Swiss Franc Once again the Swiss Franc was the strongest. The EUR/CHF depreciated to 1.0875. As said yesterday, the reasons: the Fed and the strong Swiss trade balance. Click to enlarge. FX Rates The US dollar has lost another 0.5% against most of the major currencies today, as Asia and Europe respond to the Fed’s decision. There are few exceptions to this generalization. The Norwegian krone has gained nearly...

Read More »FX Daily, September 21: BOJ Can’t Weaken Yen, Fed keeps Rates Unchanged, CHF Stronger

Swiss Franc The EUR/CHF accelerated its decline since yesterday’s strong Swiss trade balance data. The second reason was certainly the Fed decided to keep rates unchanged. We know that the Swiss Franc has similar “counter-dollar” status as gold. Click to enlarge. Japan Much of what the Bank of Japan announced today had been largely leaked. While there was a sizeable response in the asset markets, the dollar’s...

Read More »FX Daily, September 20: The Swiss Franc Continues To Rise.

Swiss Franc For us the developments in the trade balance express if a currency is overvalued or not (more details here). The Swiss trade surplus is constant or rather rising, hence the Swiss Franc is correctly valued or rather undervalued.And – as we see below – the franc appreciated. Switzerland Trade Balance(see more posts on Switzerland Trade Balance, )Switzerland Trade Balance – click to enlarge. FX Rates...

Read More »FX Daily, September 19: Dollar Begins Important Week on Softer Note

[unable to retrieve full-text content]The US dollar, which finished last week on a firm note, is under pressure to start the new week that features Bank of Japan and Federal Reserve meetings. The slighter stronger August CPI reading helped lift the greenback ahead of the weekend, but investors continue to see a low probability of a Fed hike this week.

Read More »FX Daily, September 15: Early Update: Full Calendar but Little News

Swiss Franc As happened very often, traders expected more the SNB monetary assessment. And, as usually, the franc finally appreciated because the SNB did not act. Click to enlarge. FX Rates Looking at the diary, today is the most important day of the week. The Bank of England and the Swiss National Bank meet. The UK reports retail sales. EMU reports CPI figures. The US reports retail sales, industrial output, and...

Read More »FX Daily, September 14: Precarious Stabilization

Swiss Franc Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. Switzerland ZEW Expectations (see more posts on Switzerland ZEW Expectations, )Switzerland ZEW Expectations. Click to enlarge. FX Rates The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that...

Read More »FX Daily, September 13: Much Noise, Weak Signal

Swiss Franc The last ECB meeting and Dragh’s hawkish comments is for us the main reason of the euro strength, this despite stronger Swiss GDP growth. We see a mismatch between the weak ISM Non-Manufacturing PMI and the St. Louis and Atlanta Fed GDP trackers. Click to enlarge. Federal Reserve Our approach to Fed-watching is clear: Among the cacophony of voices, the Troika of Fed leadership, Yellen, Fischer and...

Read More »FX Daily, September 12: Markets Off to a Wobbly Start

Swiss Franc The EUR/CHF retreated today together with falling stock prices. Later during the European day, U.S. stocks recovered. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure. Click to enlarge. FX Rates Stocks and bonds have begun the new week much like last week ended. Sharp losses...

Read More »FX Daily, September 9: Ahead of the Weekend

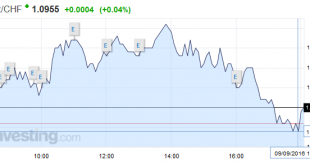

(Dublin business trip is ending, London next week, sporadic posts to continue) Swiss Franc Click to enlarge. FX Rates The US dollar is lower against all the major currencies this week as North American participants close it out. On the day, the dollar is consolidating swings yesterday and is narrowly mixed. Bond yields are higher and equities are mostly lower. The euro has finished lower the last three Fridays....

Read More »FX Daily, September 07: Dollar Stabilizes, but Hardly Recovers

[unable to retrieve full-text content]Disappointing industrial output figures from Germany and UK are helping stabilize the US dollar after yesterday's shellacking. Investors have been fickle about the prospects for a rate hike this month, and the unexpected dramatic slide in the service spurred a downgrading of such expectations, and a flight out of the dollar. It was not simply a quest for yields, though that was part of it. Surely the yen and euro's strength is not a function of superior...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org