When you choose to invest in gold it can be confusing to know the best way to add it to your portfolio. Should you buy gold bullion? Should you buy a gold ETF? Or maybe gold mining shares?It’s a minefield! Here at GoldCore, we see it very simply: if you want to get all of the benefits of holding gold then you should own physical gold. Because if you can’t hold it then you don’t own it. Never before has this philosophy been more pertinent than in the last few...

Read More »SWIFT Ban: A Game Changer for Russia?

As part of the sanctions against Russia, seven Russian banks have been cut off from SWIFT. We start by discussing what SWIFT is, and then the implications of completely cutting Russia out of SWIFT. What is SWIFT and Why Russia is Being Excluded SWIFT – The Society for Worldwide Interbank Financial Telecommunication is a messaging system that links more than 11,000 banks in 200 countries. The system doesn’t move actual money between the banks but...

Read More »Monetary Metals Provides Gold Loan to Sector Resources

The loan is denominated in gold with interest and principal paid in gold Scottsdale, Ariz., June 9, 2020—Monetary Metals® announced today that it has loaned gold to Sector Resources Canada Ltd., a British Columbia based gold mining company. The private transaction was conducted off-market, and the interest rate and terms were not disclosed. Monetary Metals’ innovative business model enables gold-owning investors to lease or lend gold to businesses that use gold....

Read More »When Is a Capital Gain Capital Consumption? Market Report, 25 May

The price of gold dropped a few bucks this week, but the price of silver jumped about half a buck. The drumbeat for the gold bull market is well underway, and it is beginning now for silver. So let’s do a quick update on the supply and demand fundamentals. Gold Basis and Co-basis and the Dollar Price Here is the graph of the gold basis. The basis has come in quite a bit—but it is still 3.6% annualized. We do not believe that this as a “true” reading. It is a sign of...

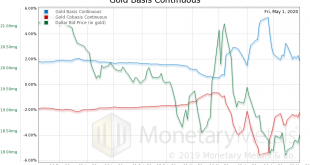

Read More »Gold and Silver Markets Start to Normalize, Report 4 May

The price of gold dropped $29 and the price of silver dropped $0.27. We’ll get back to where we think the prices are likely to go in a bit. In recent Reports, we’ve looked at the elevated bid-ask spread in gold (though not nearly as elevated as some goldbugs would have you believe) and the elevated gold basis. As an aside, we continue to see articles that get the high gold basis exactly backwards, the way John Maynard Keynes got commodity markets backwards. A high...

Read More »Useless But Not Worthless, Report 21 Oct 2018

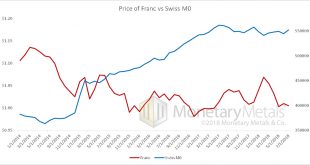

Let’s continue to look at the fiasco in the franc. We say “fiasco”, because anyone in Switzerland who is trying to save for retirement has been put on a treadmill, which is now running backwards at –¾ mph (yes, miles per hour in keeping with our treadmill analogy). Instead of being propelled forward towards their retirement goals by earning interest that compounds, they are losing principal. They will never reach their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org