Swiss Franc The EUR/CHF retreated today together with falling stock prices. Later during the European day, U.S. stocks recovered. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure. Click to enlarge. FX Rates Stocks and bonds have begun the new week much like last week ended. Sharp losses...

Read More »FX Weekly Preview: Capital Markets in the Week Ahead

Summary: Global bonds and global stocks ended last week on a weak note and this will likely carry into this week’s activity. The Bank of England meets, but the data may be more important. Oil and commodity prices more generally look vulnerable, and this coupled with higher yields sapped the Australian ad Canadian dollar in the second half of last week. The week ahead will likely be shaped by a combination of...

Read More »Services ISM Sends Greenback Reeling

[unable to retrieve full-text content]ISM showed unexpected weakness in Aug non-mfg PMI. Markit measure slipped but not as much as ISM. Odds of a Sept Fed hike slip to about 15%. Watch trendline in Dollar Index near 94.45.

Read More »FX Daily, August 23: Broadly Mixed Dollar in a Mostly Quiet Market

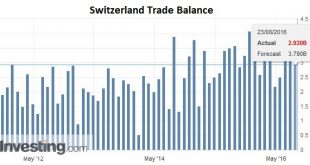

Swiss Franc Switzerland Trade Balance (See more posts for Switzerland Trade Balance) Click to enlarge. Source Investing.com FX Rates The US dollar is mostly little changed against the major, as befits a summer session. There are two exceptions. The first is the New Zealand dollar. Comments by the central bank’s governor played down the need for urgent monetary action and suggested that the bottom of cycle may be...

Read More »FX Daily, August 22: Fischer Joins Dudley; Waiting for Yellen

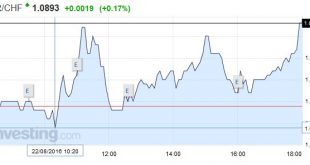

Swiss Franc As usual, when discussions about rate hikes go on, then both the dollar and the euro gain against the Swiss Franc. Click to enlarge. Federal Reserve Last week, some market participants were giving more credence to what seemed like dovish FOMC minutes than to NY Fed President Dudley’s remarks that accused investors of complacency over the outlook for rates. Yesterday, Vice-Chairman of the Federal Reserve...

Read More »FX Daily, August 19: Dollar Recovers into the Weekend

Swiss Franc: In the real effective exchange rate calculation, the PPI plays an important role. The Swiss producer price index fell by 0.8% YoY, while the German one is down 2.0%. Thismeans that in 2016 the CHF overvaluation is rising, when compared to the major Swiss trading partner Germany. The values for 2015 were -6% for the Swiss and -2.5% for Germany, the CHF overvaluation was reduced. Click to enlarge. Source...

Read More »FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

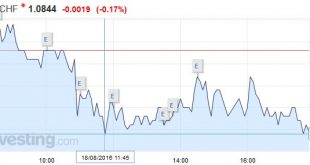

Swiss Franc A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. Click to enlarge. FX Rates It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting. The...

Read More »FX Daily, August 15: Dollar Eases to Start the New Week

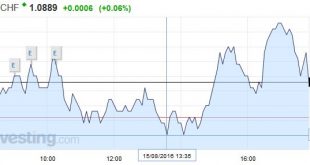

Swiss Franc The Swiss Franc was nearly unchanged against the euro. Click to enlarge. FX Rates The US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable...

Read More »FX Daily, July 29: Kuroda Hesitates, Yen Advances, Focus Turns to Europe and North America

Prospects for the Swiss Economy Remain Favourable The KOF Economic Barometer has only changed little and reached a value of 102.7 in July. In June, and therefore before the referendum in the United Kingdom about its membership in the EU, the KOF Economic Barometer stood at a value of 102.6 (revised from 102.4). Thus the Barometer has been standing above the historical average since February this year. Despite the...

Read More »Oil and Economy Pull the Canadian Dollar Lower

Summary: The decline in oil prices is a factor weighing on the Canadian dollar. US premium over Canada is rising, and may continue as the economies diverge. The general risk appetite is supportive for the Canadian dollar. Our informal and simple model for the Canadian dollar has three variables. Oil, interest rates, and general risk environment. Over time, the coefficient of the variables can and do change....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org