The US dollar has been largely confined to yesterday’s ranges against the major currencies. China’s yuan slipped lower for the first time in four sessions, while the Shanghai Composite fell 2.3%, the most since the end of February. While a few equity markets in Asia managed to follow suit after US equity market gains carried the S&P 500 above 2100 since last November, small gains in Tokyo (0.2%), Australia (0.5%) were sufficient to keep the MSCI Asia-Pacific Index flat. European...

Read More »FX Daily April 20: Bulls’ Charge Stalls, while Greenback Consolidates Losses

The US dollar has been largely confined to yesterday’s ranges against the major currencies. China’s yuan slipped lower for the first time in four sessions, while the Shanghai Composite fell 2.3%, the most since the end of February. While a few equity markets in Asia managed to follow suit after US equity market gains carried the S&P 500 above 2100 since last November, small gains in Tokyo (0.2%), Australia (0.5%) were sufficient to keep the MSCI Asia-Pacific Index flat. European...

Read More »FX Daily April 20: Markets Build on Yesterday’s Dramatic Recovery

Global capital markets staged an impressive recovery after the initial reaction to the failure to freeze oil output sent reverberations through the oil markets, commodities, and Asian equities. The sharp reversal begun in Europe and extended in North America has been sustained. Oil prices remain firm. Perhaps the realization that the labor dispute in Kuwait has reduced output by as much as 60% (to 1.1mln barrels a day) helped underpin prices. The fall in output may be of greater immediate...

Read More »FX Daily, April 18: Doha Failure Sets Tone

Oil producers failed to reach an agreement yesterday at the meeting in Doha. That is the main spur to today’s activity. It is not that the outcome was a surprise. One newswire poll found around half of the respondents thought an agreement was elusive. Although not oil experts by any stretch, we too thought political considerations made it unlikely that Saudi Arabia would be willing to sacrifice market share to its rival Iran. We also understood why Iran could not accept a freeze on...

Read More »FX Weekly: The Dollar’s Technical Condition Remains Vulnerable

The US dollar turned in a mixed performance last week, which given the softer than expected inflation, retail sales data, and industrial output figures, coupled with the poor technical backdrop, could be a signal that its decline in recent months has run its course. The dollar-bloc continued its advance, led by the Australian dollar’s nearly 2% gain. Higher commodity prices (the sixth weekly advance for the CRB Index in the last eight week) may have helped. The persistent strength...

Read More »FX Daily, 04/14: Greenback Steadies Against Majors, but Firmer vs EM After MAS Surprise

After initially extending its recent recovery gains against the major currencies, the US dollar began consolidating in the European morning. An unexpected shift by the Monetary Authority of Singapore, replacing a modest and gradual currency appreciation with a more neutral stance, coupled with softer oil prices and weaker European equities, appears to have weighed on emerging market currencies. Asian equities extended their rally, with the Nikkei gaining 3.25% and the Shanghai Composite...

Read More »FX Daily, April 13: US Dollar Comes Back Bid

The US dollar is well bid in the Europe and is poised to start the North American session with the wind to its back. Despite firmer equity and industrial metal prices, most emerging market currencies are also succumbing to the rebounding greenback. The euro has yet to convincingly breakout of the range that has confined it this month. That would require a break of the $1.1300 area. However, as we have noted the two-year interest rate differential between the US and Germany, which does...

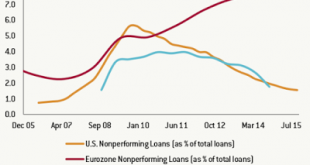

Read More »Great Graphic: Nonperforming Loans, Another Divergence

Early in the financial crisis, the US forced all large banks to take an infusion of capital. This helped put a floor under the US financial system. Regulators and stakeholders encouraged US banks to address the significant nonperforming loan problem. The eurozone banking woes persist. Before the weekend, the shares of the one the largest banks was trading at 25 -year lows. The problem with nonperforming loans though is largely concentrated in the periphery. Italy is moving to...

Read More »Specs Shift to Net Long Canadian Dollar and Set New Record Gross Long Yen

Speculators in the futures market were not particularly active in Commitment of Traders reporting week ending April 5. There was only one gross position adjustment which we regard as significant (defined as a 10k contract change), and that was in the yen. Yen bulls extended their gross long position by 13.3k contract to new record of 98.1k contracts. However, the bears are beginning to get itchy and have sold into the yen gains for the second consecutive week. The gross short yen...

Read More »Little Technical Evidence that Greenback’s Slump is Over

Although there is no convincing technical evidence that dollar's retreat in Q1 is over, we suspect it is nearly complete. We will be especially sensitive to reversal patterns, divergences with technical indicators, and other signs that the move is exhausted. The fundamental economic driver of our medium term constructive outlook for the US dollar, the divergence of monetary policy between the major central banks, relative health of the financial sector, and absorption of capacity,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org