With equities sliding and oil pushing back below $30, it may feel like the resumption of moves in the first two and half weeks of the year, but it is different. It is considerably more orderly. The contagion from the equity and oil slide is more limited than previously, and even oil is recovering in the European morning to trade back above $30. European equities opened lower but spent the morning recovering, even if not fully. The change is also evident in the foreign exchange...

Read More »Will Gold Outperform Stocks?

Let me share a little story, that I think will help illustrate a point. Before Copernicus, people believed that the other planets orbited the Earth. They looked up at the night sky and saw that the outer planets like Jupiter normally moved slowly eastwards in the night sky. But sometimes, they seemed to stop moving and then moved west for a while. With their assumption of the Earth being at the center, this funny path was hard to describe and impossible to explain. What could possibly cause...

Read More »Outlook 2016

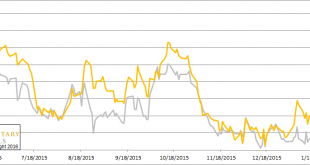

We have consistently been making the contrarian call for a falling silver price and a rising gold to silver ratio for years. This ratio has risen a lot during this time. So are we ready to change our call yet? This being the start of a new year, we wanted to take the opportunity to… [caption id="" align="alignnone" width="1064"] Gold and Silver Price[/caption] This content is for The Last Contango – Free Membership members only. Please login to view this content. (Register here.) Full...

Read More »BOJ and TPP

The Bank of Japan meets later this week. We do not think that it will expand its already aggressive monetary policy stance. Given the largely operational adjustments announced last month, it seems premature to expect substantive adjustment now. It is true that the recent string of data has been mostly disappointing, and the yen has strengthened on a trade-weighted basis over the past month. Our takeaway from talking to Japanese officials is that they are not exceptionally concerned. ...

Read More »Greece is Still in a Hot Spot

Greek Prime Minister Tsipras is celebrating the one-year anniversary of this election. He offered Greek voters an opportunity to replace him last summer, but they stuck with him. Many economic issues remain unresolved. Pension reform promises to be a flashpoint between the Tsipras government and the official creditors. Although the G10 has eleven members, official creditors are no longer represented by the Troika, as there are now four. The ESM has joined the EC, ECB and IMF. When...

Read More »Emerging Market Preview: Week Ahead

(from my colleague Dr. Win Thin) EM enjoyed a nice bounce to end last week. The global liquidity outlook has clearly moved in favor of EM, at least for now. However, the overall global backdrop has not shifted in favor of EM just yet. Bottom line: enjoy this EM rally with a short-term timeframe in mind, with the idea that EM turbulence will likely return later this year. Idiosyncratic risks abound in the usual suspects. The Brazilian real is likely to underperform in light of COPOM’s...

Read More »Recovery Pauses in Europe

[unable to retrieve full-text content] Asia followed suit, extending the recovery seen in the last couple of sessions to end last week. Equities rose as did oil prices. The MSCI Asia-Pacific Index rose 1.2%, and the Nikkei posted its first back-to-back gains this year. Brent firmed, with the March contract trading to $32.80. However, in late-Asia and early Europe, the momentum fizzled. Brent retreated $2 before finding support, and European equities edged lower before recovering...

Read More »Silver Goes Foom, Report 24 Jan, 2016

This will be a brief report, as we’re focused on releasing our Outlook 2016 Report which is over 8,000 words of our assessment of the gold, silver, currency, and credit markets. Also, this was a holiday-shortened week (Monday was Martin Luther King Day in the US). But that did not stop the fireworks in silver on Friday. We will look at what happened below. On the week, the prices of the metals were up $9 and 7 cents, for gold and silver respectively. This happened with serious volatility...

Read More »Week Ahead: Picking Up the Pieces

Whatever force had gripped the global capital markets since the start of the year has been broken. This simple characterization is rich. It is not clear if or what macroeconomic considerations were driving the markets. The markets had taken the unsurprising Fed rate hike in mid-December in stride. The dramatic moves in the market did not begin until this year. Some have suggested China was at the crux of it, but the global impact seemed out of proportion. Others suggested it was...

Read More »Speculative Positioning before the Reversal

The latest Commitment of Traders report that covers the four sessions through January 19 saw speculators anticipating the continuation of the current moves. Of the sixteen gross positions we track, only five were in reducing exposures. Last week there was only six increased exposures. With the benefit of hindsight, we know that something changed a day or two after the reporting period ended. Given the magnitude of the reversal in some cases, some of these late positions were likely...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org