While progressives blame climate change for the deadly Lahaina fire, government created the conditions for the blaze and then helped set it. Original Article: "Thanks to Government, Maui's Lahaina Fire Became a Deadly Conflagration" [embedded content] Tags: Featured,newsletter

Read More »Inflation Is a Giant “Skim” on the American People

Contrary to the government's line that "inflation hurts everyone," inflation really is a wealth transfer from those without political power to the politically connected. Original Article: "Inflation Is a Giant "Skim" on the American People" [embedded content] Tags: Featured,newsletter

Read More »Week Ahead: US CPI to Make the Doves Cry even if Core Eases, and Euro Vulnerable to ECB Regardless of Decision

The diverging economic performance between the US and Europe, Japan, and China on the other hand is stark. Yet, a greater divergence may be between widespread discussion of de-dollarization and its incredible strength in the foreign exchange market. The eight-week rally in the Dollar Index is the longest in nine years. According to SWIFT, which is not comprehensive but remains by far the largest platform, the dollar's role in international payments (46% in July) is...

Read More »The Producer Price Index

In this week's episode, Mark looks at PPI—the Producer Price Index—which provides evidence of the costs for suppliers in various industries, macroeconomic instability, and the potential for economic recovery. Here, very low prices provide the potential for recovery; and rising prices can indicate both recovery in the economy, as well as inflationary pressures moving forward. The Covid Bubble and restrictions caused a 50% increase in producer prices, and since the...

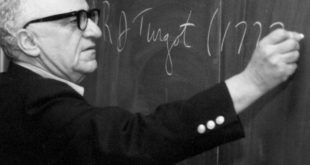

Read More »Ten Great Economic Myths

Our country is beset by a large number of economic myths that distort public thinking on important problems and lead us to accept unsound and dangerous government policies. Here are ten of the most dangerous of these myths and an analysis of what is wrong with them. Myth #1 Deficits are the cause of inflation; deficits have nothing to do with inflation. In recent decades we always have had federal deficits. The invariable response of the party out of power, whichever...

Read More »Toward a Heiddegerian Libertarianism?

How to Nurture Truth and Authenticity: A Metamodern Economic Reform Proposalby Justin CarmienManticore Press, 2022; 272 pp. Neither I nor Justin Carmien, the author of How to Nurture Truth and Authenticity, is an economist. Carmien’s book, however, is not a work of economics but a philosophical attempt to apply Heideggerian metaphysics to practical statesmanship and political economy. Nor is it an academic book: it is written with naïve yet deep insight, a result of...

Read More »Will the BRICS Dethrone the U.S. Dollar?

The summit of the so-called BRICS (Brazil, Russia, India, China, and South Africa) has closed with an invitation to join the group extended to the Emirates, Egypt, Iran, Saudi Arabia, Argentina, and Ethiopia. The summit has generated a lot of headlines about the impact of this widespread group of nations, including speculation about the end of the U.S. dollar as a global reserve currency if this group is perceived as a threat to the United States or even the...

Read More »Forced Isolation of Patients in the ICU Is Barbaric and Counterproductive

Healthcare providers have known for years that contact between patients and family members are essential for good outcomes during intensive care unit (ICU) stays. The ABCDEF bundle is generally accepted as best practice in ICU care. The F stands for “family engagement and empowerment.” Yet, most (if not all) ICUs threw this practice out the window during covid. Family engagement and empowerment is not merely a humanitarian gesture but is necessary for the optimal...

Read More »Family Flourishing and State Denigration

As family life descends into crisis in the USA, many conservatives call for state intervention to "fix" things. It's state intervention that created the problems in the first place. Original Article: "Family Flourishing and State Denigration" [embedded content] Tags: Featured,newsletter

Read More »The Beltway Libertarians Are Too Smart for Oliver Anthony

Ryan McMaken joins Bob to discuss the surprisingly negative reaction (from a Reason writer and Tyler Cowen) to Oliver Anthony's hit song, "Rich Men North of Richmond." Ryan and Bob defend the lyrics, arguing that Anthony doesn't say anything objectionable from either a libertarian or economic perspective. Listen to Oliver Anthony's "Rich Men North of Richmond": Mises.org/HAP412a Christian Britschgi's article in Reason on Oliver Anthony: Mises.org/HAP412b Tyler...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org