History of Gold - How the gold industry has changed over 50 years Thomson Reuters GFMS have compiled an interesting high level history of the gold industry in the last fifty years. Topics covered and interesting historical facts to note include: - Gold market size- Gold mine production "peaked in 2015"- South African production collapse from 1,000 tonnes- South African gold was flown to London and Zurich and an airliner had its own designated...

Read More »SocGen: Beware The Ghost Of 1993

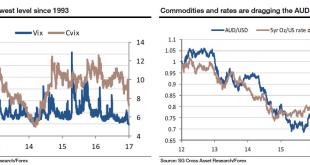

With Monday’s financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen’s Kit Juckes with his overnight note,...

Read More »Swiss happy with chemical controls in Geneva

Asbestos being removed from a Zurich tower block in 2003 (Keystone) Despite a lack of progress to limit products such as asbestos and the herbicide paraquat, Switzerland is largely pleased with the results of a summit on chemicals and hazardous waste held in Geneva. “We obtained much more than we expected,” Franz Perrez, the head of international affairs at the Federal Environment Office, told the Swiss News Agency on...

Read More »How The US Government Let A Giant Bank Pin A Scandal On A Former Employee

The following is an excerpt from David Enrich’s nonfiction financial and legal thriller The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. (Read part of the prologue here; another excerpt can be found here) This excerpt takes place shortly after the accused mastermind of the Libor scandal, Tom Hayes, is fired from his job at...

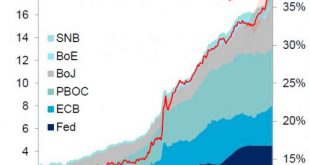

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More »Europe, US Futures Slip Despite Brent Bouncing Back To $51

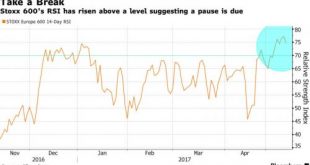

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

Read More »UBS escapes shareholder rebellion fate of rival

UBS shareholders overwhelmingly approved executive bonuses at the bank’s annual general meeting on Thursday. Why such a difference from the Credit Suisse shareholder rebellion seen just one week ago? Both Swiss banks have experienced hard times since their heyday before the financial crash. The shares of both banks have been trading in similar territory (CHF15-17) in recent months from 2007 highs of CHF89 for Credit...

Read More »“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank’s interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the “the...

Read More »How The US Government Let A Giant Bank Pin A Scandal On A Former Employee

The following is an excerpt from David Enrich's nonfiction financial and legal thriller The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. (Read part of the prologue here; another excerpt can be found here) This excerpt takes place shortly after the accused mastermind of the Libor scandal, Tom Hayes, is fired from his job at Citigroup, kicking government investigations into interest-rate-rigging into a...

Read More »Sweden’s Gold Reserves: 10,000 gold bars (pet rocks) shrouded in Official Secrecy

In February 2017 while preparing for a presentation in Gothenburg about central bank gold, I emailed Sweden’s central bank, the Riksbank, enquiring whether the Riksbank physically audits Sweden’s gold and whether it would provide me with a gold bar weight list of Sweden’s gold reserves (gold bar holdings). The Swedish official gold reserves are significant and amount to 125.7 tonnes, making the Swedish nation the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org