In our post on August 11 titled End of an ERA: The Bretton Woods System and Gold Standard Exchange, we discussed the significance of then-President Nixon’s action of closing the gold window thereby ending the Bretton Woods Monetary system. Under the Bretton Woods monetary system, central banks could exchange their US dollar reserves for gold. This also ended the gold fixed price of US$35 per ounce. This week we explore the two questions that concluded last week’s...

Read More »Gold, Stocks & Commodities- A Complicated Correlation

In our July 29 post titled How Gold Stacks Up Against Stocks, Property, Commodities and Big Macs! we showed readers charts of gold as a ratio to other assets and products. We discussed that gold competes with crypto and stocks for the investment dollars. It was clear that gold as a ratio of the S&P 500 Index and of the broader MCSI World Equity Index show that gold is ‘relatively cheap’ compared to these measures. But then we showed that this wasn’t the...

Read More »Quantitative Easing: A Boon or Curse?

Central banks’ massive Quantitative Easing (QE) programs have come under scrutiny many times since the central banks fired up the printing press and began quantitative easing programs en masse after the 2008-09 Great Financial Crisis. However, the increase in central bank assets due to quantitative easing programs during the crisis pale in comparison to the QE programs during the Covid pandemic. As economies recovered after the Great Financial Crisis many worried...

Read More »Is Gold Still in a Bull Market?

[unable to retrieve full-text content]Today Gareth Soloway, Chief Market Strategist of InTheMoneyStocks.com talks about his technical analysis of gold and silver as well as giving us insights in to the recent moves in Bitcoin and the stock markets. Recent comments from the Federal Reserve Chairman Jerome Powell indicated that they may need to raise rates in 2023 (2 years away!). This is primarily due to the continued excessive money printing fueling a surge in inflation. Inflation is no...

Read More »Demand for Gold is Expected to Grow Exponentially in 2021

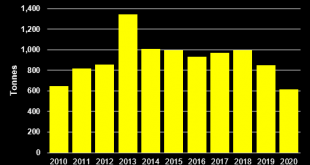

The difference between physical gold investing and ETF investing was stark in the first quarter 2021 according to the World Gold Council’s Gold Demand Trends data released last week. Before focusing in on investment demand below a few notes on overall gold demand in the first quarter. Total gold demand in the first quarter of 2021 was down 4%. However, because gold production and gold demand (jewellery, bar and coin etc.) are decentralized around the globe, and no...

Read More »Marriage of Gold and Cryptocurrencies: A New Future?

The debate between relatively new digital cryptocurrencies versus ‘tried and true’ gold has dominated most precious metals related websites. But what if gold and cryptocurrencies were combined? According to a Bloomberg article a NYC Real Estate Mogul, after learning about cryptocurrencies from his son, is putting this concept to work by securing a minimum of $6 billion in gold reserves to back his new cryptocurrency. The concept of pegging a digital currency to an...

Read More »Is ESG Investment the Future of Gold & Silver?

‘ESG’ is a great buzzword in investing right now. For years the momentum has been building for the idea that retirement savings should do more than keep you secure, it also should help the planet. Obviously, no one wants to hurt the planet since its our only home. ESG Investment is shorthand for Environmental, Social and Governance, which are the three lenses through which investments are to be ranked. High ranking companies get more money from investors than low...

Read More »Is The Bull Market Over For Gold?

Gold has not made new highs in many months. Gold peaked last year at US$2067 on August 6. The 7 month down leg of more than 18% as been deep enough and long enough that some commentators are now saying that the bull market has now turned to a bear market for gold. Losing faith is understandable because falling prices feel bad. But this week we want to show that current prices may not reflect reality. We will review the story of Archegos Capital Management which...

Read More »ETF Gold Demand Soars while Consumer Demand Slows

ETF gold demand from investors has soared over the past year. The unprecedented fiscal and monetary stimulus were rolled out to tackle the effects of Covid -19. However, consumer demand, particularly but not surprisingly, jewellery demand slumped. What’s in store for gold demand fundamentals for 2021? Increased consumer demand in China and India will help support the gold price in 2021. There is little doubt that investment demand – especially into Exchange Traded...

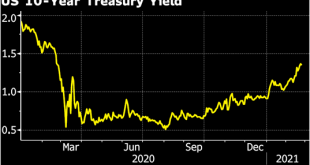

Read More »How High is Too High for Rising Government Bond Yields?

The two day rise in the gold price of more than US$50 fizzled out on Tuesday. The gold price is down about 7% (in US dollar terms) since its year-to-date high set on January 6. It is also down 13% from its all-time high set in August 2020. The silver price, boosted by social media attention, did not set its year-to-date high until February 1. Since then the silver price has slid about 5% from that high. Chairman Powell testified to Congress on Tuesday stating that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org