Swiss Franc The Euro has risen by 0.17% to 1.1449 CHF. EUR/CHF and USD/CHF, September 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Supported by a sharp rise in interest rates and ideas of tax reform, the US dollar is closing one of its best months of the year. The Dollar Index is snapping a six-month decline, and the euro’s monthly advance since February is ending....

Read More »FX Daily, August 31: US Core PCE Deflator may Challenge the Greenback’s Firmer Tone

Swiss Franc The Euro has fallen by 0.05% to 1.1441 CHF. EUR/CHF and USD/CHF, August 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar recovery was marginally extendedin Asia, and while it remains firm, it is lost some of its momentum. The Fed’s target inflation measure, the core PCE deflator, may decline from 1.5% to 1.4%, according to the median forecast in...

Read More »FX Daily, May 31: Sterling Takes it On the Chin

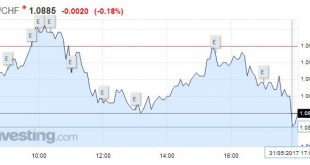

Swiss Franc The euro is lower at 1.0885 (-0.18%). EUR/CHF - Euro Swiss Franc, May 31(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Corbyn gains on the Tories. Theresa May calling a snap general selection seemed to be a wise move while the opposition was so weak. With a Tory victory seeming almost inevitable at that point Sterling strengthened against the majority of major currencies. This is due to a...

Read More »FX Daily, May 03: Marking Time

Swiss Franc EUR/CHF - Euro Swiss Franc, May 03(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact...

Read More »FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

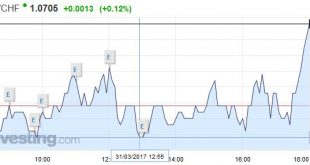

Swiss Franc EUR/CHF - Euro Swiss Franc, March 31(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March. The Fed did hike rates, but the...

Read More »FX Daily, January 31: Markets Look for Solid Footing

Swiss Franc EUR/CHF - Euro Swiss Franc, January 31(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The immigration imbroglio in the United States is being cited in various accounts for the price action, including yesterday’s drop in the S&P 500, where the intraday loss was the largest since before the election. The drama is also being blamed for the dollar’s losses yesterday, which it is...

Read More »FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

Swiss Franc Switzerland SVME PMI, December 2016(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge FX Rates The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling’s earlier losses were recouped following news that the manufacturing PMI jumped to...

Read More »FX Daily, November 02: Standpat FOMC Trumped by US Political Jitters

Comment on GBP and CHF by Jonathan Watson My articles My siteAbout meMy booksFollow on:TwitterLinkedIN Swiss Franc The Swiss Franc is a safe haven currency and benefits in time of uncertainty. With Donald Trump now looking much more likely to win the Election the Swissie has found favour. If you are buying the Franc with sterling in the future the combination of global uncertainty and a weak pound looks set...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org