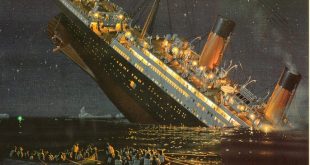

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. An image from the future: the US dollar, which one of these days is going to sink. Alas, there is many a slip ‘twixt the cup and the lip… Image via pinterest.com The Long Term vs. Trading Ideas The price of gold was up about thirty bucks this week. The price of silver was up almost seventy cents. Last week, a reader...

Read More »Gold is not Going to $10,000

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango One Cannot Trade Based on the Endgame The prices of the metals were down again this week, -$15 in gold and more substantially -$0.57 in silver. Stories continued to circulate this week, hitting even the mainstream media. Apparently gold is going to be priced at $10,000. Jump on the bandwagon now, while it’s still cheap...

Read More »A Sense of Foreboding

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Amerexit and Brexit… Doubts About Debt This was a shortened week, due to the American holiday of July 4, celebrating the start of the war that lead to “Amerexit”, 240 years ago. The prices of the metals were up this week, +$25 in gold and +$0.48 in silver. The gold to silver ratio dropped a fraction of a point, showing...

Read More »Silver – OMG!

A hi-ho silver moment… Photo credit: Pat Corkery, United Launch Alliance Going Parabolic From Wednesday through Friday, the price of silver spiked massively. It ended the week about $2 higher than the previous week. The last time we recall silver price action like this was about 3 years ago, in August 2013. That one week, the price rose about $2.50. Before that was a week in August 2012, with a price gain of about...

Read More »Brexit Drives Gold Frenzy

He should have known… (the cartoon shows a list of polls of “Dewey wins by landslide” or “Trump will never win the primaries” quality…) Markets Blindsided by Brexit The big news this week was that the British voted to exit the European Union. This was not the outcome expected by pundits, or the polls. “Risk on” assets were relentlessly bid up prior to the vote. For example, S&P 500 index futures had closed the...

Read More »Soft and Softer Silver Fundamentals

It was just a thought…. Cartoon by Bob Rich Loose Monetary Policy Remains in Place Last week, we asked where then will silver go. Well, the price moved around this week, dipping on Thursday but then rebounding sharply on Friday. It closed up 13 cents from last week. The price of gold rose $24. This week, the Federal Reserve announced that it will not hike rates. Most economists (and traders) have long been expecting a...

Read More »Where Then Will Silver Go?

Silver gets the Saruman question…(see further below) Photo credit: New Line Cinema Precious Metals Surge The price of gold bumped up thirty bucks, and that of silver about one buck. Is this liftoff — when the dollar falls sharply, and the price of each metal in dollar terms skyrockets? Is this the denoument when the gold bug does not get rich, because although his net worth measured in dollar is massively up, the...

Read More »The Cost of Bullish Bets

Philipsburg, Montana, 1890: evidently, these gentlemen did not suffer from a silver shortage. Photo via mininghistoryassociation.org Surging Contango There are two views of the markets for the monetary metals. One, as we have discussed many times in this Report, holds that gold and silver will eventually go up so high that those who own the metals will be rich. This is the Schrodinger’s dollar view. Buy gold because...

Read More »Gold and Silver Aren’t Getting Stronger

The buck. The Dollar Increases in Value The dollar moved up, though most people would say gold fell about $40, and silver 32 cents. In the mainstream view, the value of the dollar is 1/N (N is the quantity). So how could the dollar go up? Certainly, the quantity keeps on increasing. Our view is different. If you borrow dollars to buy an asset, and the asset doesn’t generate enough yield to pay the interest, you have to sell or default. It should go without saying that it is an...

Read More »Revenge of the Fundamentals

Illustration via irs.com A Wake-Up Call The price of gold moved down about twenty Federal Reserve Notes, and the price of silver dropped $0.57. The big news is that the gold-silver ratio moved up about 1.5. We hate to say “we told you so,” well, OK. Actually… sometimes there’s a certain je ne said quoi about gloating. *Achem* In all seriousness, the dollar is going up. We measure it in gold, or alternatively in silver. In gold, the dollar rose 0.4mg gold to 24.84. In silver, it was up...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org