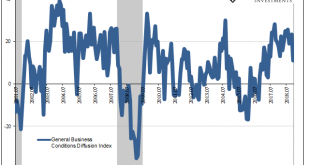

It is time to start paying attention to PMI’s again, some of them. There are those like the ISM’s Manufacturing Index which remains off in a world of its own. The version of the goods economy suggested by this one index is very different than almost every other. It skyrocketed in late summer last year way out of line (highest in more than a decade) with any other economic account. For that reason alone, it has been...

Read More »Sometimes Bad News Is Just Right

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019). We won’t know the full details...

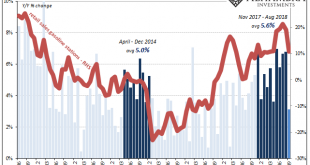

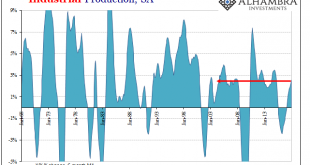

Read More »Just The One More Boom Month For IP

The calendar last month hadn’t yet run out on US Industrial Production as it had for US Retail Sales. The hurricane interruption of 2017 for industry unlike consumer spending extended into last September. Therefore, the base comparison for 2018 is against that artificial low. As such, US IP rose by 5.1% year-over-year last month. That’s the largest gain since 2010. While that may be, over the last five months American...

Read More »Now Back To Our Regularly Scheduled Economy

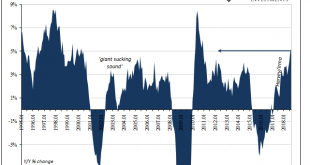

The clock really was ticking on this so-called economic boom. A product in many economic accounts of Keynesian-type fantasy, the destructive effects of last year’s hurricanes in sharp contrast to this year’s (which haven’t yet registered a direct hit on a major metropolitan area or areas, as was the case with Harvey and Irma) meant both a temporary rebound birthed by rebuilding as well as an expiration date for those...

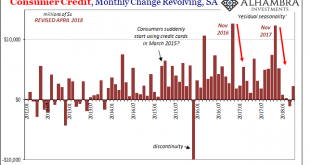

Read More »Recent Concerning Consumer Credit Trends Carry On Into April

US consumers continue to recover from their debt splurge at the end of last year. Combined with still weaker income growth, the Federal Reserve estimates that aggregate revolving credit balances grew only marginally for the fourth straight month in April 2018. To put it in perspective, the total for revolving credit (seasonally adjusted) is up a mere $2.2 billion for all four months of this year combined, compared to...

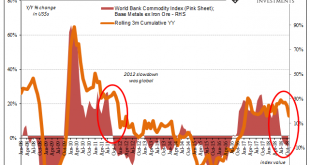

Read More »Globally Synchronized Asynchronous Growth

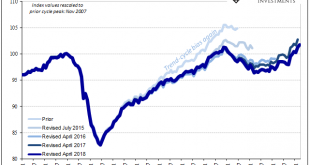

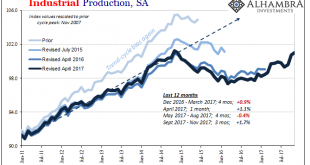

Industrial Production in the United States rose 3.5% year-over-year in April 2018, down slightly from a revised 3.7% rise in March. US Industrial Production, Jan 2006 - May 2018(see more posts on U.S. Industrial Production, ) - Click to enlarge Since accelerating to 3.4% growth back in November 2017, US industry has failed to experience much beyond that clear hurricane-related boost. IP for prior months,...

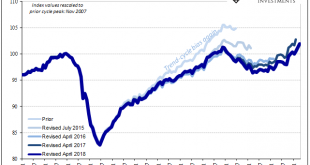

Read More »Why The Last One Still Matters (IP Revisions)

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of...

Read More »US IP On The Other Side of Harvey and Irma

Industrial Production in the US was revised to a lower level for December 2017, and then was slightly lower still in the first estimates for January 2018. Year-over-year, IP was up 3.7%. However, more than two-thirds of the gain was registered in September, October, and November (and nearly all the rest in just the single month of April 2017). US Industrial Production, Jan 1995 - 2018(see more posts on U.S. Industrial...

Read More »Is Un-Humming A Word? It Might Need To Become One

Industrial Production in the US was up 3.6% year-over-year in December 2017. That’s the best for American industry since November 2014 when annual IP growth was 3.7%. That’s ultimately the problem, though, given all that has happened this year. In other words, despite a clear boost the past few months from storm effects, as well as huge contributions from the mining (crude oil) sector, American production at its best...

Read More »The Economy Likes Its IP Less Lumpy

Industrial Production rose 3.4% year-over-year in November 2017, the highest growth rate in exactly three years. The increase was boosted by the aftermath of Harvey and Irma, leaving more doubt than optimism for where US industry is in 2017. For one thing, of that 3.4% growth rate, more than two-thirds was attributable to just two months. Combining April 2017 with October, IP advanced by 2.2% leaving the other 10 to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org