Swiss Franc The Euro has fallen by 0.04% to 1.0715 EUR/CHF and USD/CHF, October 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors have not let the surge of the virus or uncertainty over the UK-EU talks or US fiscal stimulus to stand in their way. Sterling is leading the major currencies higher, returning to the $1.30 area, while global equities are trading higher. In the Asia Pacific region, Chinese...

Read More »Cool Video: Forces Driving the Dollar and Downplaying Claims Sterling is an Emerging Market Currency

From my remote location in Ocean Grove (next to Asbury Park of Bruce Springstein fame), I joined Martin Soong and Sir Jegarajah for a brief interview as the Asia session was about to begin the new week. A three-minute clip of the interview can be found here. I suggest that there are two main drivers of the markets now. There is the fear of the new surge in Covid cases and the economic implications, on the one hand, which discourages risk-taking. On the other hand,...

Read More »FX Weekly Preview: Is Conventional Wisdom Too Optimistic?

There have been three general issues that the macro-fundamental picture has revolved around this year: trade, growth, and Brexit. On all three counts, conventional wisdom seems unduly optimistic, and this may have helped dampen volatility. A series of signals suggest that the US and China remain far apart in trade negotiations. The US wants China to promise to increase agriculture imports from American farms to more than twice the 2017 peak. Not only is China...

Read More »FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

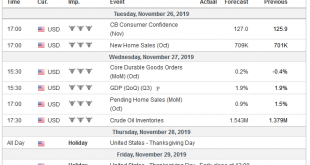

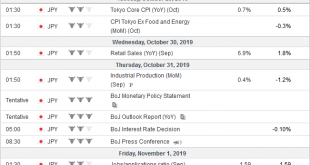

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU. A few hours before the FOMC meeting concludes on October 30,...

Read More »Great Graphic: Views Distill to Short Sterling Long Yen Opportunity

We have argued that the road to an orderly Brexit remains arduous and that sterling had entered an important technical area ($1.2500-$1.2530). At the same time, see the dollar as having approached the upper end of its broad trading range against the yen. One of the important drivers lifting the dollar was the dramatic rise in US yields. We thought that move is counter trend and that yields are headed lower again. These views could be expressed in a short-sterling...

Read More »Brexit Update

The October 31 deadline for the UK to leave the EU is less than 100 days away. The new Prime Minister is beginning to convince others that that UK will, in fact, leave at the end of October. PredictIt.Org shows the odds of the UK leaving has risen to almost 50% from about a 33% chance a month ago. Here is a summary of where the situation stands and some key dates going forward. Boris Johnson handily won the Tory...

Read More »FX Daily, July 16: Sterling Weakness Punctures Subdued Session

Swiss Franc The Euro has fallen by 0.05% at 1.1078 EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Summer in the northern hemisphere contributing to the subdued activity in the global capital markets. The MSCI Asia Pacific index stalled after a four-day advance, with Japanese, Chinese, and Australian equities offsetting gains in Taiwan,...

Read More »April Monthly Currency Outlook

Poor economic data and soft inflation saw several central banks, including the Federal Reserve and European Central Bank, take a dovish turn in March. Contrary to expectations that interest rates would rise as the G3 central banks were no longer adding to their balance sheets on a combined basis. The sharp drop in interest rates and the flattening of curves in March is one of the key factors shaping the investment...

Read More »FX Daily, March 29: Equities Bounce While Bonds Pullback to End Q1

Swiss Franc The Euro has keep position 0.00% at 1.1194 EUR/CHF and USD/CHF, March 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global growth scare may be subsiding. It had been fanned by the ECB and Fed statements and projections. Poor US jobs growth reported in early March and the poor flash EMU PMI late in the month contributed. The slowdown in China...

Read More »FX Daily, March 28: Brexit Uncertainty Deepens as Parliament is Divided, while Turkey’s Short Squeeze Falters

Swiss Franc The Euro has risen by 0.07% at 1.1192 EUR/CHF and USD/CHF, March 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The lurch lower in global interest rates continue. The US 10-year yield is at new 15-month lows, five basis points through the average effective Fed funds rate. Late yesterday, it appeared that 10-year German Bund yields slipped below...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org