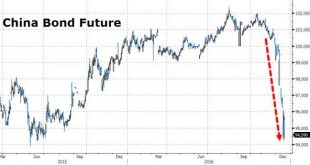

Despite considerably weaker than expected Services PMI, an assassination in Turkey, a terrorist attack in Zurich, and a bloodbath in Berlin, stocks rallied... As a reminder - Chinese bonds crashed overnight again.. Hong Kong stocks tumbled into correction (red for 2016)... And Italian banks all crashed (led by BMPS)... First things first in The US - the market broke today and stocks loved it... The Dow still has not had two down days in a row since before the...

Read More »WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but… growth, and inflation, and supply cuts, and growth again… Well that de-escalated quickly… As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th. WTI CrudeWTI Crude - Click to enlarge “The OPEC cuts are going to prevent some of the mega-glut,” said Olivier Jakob, managing director at Petromatrix GmbH in Zug,...

Read More »Who Has To Work The Longest To Afford An iPhone?

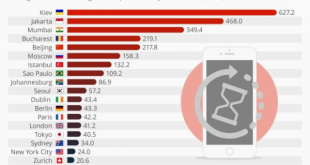

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone...

Read More »Who Has To Work The Longest To Afford An iPhone?

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone...

Read More »Who Has To Work The Longest To Afford An iPhone?

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »Who Has To Work The Longest To Afford An iPhone?

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone 6 in under three working days. In Kiev, by contrast, it would take 13...

Read More »Gold In London And Hong Kong Is Used To Settle COMEX Futures

Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market. This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at...

Read More »Gold In London And Hong Kong Is Used To Settle COMEX Futures

Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market. This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org