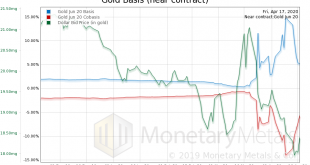

The price of gold has been up steadily for the last 30 days (with a few zigs and zags), now re-attaining the high it achieved prior to the big drop in March. Gold ended the week at $1,662. Alas, it’s not quite the same story in silver, whose price drop was bigger. Now its price blip is smaller. Silver ended the week at $15.19. One does not need to look to the gold-silver ratio, which is currently off the charts, to see that the world has gone mad. Silver, it has long...

Read More »What Can Kill a Useless Currency, Report 28 Oct 2018

There is a popular notion, at least among American libertarians and gold bugs. The idea is that people will one day “get woke”, and suddenly realize that the dollar is bad / unbacked / fiat / unsound / Ponzi / other countries don’t like it / <insert favorite bugaboo here>. When they do, they will repudiate it. That is, sell all their dollars to buy consumer goods (i.e. hyperinflation), gold, and/or whatever other...

Read More »Useless But Not Worthless, Report 21 Oct 2018

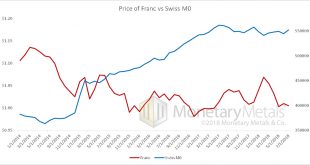

Let’s continue to look at the fiasco in the franc. We say “fiasco”, because anyone in Switzerland who is trying to save for retirement has been put on a treadmill, which is now running backwards at –¾ mph (yes, miles per hour in keeping with our treadmill analogy). Instead of being propelled forward towards their retirement goals by earning interest that compounds, they are losing principal. They will never reach their...

Read More »Bitcoin, Arbitrage, and the Human Side of the Blockchain

On Bloomberg view, Matt Levine discusses the recent bitcoin fork. The handling of long and short positions on Bitfinex, a bitcoin exchange, created an arbitrage opportunity, until Bitfinex changed its mind. Bitfinex announced a policy to deal with the fork, people took advantage of the policy, and Bitfinex changed its mind after the fact. Each of its decisions was rational, and quite plausibly the fairest option available to it. None of those decisions were required by, like, the nature...

Read More »Limits of Arbitrage and Covered Interest Parity

In a BIS working paper, Dagfinn Rime, Andreas Schrimpf, and Olav Syrstad analyze the apparent breakdown of covered interest parity (CIP). They argue that CIP holds remarkably well for most potential arbitrageurs when applying their marginal funding rates. With severe funding liquidity differences, however, it becomes impossible for dealers to quote prices such that CIP holds across the full rate spectrum. A narrow set of global top-tier banks enjoys risk-less arbitrage opportunities as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org