Frankfurt School of Finance Center and its Blockchain center designed a new four semester long post-experience master program (MSc) last year. The Frankfurt School’s goal is to provide the expert knowledge necessary to students looking to shape and lead blockchain innovation around the globe and in all industries. Technical and economical understanding on the topics of blockchain, digital assets (including Bitcoin and Ethereum), DeFi, Web3, tokenization, smart contracts, NFTs, financial technology, metaverse, digital euro, CBDCs, legal frameworks and entrepreneurship are part of the curriculum that is taught in seven block weeks and further deepened during the students’ master thesis. Application deadline is autumn 2023, and lectures will commence in October

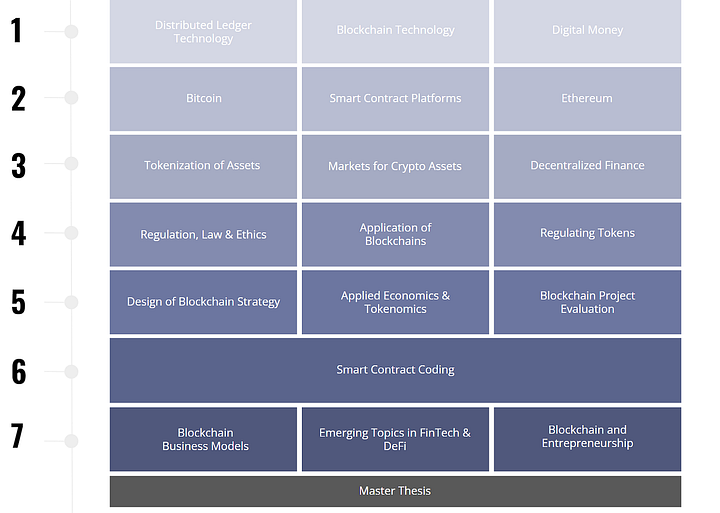

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Blockchain/Bitcoin, Featured, Germany, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Frankfurt School of Finance Center and its Blockchain center designed a new four semester long post-experience master program (MSc) last year. The Frankfurt School’s goal is to provide the expert knowledge necessary to students looking to shape and lead blockchain innovation around the globe and in all industries.

Technical and economical understanding on the topics of blockchain, digital assets (including Bitcoin and Ethereum), DeFi, Web3, tokenization, smart contracts, NFTs, financial technology, metaverse, digital euro, CBDCs, legal frameworks and entrepreneurship are part of the curriculum that is taught in seven block weeks and further deepened during the students’ master thesis. Application deadline is autumn 2023, and lectures will commence in October 2023.

During the study program, they will also make an excursion to the crypto valley in Switzerland, students will also setup up a Bitcoin node, do analytics of on-chain data and do a “coding camp” to understand smart contracts.

Website: Master in Blockchain and Digital Assets (frankfurt-school.de)

Tailored to students who have completed their first academic degree (min. Bachelors or equivalent) and have taken their first practical steps in the world of business with a minimum of one year of relevant work experience, the Master in Blockchain & Digital Assets course offers a way to take your career to the next level by adding innovative and revolutionary components, competences and methodology as well as objectives for their businesses.

The graduates are qualified to lead in areas such as digital strategy, digital asset management, growth management, business development, decentralized application development, blockchain development, policymaking and many more. Blockchain is considered by many to be one of the most important developments in recent history. This course is meant to prepare you to take on a leading role in the development and expansion of this technology.

The programme is specifically tailored to the needs of managers or professionals who wish to stay fully employed throughout their studies while gaining expertise to develop their businesses further.

What is the Masters’ program about?

In this seven week block program students will be taught how blockchain builds the infrastructure for future financial markets and how companies can leverage the new technology to provide more security, transparency, efficiency and digitalization. Blockchain technology will be the basic infrastructure for finance and capital markets in the future.

This includes crypto assets and enterprise DLT solutions. With this, a transformation of operating cycles, design and development of products and organisational structures can be expected in any business sector. Existing assets will be tokenised, resulting in digital securities, money will be running on blockchain ledgers, crypto assets are now an asset class on their own.

In order to get up to speed, step one is to cover the technical background such as DLT technology, blockchain, DeFi, tokenization, digital money, smart contracts and the coding thereof. In the second step, they look at applications for advancing blockchain solutions and the design of suitable strategies, as well as their regulation through law and ethics. In the third step, you will have the choice between the Blockchain in Business or the digital strategy elective.

In the seventh module called “Blockchain in Business, students will identify emerging topics in DeFi and FinTech while understanding their impact on entrepreneurship, sustainability and innovative business models. In the digital strategy module, they will focus on law and data protection, ethics and building digital strategy for businesses.

What are the highlights of this master?

The curriculum, taught completely in English, not only keeps pace with emerging topics and trends but also offers an excursion to Zurich, Switzerland, one of the most renowned crypto and blockchain hubs worldwide. This will give students the opportunity to discuss and network with industry experts. To gain hands-on experience with Bitcoin, students will be building a Bitcoin Lightning Node to go beyond theoretical understanding of the subject.

The smart contract boot camp as one of the week long modules further deepens the learnings and prepares students to drive blockchain adoption in their industries regarding products, business operations and new business models. The next intake will start in October 2023.

Featured image credit: Edited from Freepik

The post Frankfurt University Forms Master in Blockchain & Digital Assets appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Tags: Blockchain/Bitcoin,Featured,Germany,newsletter