The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday announced it will raise the target federal funds rate by 50 basis points, bringing the target rate to 4.5 percent. Wednesday’s rate hike followed four hikes in a row of 75 basis points, and is the smallest rate hike since March. According to the FOMC’s press release, the committee voted unanimously for the half point hike, pointing out that “[price] inflation remains elevated” while also dogmatically (and wrongly) placing the blame for a year of 7-point-plus price inflation on “supply and demand imbalances related to the pandemic” and “Russia’s war against Ukraine.” The 50 basis-point increase had been predicted by many finance pundits following Tuesday’s print of a 7.1 percent CPI inflation

Topics:

Ryan McMaken considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

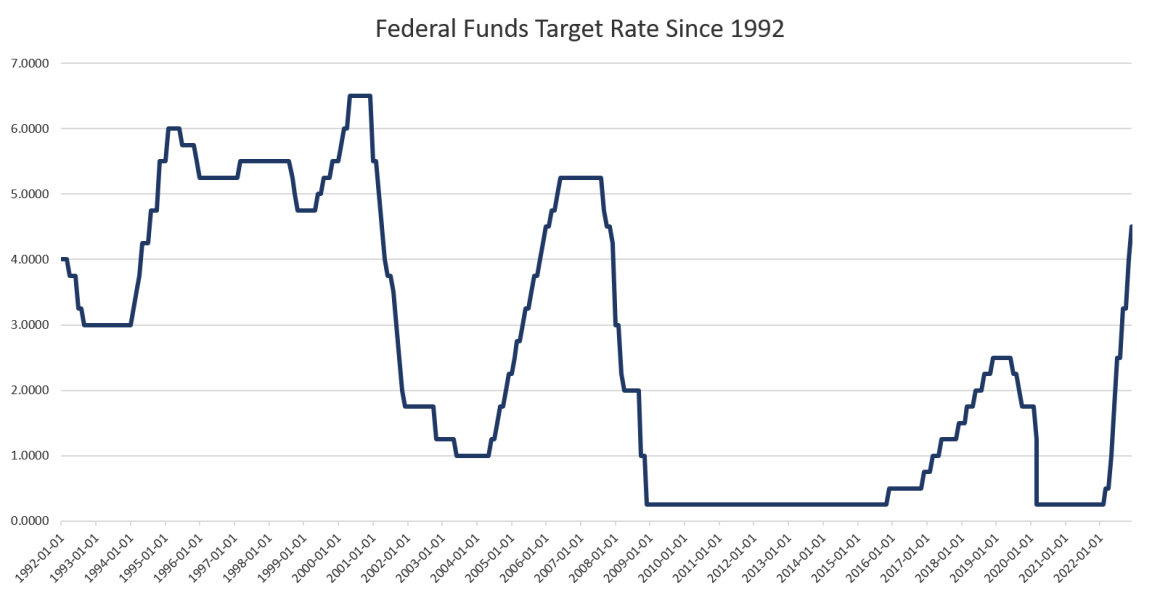

The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday announced it will raise the target federal funds rate by 50 basis points, bringing the target rate to 4.5 percent. Wednesday’s rate hike followed four hikes in a row of 75 basis points, and is the smallest rate hike since March.

According to the FOMC’s press release, the committee voted unanimously for the half point hike, pointing out that “[price] inflation remains elevated” while also dogmatically (and wrongly) placing the blame for a year of 7-point-plus price inflation on “supply and demand imbalances related to the pandemic” and “Russia’s war against Ukraine.”

| The 50 basis-point increase had been predicted by many finance pundits following Tuesday’s print of a 7.1 percent CPI inflation rate. The reasoning is that since price inflation eased somewhat in November from June’s high of 9.1 percent, this would mean the Fed would be less aggressive with rate hikes.

This proved to be true, although it was clear from Powell’s press conference that the Fed is still at least attempting to put on a hawkish face and send the message that it plans to keep hiking rates and otherwise embracing “restrictive” monetary policy. For example, Powell insisted that “we continue to anticipate that ongoing increases will be appropriate” so that they are “sufficiently restrictive.” and he reiterated the committee is “strongly committed” to bringing down inflation and that “we still have a long way to go.” |

Good Reasons to Think the Fed Will Cave to Pressure in 2023

A “long way to go” is a rather subjective measure, however. The FOMC’s Summary of Economic Projections (SEP) showed that most members of the committee believe the target policy rate will peak at 5.5 percent or less in 2023 and then fall back below 5 percent by 2024. In other words, most on the FOMC believe only two more hikes of 50 basis points are going to be “needed”—at most—and the FOMC would then get back to cutting the target rate yet again by mid 2023.

