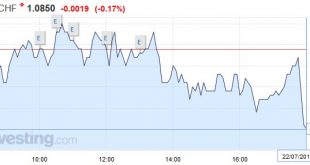

Swiss Franc The EUR/CHF ended lower today. Today’s data showed that Germany has stronger growth than the rest of the Eurozone. Given the strong Swiss trade ties with Germany, the Swiss franc appreciated. See more in Correlation between CHF and the German Economy Click to enlarge. FX Rates As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US...

Read More »FX Daily, July 11: Dollar Extends Gains

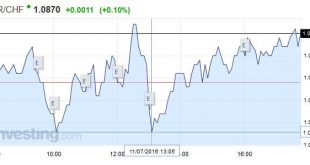

Swiss Franc Improving US job data also helped to increase demand for EUR/CHF long. For last week’s sight deposits see here. Click to enlarge. The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put...

Read More »FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

Swiss Franc Once again, CHF is one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular “Weekly SNB sight deposits” report. See the Dukascopy Video FX Rates The US dollar weakened in the first half of the week as participants continued to react to the shockingly poor jobs report and shift in Fed expectations. However, it...

Read More »Great Graphic: CAD Takes out Trendline

CAD BGN Curncy It has been painful trying to pick a bottom of the US dollar against the Canadian dollar. But now a 4-5 point downtrend from the secondary high in late-January is being violated today. It is found near CAD1.2785 today. Intraday penetration is one thing, but some models may take the signal on a closing basis only. CAD BGN Curncy The US dollar recorded the multi-year high against the Canadian dollar on January 20 a little below CAD1.47. Since then the Canadian...

Read More »FX Daily, April 22: Capital Markets Mostly Consolidate, Yen Drops

Equity markets are seeing this week's gains trimmed after the S&P 500 fell 0.5% yesterday, recording its biggest loss in two weeks. Disappointing earnings in some tech leaders spurred profit-taking, The US 10-year Treasuries are consolidating the week's nine basis point increase in yields after nearing 1.90% yesterday. Asian bonds yields tracked US Treasury yields higher while European bonds are narrowly mixed as they consolidate yesterday's increase. The US dollar recovered from...

Read More »FX Daily April 20: Markets Build on Yesterday’s Dramatic Recovery

Global capital markets staged an impressive recovery after the initial reaction to the failure to freeze oil output sent reverberations through the oil markets, commodities, and Asian equities. The sharp reversal begun in Europe and extended in North America has been sustained. Oil prices remain firm. Perhaps the realization that the labor dispute in Kuwait has reduced output by as much as 60% (to 1.1mln barrels a day) helped underpin prices. The fall in output may be of greater immediate...

Read More »Specs Shift to Net Long Canadian Dollar and Set New Record Gross Long Yen

Speculators in the futures market were not particularly active in Commitment of Traders reporting week ending April 5. There was only one gross position adjustment which we regard as significant (defined as a 10k contract change), and that was in the yen. Yen bulls extended their gross long position by 13.3k contract to new record of 98.1k contracts. However, the bears are beginning to get itchy and have sold into the yen gains for the second consecutive week. The gross short yen...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org