Swiss Franc The Euro has risen by 0.08% at 1.1379 EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Dollar index is trading within last Friday’s trading ranges. The year’s high, set on August 15, was just shy of 97.00. The euro continues to straddle the $1.14 level but is spending more time in Europe below there. There is a 1.5 bln euro...

Read More »Macro Cheat Sheet

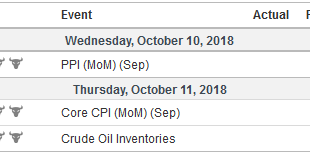

Key considerations and price for selected currencies distilled into four bullet points.US Dollar The dollar’s recovery ahead of the weekend was aided by the stabilization of the stock market, where the S&P 500 managed to close back above the psychologically important 200-day moving average. Interpolating from prices, the market does not expect the President’s criticism to alter the Fed’s course. US data highlights...

Read More »FX Daily, October 09: A (Short) Reprieve For China while the Dollar Stays Firm

Swiss Franc The Euro has fallen by 0.10% at 1.1393 EUR/CHF and USD/CHF, October 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The small gains in China’s Shanghai Composite and the yuan is helping sentiment today. News that Italy’s budget watchdog may reject the government’s fiscal plans has helped stabilize Italian assets initially, but renewed pressure...

Read More »FX Daily, October 08: China and European Woes Weigh on Equities but Buoy the Dollar

Swiss Franc The Euro has fallen by 0.24% at 1.1395 EUR/CHF and USD/CHF, October 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets are having a rough adjustment to the return of the Chinese markets are the week-long holiday. The cut in the required reserves failed to lift investor sentiment. The Shanghai and Shenzhen Composites fell almost 4%, and...

Read More »FX Weekly Preview: Has an Inflection Point been Reached for Investors?

Interest rates, led by the US, have accelerated to the upside. With price pressures generally rising and oil prices at four-year highs, it is understandable. Market participants need to see the breakout that has lifted US 10-year yields to their highest level in seven years is confirmed in subsequent price action. The first test was passed as the disappointing jobs growth in September could have been an excuse to push...

Read More »FX Daily, October 05: US Jobs Data will Test Dollar Bulls and Bond Bears

Swiss Franc The Euro has risen by 0.11% at 1.1429 EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is firmer against most of the major and emerging market currencies. The yen and sterling are resisting the pressure, while the South African rand and Russian rouble are paring some of this week’s declines. US equity losses...

Read More »Gold’s Price Performance: Beyond the US Dollar

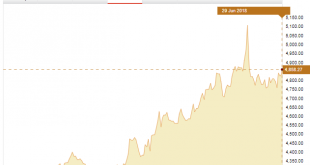

With the first half of 2018 now drawn to a close, much of the financial medias’ headlines and commentary relating to the gold market has been focusing on the fact that the US dollar gold price has moved lower year-to-date. Specifically, from a US dollar price of $1302.50 at close on 31 December 2017, the price of gold in US dollar terms has slipped by approximately 3.8% over the last six months to around $1252.50, a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org