So, while Powell’s tone was undoubtedly hawkish, the Committee gave many reasons to look for a return to Fed easing just a few months away.

Indeed, market indicators suggested that markets are skeptical of the Fed’s hawkish bluff. Bond prices headed up—i.e., yields went down—in the wake of Powell’s press conference. Or, as Bloomberg noted Wednesday:

After buckling on what was initially seen as tough-love message from the Fed, bond prices reversed course as investors bet that the central bank would execute a U-turn next year and eventually end up cutting interest rates as the economy falters.

“The market is not buying the Fed’s increasingly hawkish position that they are going to raise rates to a higher-than-expected level and keep them there,” said Lindsey Piegza, chief economist at Stifel Nicolaus & Co. “The market clearly thinks inflation is going to be on a much more desirable path than the Fed is anticipating.”

Of course, “a more desirable path” for price inflation is exactly what we should expect when economic indicators point to recession as they do now. With savings rates plummeting, disposable income disappearing, credit card debt soaring, real wages falling, and an inverted yield curve, there’s every reason to expect falling economic activity, and with it, slowing price growth. After all, even the Fed’s SEP prediction for economic growth in both 2022 and 2023 is a paltry 0.5 percent. Given that the Fed virtually always takes a rosy view of the economy, this might as well be an admission of an ongoing de facto recession.

