In 2024 the Australian senate is establishing an inquiry into Coles and Woolworths, the two biggest grocery retailers in the country. These two retailers hold a market share of two-thirds of the retail grocery market in Australia.This follows sharp rises in government spending, inflation, consumer prices, and lending rates following the Covid crisis. Instead of addressing inflation-fueled spending, governments have chosen grocery retailers as the bad guy to blame for...

Read More »The Fed Cannot Cut Rates as Fast as Markets Want

Market participants started the year with aggressive expectations of rapid and large rate cuts. However, after the latest inflation, growth, and job figures, the probability of a rate cut in March has fallen from 39 to 24%. Unfortunately for many, headline figures will support a hawkish Federal Reserve, and the latest comments from Jerome Powell suggest rate cuts may not come as fast as bond investors would like.For the Federal Reserve, the headline macro figures...

Read More »Playing for Kekes

Moderate Conservatism: Reclaiming the Centerby John KekesOxford University Press, 2022; 256 pp.John Kekes, who taught for many years at the State University of New York at Albany, does not agree with the protagonist of Henrik Ibsen’s Brand that “the devil is compromise,” at least where politics is concerned. The thesis of Moderate Conservatism can be seen as an extended commentary on that disagreement. Kekes is a value pluralist who values many different things,...

Read More »A Black Man’s Inconvenient Truth: Canceling Racist Historical Omissions

Can a Black man communicate inconvenient truths? One did and a reporter for The Root, a Black on-line magazine, labeled them foolishness. What has he said? Among others, reportedly this: It was Africans who fought wars against Africans and then enslaved the losers. It was victorious African warriors who sold defeated African warriors to European slave traders in exchange for cloth, guns, and money. . . It was Africans who watched as Africans were sailed away in the...

Read More »Governments Never Give Up Power Voluntarily

[A selection from Liberalism.]All those in positions of political power, all governments, all kings, and all republican authorities have always looked askance at private property. There is an inherent tendency in all governmental power to recognize no restraints on its operation and to extend the sphere of its dominion as much as possible. To control everything, to leave no room for anything to happen of its own accord without the interference of the authorities—this...

Read More »When Ideology Turns Pathological

Aleksandr Solzhenitsyn may be the 1970 Nobel Prize winner for literature, but that does not make his work The Gulag Archipelago enjoyable reading. The detailed description of the methods of torture employed within the Soviet system alone will turn many readers away. Beyond the interrogations are the trials based upon a mock-legal system epitomized by Soviet jurist Andrei Vyshinsky’s theory that truth is relative and that evidence can be ignored, to be replaced by...

Read More »The Fed’s Milkshake Brings All the Foreigners to the Yard

Tu ne cede malis, sed contra audentior ito Website powered by Mises Institute donors Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436 [embedded content] Tags: Featured,newsletter

Read More »The End of “Extend and Pretend”

The number of U.S. commercial foreclosures spiked to 635 in January 2024 from a low of 141 in May 2020 reports real estate data firm ATTOM. The January count was up 17% from the previous month and roughly twice as many as in January 2023. “Commercial property deals in the US are picking back up at deep discounts—and forcing lenders to face just how far real estate prices have fallen,” notes Sarah Holder on Bloomberg’s “Big Take” podcast.Bloomberg commercial real...

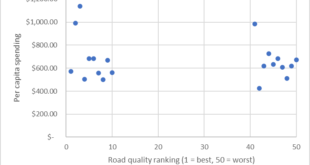

Read More »Who Will Take Care of the Roads? Why, The Coercive, Substandard, and Monopolistic Government Department, That’s Who

The sight of fresh snow is always invigorating to me, so I was happy to wake up the other day to a blanket of snow—roughly three inches—on my yard. I was less happy, though, to see the same blanket still covering the street in my neighborhood. Things took an even-more disheartening turn when, a few hours later around 10 a.m., I got to the main state road at the end of my street: still snow covered, despite the relatively meager (for this area) snowfall and the fact...

Read More »In Defense of GK Chesterton’s Manalive

G.K. Chesterton is a somewhat controversial author in most libertarian circles. As an intelligent man who wisely predicted a century out so many of the problems we face today, he has garnered great respect among many who have read him. However, as a proponent of distributism, advocating ideas such as “the taxation of contracts so as to discourage the sale of small property to big proprietors and encourage the break-up of big property among small proprietors,” he has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org