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and...

Read More »Who Is The “European Movement” And Why The Answer May Change How You Vote On “Brexit”

Werner’s main points: The “EU Movement” has been created by the US Government and their secret services in order centralise their influence over Europe. Big business, banks, central banks and the IMF want to excercise their power through unelected officials. The free trade area with the EU is beneficial and will surely be maintained, even in the Brexit case. The election outcome is not so clear as it seems to the...

Read More »In Historic First, Singapore Shuts Local Private Bank Due To “Worst Gross Misconduct” Is Has Ever Seen

Following the demise of the thousand year-long tradition of Swiss banking secrecy, crushed virtually overnight by Barack Obama's demands to make the central European nation's banking industry transparent, one of the major consequences was the shift in money laundering from Geneva and Zurich to the latest and greatest "anonymous" banking and tax evasion hub located halfway around the world, namely Singapore. And overnight, we got the first shot across the bow of the city state's "Swiss banking...

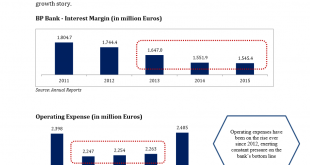

Read More »Veritaseum Blockchain-based Bank Research Hits Another Home Run – Banco Popular Shown to be Bear Stearns Redux!

During the months of March and April of 2016 we released a series of proprietary research reports indicating signficant weakneses that we found in the European banking system and released it for sale through the blockchain (reference The First Bank Likely to Fall in the Great European Banking Crisis). This was performed by the same macro forensic and fundamental analysis team that first warned about the pan-European sovereign debt crisis in 2009 and 2010 (reference Pan-European...

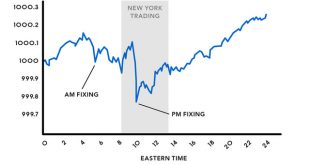

Read More »Every Single Bloody Market Is Manipulated … See For Yourself

Gold and Silver Are Manipulated Deutsche Bank admitted today that it participated with other big banks in manipulating gold and silver prices. In 2014, Switzerland’s financial regulator (FINMA) found “serious misconduct” and a “clear attempt to manipulate precious metals benchmarks” by UBS employees in precious metals trading, particularly with silver. Reuters reported: Swiss regulator FINMA said on Wednesday that it found a “clear attempt” to manipulate precious metals benchmarks during...

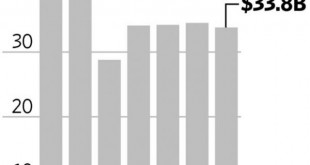

Read More »Guess Which Major Bank Loses The Most From Brexit?

Banks have been lobbying intensively against Brexit. Among those leading the charge is Goldman Sachs. For three years, the bank’s executives have publicly warned about the downsides of leaving the EU... and now we know why (hint - it's not concern for the common man). As The Wall Street Journal reports, about a decade ago, Goldman launched project “Armada,” a plan for a hulking European headquarters on the site of an old telephone exchange in London. Unbundling this kind of structure...

Read More »Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into nothing more than a TV studio for financial cable networks. Some might be closer to the truth and say that the most important building is the true New York Stock Exchange located in Mahwah, New Jersey however that also is not true as the NYSE...

Read More »Futures Jump On Chinese Trade Data; Oil Declines; Global Stocks Turn Green For 2016

With oil losing some of its euphoric oomph overnight, following the API report of a surge in US oil inventories, and a subsequent report that Iran's oil minister would skip the Doha OPEC meeting altogether, the global stock rally needed another catalyst to maintain the levitation. It got that courtesy of the return of USDJPY levitation, which has pushed the pair back above 109, the highest in over a week, as well as a boost in sentiment from the previously reported Chinese trade data where...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org