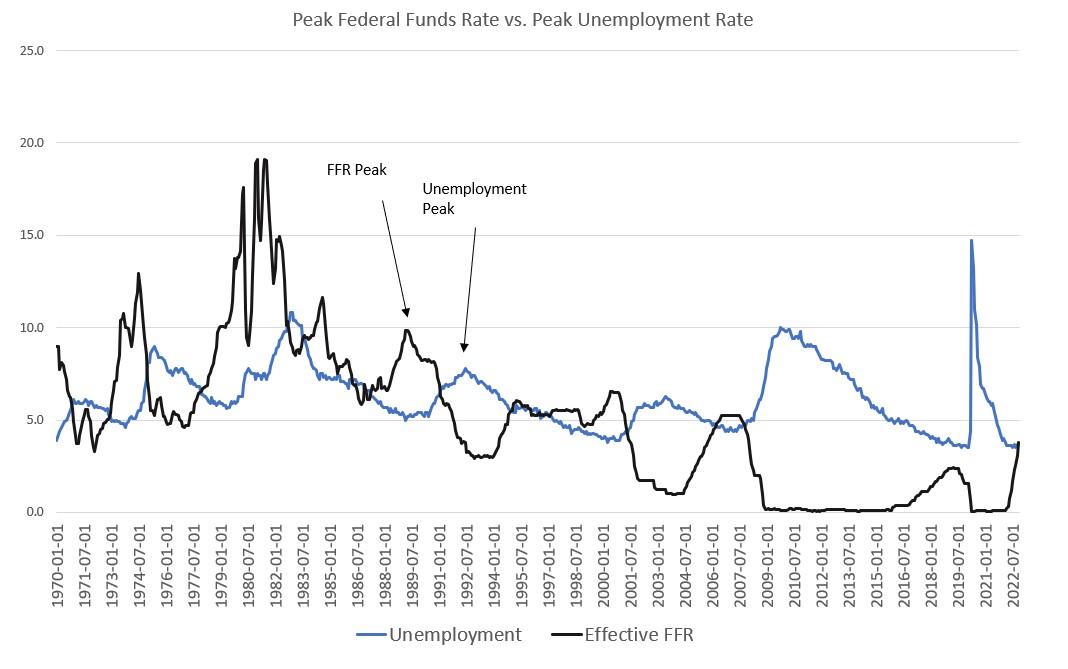

Unemployment Lags the Interest RateMoreover, we have yet to see the effects of the end of the ultra-easy-money boom playing out in real time. We live in an economy that’s increasingly dependent on constant new infusions of fiat money. Once that even slows, we should expect rising unemployment. But, there’s no reason to expect to see rising unemployment in the early phase of a Fed tightening cycle. History shows that rising unemployment tends to come months after the Fed ends its tightening and reverts to a loosening cycle. We can see this in the delays between peaking fed fund rates and peaking unemployment rates. For example, in the leadup to the recession in the early 1990s, the federal funds rate started going down again in June 1989. But unemployment did not peak until the summer of 1992. Similarly, the federal funds rate began to fall in late 2000, but unemployment in the dot-com bust did not peak until the summer of 2003: So, a return to the Fed lowering rates hardly means the economy is out of the woods, and this uncertainty reminds us that the Fed is winging it when it comes to what it will do next. In recent months, the FOMC has eliminated forward guidance as it has been forced to face the reality it was very wrong about “transitory” inflation and the Fed’s ability to stop inflation before it started. The Fed had promised for months that it had a secret plan that would make everything turn out well. But nowadays, the Fed no longer even attempts to keep up the pretense that it has the situation well in hand. Thus, Wednesday’s press conference lacked all the cocksure pronouncements of there being no recession on the horizon, and how the Fed would guide everything to a favorable end. Powell instead was saying things like “I don’t know what we’ll do [at the next meeting]” and “I don’t think anyone knows if we’re going to have a recession or not.” He even said at one point “this is the best we can do.” |

Wall Street Is Still Planning on a Soft Landing

Markets, however, continue to cling to the idea that a soft landing is coming, and this is why there is relatively little alarm over the Fed’s predictions of weak economic fundamentals next year and continued inflation. Markets continue to indulge in quite a bit of wishful thinking in the narrative that mere moderation in the economy—with a mild recession at worst—will bring inflation down, and then that the Fed can return to pumping out a wave of easy money. In other words, the hope—and hope is all it is—is that there will be a few weak months in early 2023, but then easy money will bring all the usual asset price inflation roaring back. This is what the banker and investor classes—not to mention Biden and Congress—so desperately want and need.

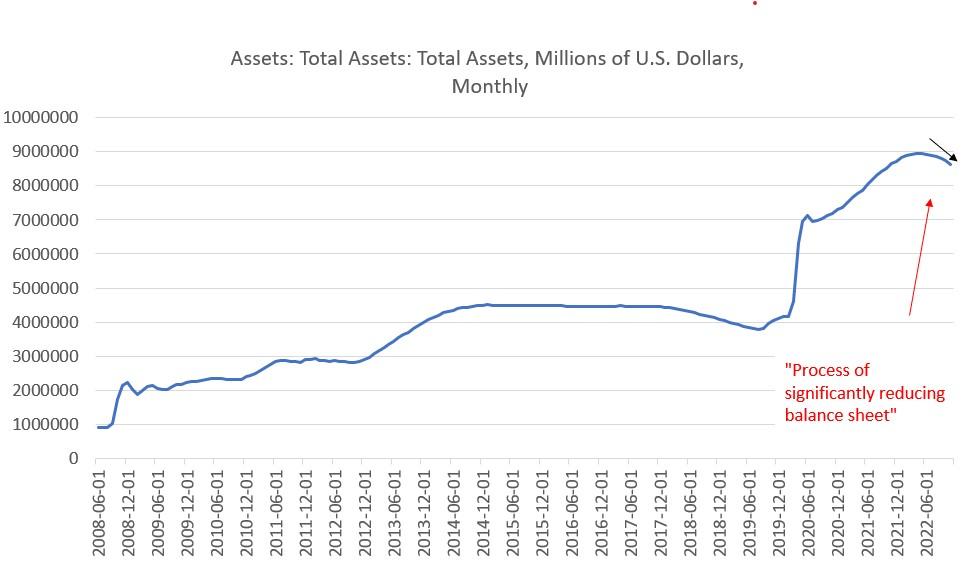

What about the Fed’s Portfolio?That said, the Fed continues to provide Wall Street with a good reason to believe that there will be no sustained monetary tightening. For this, we need only look to the lack of action on the Fed’s portfolio. For months, the FOMC has repeatedly stated that it is “significantly reducing its balance sheet,” yet in the six months since the balance sheet peaked, it has been reduced by only 3.4 percent of $8.9 trillion. One might claim that is indeed “significant” in that it is not zero, but it hardly points to aggressive tightening on the part of the Fed. Rather, the Fed know that any sizable reduction in the balance sheet would cause government bond yields to soar upward and this would be disastrous for federal debt obligations. Washington won’t let the Fed do that. |

Tags: Featured,newsletter