Claudio Grass (CG): During the 2017 hype, when most people became aware of Bitcoin, it was mainly sold as the payment vehicle of the future, as a great investment for the “little guy” who has no access to equity markets and even as a store of value that would replace precious metals. In your opinion, what are the main misconceptions that the average “crypto layman” may still hold today? Konrad S. Graf (KG): Some critics argue that Bitcoin as a whole can just be copied to make...

Read More »While everyone talks, Bitcoin just keeps running – Part I

I have long been fascinated by both the progress made so far, and by and the promise of this new era of decentralized money that is only just beginning. Although I lack the technical expertise to fully understand the finer points of the code behind the different cryptocurrencies or to assess the nuances of the inner workings of Bitcoin, I do understand money, its history, its multifaceted functions, and the potential for abuse once a monetary monopoly arises. Therefore, I was...

Read More »Corporate Debt Time Bomb

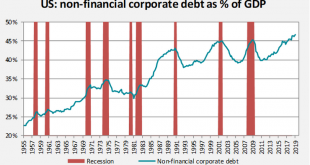

While I have reportedly highlighted the many risks of the current monetary policy direction and the multiple distortions that it has created in the markets, in the economy, and even in society, one of the most pressing dangers of the unnaturally low rates and cheap money is the staggering accumulation of debt. Nowhere is this more obvious than in the ballooning corporate debt, especially in the US. It has been growing so rapidly and for so long, that many investors...

Read More »Corporate Debt Time Bomb

While I have reportedly highlighted the many risks of the current monetary policy direction and the multiple distortions that it has created in the markets, in the economy, and even in society, one of the most pressing dangers of the unnaturally low rates and cheap money is the staggering accumulation of debt. Nowhere is this more obvious than in the ballooning corporate debt, especially in the US. It has been growing so rapidly and for so long, that many investors and analysts...

Read More »The destruction of civilization – implications of extreme monetary interventions

When I was asked to write an article about the impact of negative interest rates and negative yielding bonds, I thought this is a chance to look at the topic from a broader perspective. There have been lots of articles speculating about the possible implications and focusing on their impact in the short run, but it’s not very often that an analysis looks a bit further into the future, trying to connect money and its effect on society itself. Qui bono? Let...

Read More »The destruction of civilization – implications of extreme monetary interventions

When I was asked to write an article about the impact of negative interest rates and negative yielding bonds, I thought this is a chance to look at the topic from a broader perspective. There have been lots of articles speculating about the possible implications and focusing on their impact in the short run, but it’s not very often that an analysis looks a bit further into the future, trying to connect money and its effect on society itself. Qui bono? Let us begin with a basic...

Read More »The ECB’s “mea culpa”

Economists, conservative investors and market observers have been issuing stern warnings for years regarding the severe impact of the current monetary policy direction. The problems In a recent statement, ECB Vice President Luis de Guindos warned of potential side effects and risks to the economy resulting directly from the central bank’s policies. He outlined how a decade of extremely aggressive monetary interventions have resulted in an erosion of financial...

Read More »The ECB’s “mea culpa”

Economists, conservative investors and market observers have been issuing stern warnings for years regarding the severe impact of the current monetary policy direction. The problems In a recent statement, ECB Vice President Luis de Guindos warned of potential side effects and risks to the economy resulting directly from the central bank’s policies. He outlined how a decade of extremely aggressive monetary interventions have resulted in an erosion of financial stability and now...

Read More »The Evolution Of The Bank Run

There are numerous and wide-ranging reasons why someone may choose to invest in physical precious metals. A deep understanding of monetary history provides plenty of solid arguments, and so do the mounting geopolitical risks, the spiking probability of a recession and the long-term goal of many conservative investors to safeguard their financial self-determination. For me, while all of these reasons are important, there is also another argument that I find...

Read More »The Evolution Of The Bank Run

There are numerous and wide-ranging reasons why someone may choose to invest in physical precious metals. A deep understanding of monetary history provides plenty of solid arguments, and so do the mounting geopolitical risks, the spiking probability of a recession and the long-term goal of many conservative investors to safeguard their financial self-determination. For me, while all of these reasons are important, there is also another argument that I find especially powerful and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org