Overview: The S&P 500 hit three-month lows yesterday, while the Conference Board's measure of consumer confidence fell to a four-month low. New home sales fell to their lowest level in five years. The US federal government appears headed for a partial shutdown on October 1. Still, the greenback rides high. It is extending its gains against several G10 currencies, including the euro and sterling. The Swiss franc is moving lower for the 12th consecutive session....

Read More »The Dollar and Oil Steady After Yesterday’s Advance

Overview: Bonds and stocks are mostly heavier today and the dollar has turned mixed. Oil prices are consolidating after soaring to new highs since late last year on the longer than expected extension of Saudi Arabia's extra cut of one million barrels a day. Since July, it has been extending it by one month at a time. Yesterday, it extended it through Q4. Russia, who had previously indicated intentions on reducing its exports by 500k barrels, announced it was...

Read More »US Dollar Punches Higher

Overview: Disappointing data in Asia and Europe has sent the greenback broadly higher. The strong gains posted before the weekend were mostly consolidated yesterday when the US and Canadian markets were on holiday. The rally resumed today. The Antipodeans and Scandis have been hit the hardest (-0.7% to -1.25%) but all the G10 currencies are down. The Swiss franc and yen are off the least (-0.35%-0.45%), and the euro and sterling have taken out their recent lows....

Read More »China’s Measures Begin to Find Traction, US Employment Report on Tap

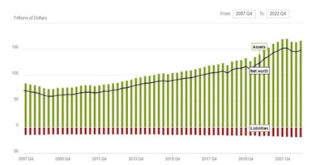

Overview: Beijing's seemingly steady stream of measures to support the economy and steady the yuan are beginning to produce the desired effect. The yuan is snapping a four-week decline and the CSI 300 halted a three-week drop. Some economists estimate that the bevy of measures may be worth as much as 1% for GDP. The dollar is narrowly mixed ahead of the US employment data, which is expected to see the pace of job growth slow to around 170k. Of note, the Mexican peso...

Read More »Markets Remain Unsettled, Bonds and Stocks Retreat, Dollar Gains Ahead of BOE

Overview: The global capital markets remain unsettled. The combination of the BOJ adjustment of its monetary policy, Fitch's downgrade of the US to AA+, ahead of a flood of supply, and new measures by China have injected volatility into the summer markets. The US dollar has extended it gains today against the G10 currencies and most emerging market currencies. The yen has recovered a bit after the BOJ stepped in and bought JGBs for the second time this week at...

Read More »Dollar Sell-Off is Getting Stretched

Overview: Softer-than-expected US CPI, following weaker than expected job growth has sent the greenback tumbling. The dollar is stabilizing against the yen today, but the downside momentum is intact against the other major currencies. The euro approached $1.1175, sterling $1.3080, and the greenback slumped to almost CHF0.8615. The Australian dollar reached $0.6850, and the New Zealand dollar tested $0.6360. The Canadian dollar, often a laggard in a weak US dollar...

Read More »Scandis and Antipodeans Lead the Greenback’s Recovery

Overview: The market continues to resist the Fed's signal that another 50 bp of hikes may be necessary to ensure inflation is headed toward its target. Previously, the market had rate cuts priced in, and it took some time for the Fed's push back to be accepted. The market converged with the Fed, and this helped the dollar recover. We suspect a similar pattern to play out again. The market does not have even one of the two Fed hikes discounted. As it moves in this...

Read More »ECB’s Turn

Overview: The Fed's hawkish hold and signal that it may raise rates two more time this year sent ripples through the capital markets. Risk appetites have been dealt a blow. However, China's rate cut and likely additional supportive measures after disappointing data, helped lift the CSI 300 by 1.6%, the most this year. The Hang Seng rose by nearly 2.2%, the most in three months. Europe's Stoxx 600 is snapping a three-day advance and US index futures are trading...

Read More »Japan’ Q1 GDP was Revised Up, While the Eurozone’s was Revised Down

Overview: The back-to-back surprise rate hikes by the Australia and Canada spurred speculation that the Fed could hike next week, and this lifted US rates and helped the dollar recover. The odds of a hike increased, according to the indicative pricing in the Fed funds futures market from about a 20% chance to a little above 35%. now. At yesterday's high, the two-year yield was up a little more than 25 bp since the low before the US employment data last Friday. It is...

Read More »Dollar Steadies After Fed’s Push Back

Overview: The market was gearing up for a June Fed hike and officials and this helped lift the greenback. However, the Fed Governor Jefferson, nominated to be the next vice-chair, pushed back against it. His views are thought to reflect the Fed's leadership. Philadelphia Fed's Harker, who is a voting member of the FOMC also backed a pause. This is not quite what we expected when we suggested the US interest rate adjustment was complete or nearly so. Still, it broke...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org