Canada reported its monthly GDP estimate for September, and at the same time, provided its first estimate of Q3 GDP. The Great Graphic, created on Bloomberg, shows both time series. The monthly GDP is depicted by the yellow line and the quarterly estimate is the white line. Clearly they track each other, as one would expected. The good news is that after contracting in the first two quarters of the year, the Canadian economy expanded by 2.3% in Q3. The bad news is that the growth...

Read More »China, the SDR, and Toward a Less Euro-Centric World

(Here is a draft of a monthly column I write for a Chinese paper) It is official. The Chinese yuan will be in the SDR. At a 10.4% share, it is a bit more than I expected, but less than the 14%-16% share that the IMF staff has intimated a few months ago. This is a significant event, even if there is no short-term market opportunity. The yuan’s exchange rate against the dollar has steadily declined over the month of November contrary to conspiracy theories that warned Chinese...

Read More »Dollar Trades Heavier, Key Events Awaited

The US dollar is trading with a heavier bias today amid some last minute position squaring ahead of the key events of the week, which are stacked in the second half. The ECB meeting and US jobs data are the two most important events in a jam packed week for most participants. The recent pattern has been for new lows in the euro to be greeted with a bit of profit-taking. This pattern is holding. New lows were made yesterday just below $1.0560, and short-covering lifted it to nearly...

Read More »Cool Video: CNBC Discussion about China and the SDR

I had the privilege of being on CNBC to discuss the significance of China being included in the IMF's Special Drawing Right. Here is the link to the discussion. The decision was announced shortly after the interview on CNBC. It was largely a foregone conclusion that China would join. Besides the confirmation, the new news was in the weighting. China's yuan got an almost 11% share of the new SDR that will be launched 1 October 2016. The room for the yuan comes comes mostly at the...

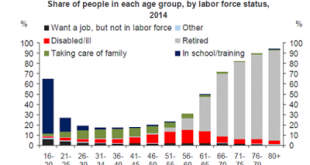

Read More »Great Graphic: Decline of US Participation Rate Explained

The decline in the labor force participation rate helps explain the substantial decline in the US unemployment rate over the past couple of years. That decline has helped bring the Federal Reserve to the point that a December rate hike is thought to be extremely likely barring a significant disappointment at the end of the week with the November jobs report. This Great Graphic was posted on Ritholtz's Big Picture Blog and was compiled by Deutsche Bank's Torsten Slok from BLS data. ...

Read More »Emerging Markets: Preview of the Week Ahead

(from my colleagues Dr. Win Thin and Ilan Solot) This is set to be one of the most important weeks of the year. EM is likely to take a backseat between the ECB monetary policy decision, the OPEC meeting and the US jobs report. That said, there are several potential sources of idiosyncratic risk to key an eye on. There could be more headline risks from the Russia-Turkey situation. Some think that the leader of Brazilian lower house may bring forward the impeachment process this week,...

Read More »Dollar Edges Higher Ahead of Month-End and Key Events

The US dollar remains firm against most of the major currencies to start what promises to be a critical week for investors. There are two main considerations. The first is the last minute position adjustments ahead the key events that begin with the IMF's SDR decision later today, running through the start-of the month data (especially PMIs), central bank meetings in Australia, Canada, and then the big one, the ECB. The US monthly jobs report and the OPEC meeting cap the weeks. The...

Read More »Seven Events Next Week that will Shape the Investment Climate

The week ahead is among the most important of the year. Rarely is there such a confluence of events in a short period that will have far-reaching implications for investors that are known ahead of time and have been discussed so extensively. One implications of this is that there are expectations that have been discounted by the market. The potential for sharp price gyrations and the dictates of money management should not distract from the big picture and the durable trends. In this...

Read More »How Dangerous are Technical Conditions for Dollar Bulls?

Anticipating a yawning divergence of monetary policy between the world's largest central banks, market participants continued to drive the dollar higher over the past week. In fact, the greenback appreciated against all the major and emerging market currencies except the Malaysian ringgit and South Korean won. Next week is one of the most eventful weeks of the year, and the speculative community has amassed a very large long dollar position. It begs the question of whether the ECB...

Read More »France’s Revival or Politics Trumps Economics

With the ECB poised to take additional steps down the unorthodox monetary policy route, financial and economic forces are as potent as ever. However, there is a subtle shift taking place that few seem to recognize. It is the re-emergence of non-economic/non-financial issues. Since the Great Financial Crisis began, and especially since the emergence of the European debt problems, economics have been paramount in Europe. Even political developments were understood in relation to the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org