Swiss Franc The Euro has risen by 0.13% at 1.1056 EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors are happy for the weekend. Between the ECB, Brexit, and next week’s FOMC, BOJ, and BOE meetings, the markets are mostly in a consolidative mode ahead of the weekend. The first look at Q2 US GDP is the last important data...

Read More »FX Daily, July 24: Poor PMI Weighs on Euro Ahead of ECB

Swiss Franc The Euro has fallen by 0.17% at 1.0966 EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Disappointing flash PMI pushed an already offered euro lower ahead of tomorrow’s ECB meeting. European bonds rallied and equities, amid a rash of earnings, is trying to extend the advance for a fourth consecutive session. Italian and...

Read More »FX Daily, July 23: Debt Deal Help Lifts the Dollar

Swiss Franc The Euro has fallen by 0.32% at 1.097 EUR/CHF and USD/CHF, July 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The gains in US equities and the apparent US budget agreement has underpinned equities today and the US dollar. Asia Pacific equities recouped yesterday’s losses, and Europe’s Dow Jones Stoxx is posting gains for the third consecutive...

Read More »FX Daily, July 22: Greenback is Mostly Firmer to Start New Week, while the Euro is Pinned near $1.12

Swiss Franc The Euro has fallen by 0.03% at 1.1007 EUR/CHF and USD/CHF, July 22(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: What promises to be an eventful two weeks has begun quietly. The ECB, Fed, BOJ, and BOE will meet over the next fortnight. The central banks of Turkey and Russia meet this week and are expected to cut rates. The UK will have a new...

Read More »FX Daily, July 19: Dollar Pares Losses as Market Partly Corrects Confusion of Magntiude and Timing of Fed

Swiss Franc The Euro has fallen by 0.35% at 1.1024 EUR/CHF and USD/CHF, July 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments underscoring the importance of acting preemptively by two Fed officials sent the dollar reeling and helped lift equities after the S&P fell to a two and a half week low. The decline in rates and the US shooting down of an...

Read More »FX Daily, July 18: Dollar on Back Foot as Equities Slide

Swiss Franc The Euro has fallen by 0.09% at 1.107 EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Profit-taking continues to weigh on global equities earnings concerns saw the biggest drop in the S&P 500 in three weeks. The MSCI Asia Pacific Index fell for the fourth consecutive session. The Nikkei gapped lower for the second...

Read More »FX Daily, July 16: Sterling Weakness Punctures Subdued Session

Swiss Franc The Euro has fallen by 0.05% at 1.1078 EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Summer in the northern hemisphere contributing to the subdued activity in the global capital markets. The MSCI Asia Pacific index stalled after a four-day advance, with Japanese, Chinese, and Australian equities offsetting gains in Taiwan,...

Read More »FX Daily, July 15: Marking Time on Monday

Swiss Franc The Euro has fallen by 0.10% at 1.108 EUR/CHF and USD/CHF, July 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed...

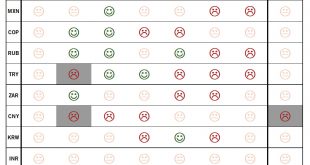

Read More »Scorecard still shows Brazilian real as most attractive EM currency

Trade tensions could continue to have an impact, but we have a more constructive view on emerging-market currencies than at the start of the year.Despite recent moderation in the US dollar and in the 10-year US Treasury yield, emerging-market (EM) currencies remain under pressure, especially as a result of a recent escalation in trade tensions. Asian currencies have outperformed their emerging peers. The stability of the Chinese renminbi is likely serving as an anchor for Asian currencies,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org