The vast majority of market participants are about as ready for a semi-random “volatility event” as the dinosaurs were for the meteor strike that doomed them to oblivion. Judging by euphoric gambler–oops I mean “investor”–sentiment and measures of volatility, risk of a market drop has been near-zero for the past 18 months. But risk was never actually low, it was only hidden. When it emerges, it’s a surprise only to those who mistakenly thought risk had vanished. As Benoit Mandelbrot explained in his bookThe (Mis)behavior of Markets, crashes are an intrinsic feature of systems like stock markets. These risks are not generated by specific human actions or sentiment but by the system itself. Just as humans make subconscious decisions and then conjure up

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The vast majority of market participants are about as ready for a semi-random “volatility event” as the dinosaurs were for the meteor strike that doomed them to oblivion.

The vast majority of market participants are about as ready for a semi-random “volatility event” as the dinosaurs were for the meteor strike that doomed them to oblivion.

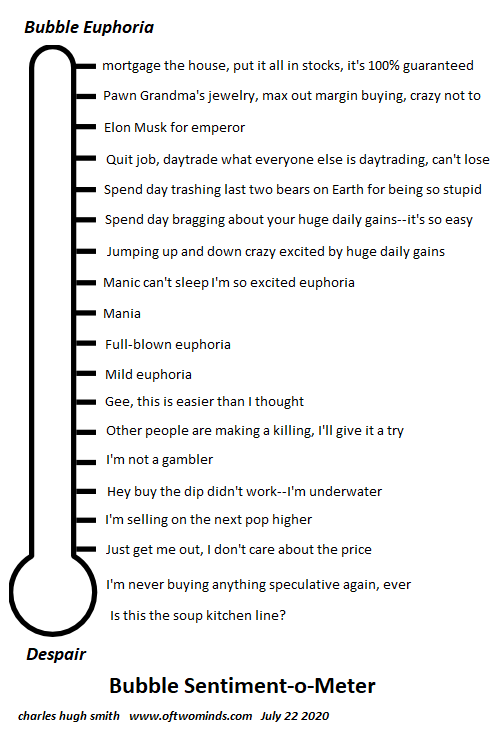

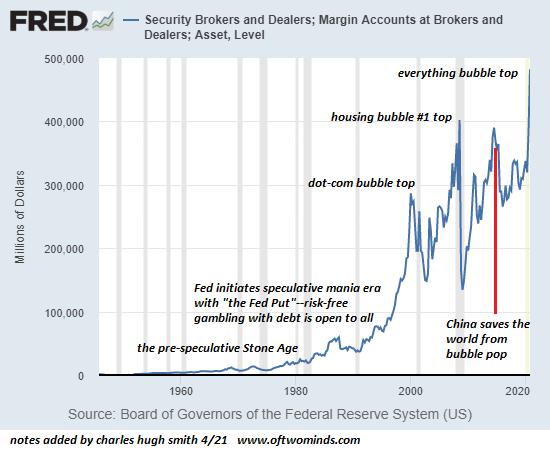

Judging by euphoric gambler–oops I mean “investor”–sentiment and measures of volatility, risk of a market drop has been near-zero for the past 18 months. But risk was never actually low, it was only hidden. When it emerges, it’s a surprise only to those who mistakenly thought risk had vanished.

As Benoit Mandelbrot explained in his bookThe (Mis)behavior of Markets, crashes are an intrinsic feature of systems like stock markets. These risks are not generated by specific human actions or sentiment but by the system itself.

Just as humans make subconscious decisions and then conjure up quasi-rational justifications for their choice after the fact, market participants always conjure up some event or decision as the cause of the crash. Favorites include central bank policy error, black swan events (“bolts from the blue”), earnings surprises, technical levels were breached, and so on.

Mandelbrot’s insights reveal why markets crash without any policy error or other fabricated- after-the-fact justification: as those who witnessed the collapse of Japan’s massive credit-asset bubble in 1989-1990 observed, markets just stopped going up and started falling.

Risk is a reflection of many dynamics, but the key dynamic few participants seem to understand is the inherent instability of complex systems: surface tranquility is not an accurate reflection of the actual state of stability or risk, no mater how long the period of tranquility stretches.

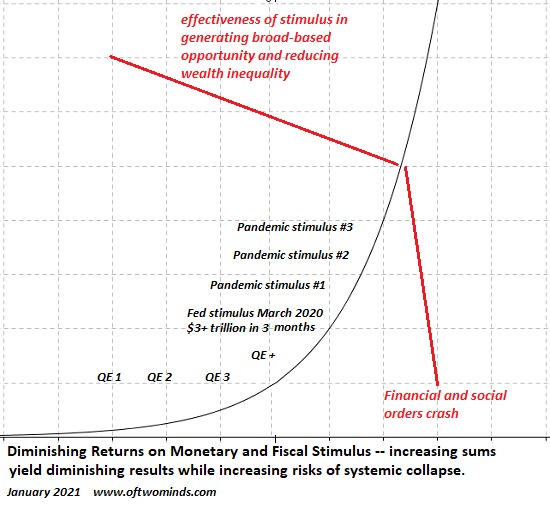

The human mind rebels at the dominance of quasi-random crashes, as our hubris and need to be in charge generates an illusion of control: rather than accept that markets can crash more or less “out of the blue” without any black swan or other trigger, we place our faith–yes, faith–in central bank policies, readings of sentiment, technical indicators and the like.

This illusion of control blindsides us to the reality that no policy tweak can stave off the quasi-random meteor strikes that are intrinsic features of complex systems. Wallowing in our hubris-soaked illusion of control, we believe that if there were no pilicy errors or black swans, markets could move smoothly higher forever. That is a fundamental misunderstanding of the systemic foundations of markets.

The vast majority of market participants are about as ready for a semi-random “volatility event” as the dinosaurs were for the meteor strike that doomed them to oblivion. Financial oblivion awaits those ensnared in the quasi-religious faith of Federal Reserve power and other hubris-soaked illusions of control.

Tags: Featured,newsletter