What typifies the phenomenon of the boom-bust cycle is that it is recurrent. What is the reason for this? Loose monetary policies set the platform for various activities that would not emerge without the easy monetary stance. What loose monetary policy does here is to engineer the transfer of real savings from wealth generating activities to artificially stimulated activities, which we can label as bubble activities. Over time, these loose monetary policies begin to manifest as increases in price inflation (consumer prices, producer prices, and/or asset prices) and various forms of distortions that economists call overheating. To counter these side effects the central bank may reverse its earlier loose stance, as happened in 2018 when the Fed allowed interest

Topics:

Frank Shostak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

What typifies the phenomenon of the boom-bust cycle is that it is recurrent. What is the reason for this?

What typifies the phenomenon of the boom-bust cycle is that it is recurrent. What is the reason for this?

Loose monetary policies set the platform for various activities that would not emerge without the easy monetary stance. What loose monetary policy does here is to engineer the transfer of real savings from wealth generating activities to artificially stimulated activities, which we can label as bubble activities.

Over time, these loose monetary policies begin to manifest as increases in price inflation (consumer prices, producer prices, and/or asset prices) and various forms of distortions that economists call overheating.

To counter these side effects the central bank may reverse its earlier loose stance, as happened in 2018 when the Fed allowed interest rates to slightly rise and slightly cut back its balance sheet. This starts to undermine those bubble activities and the process of expansion is reversed: an economic bust is set in motion. Note that an economic bust is great news for various wealth generating activities—because less real wealth is now diverted from them to bubble activities.

Against the background of this central bank–determined cycle, there are various economic shocks. These shocks are not the cause of the cycle but they can, and do, amplify its effects.

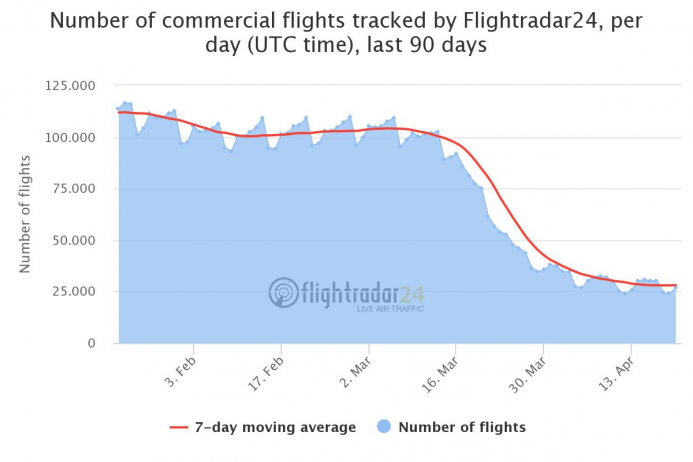

In this sense, lockdowns to counter the coronavirus are likely to magnify the severity of the economic bust that has been brewing in recent years.

How Lockdowns Are Making Things Worse

By paralyzing the production of goods, lockdowns undermine the process of real wealth generation,which is driven by real savings.

As long as the inflow of consumer goods exceeds the outflow of these goods, all other things being equal, economic growth follows, because the pool of real savings continues to expand.

In this scenario, we are still going to have boom-bust cycles on account of central banks’ monetary policies. These cycles oscillate around the rising trend of economic growth.

Once the outflow of consumer goods starts to exceed the inflow of these goods, however, the pool of real savings starts to decline and the underlying growth rate of the economy follows suit.

Lockdowns generate a situation where the inflow of consumer goods comes to a halt, because the production of these goods has stopped, while the consumption of these goods continues. This reduces the pool of real savings.

As a result, it will be harder to restart the economy after the lockdowns are removed. The longer the duration of the lockdowns, the harder it is going to be to get the economy going.

Also, the reduction in the maintenance of various tools and machinery during the lockdowns is going to undermine the infrastructure’s ability to restart.

What further aggravates the damage inflicted by the lockdowns is the massive monetary pumping by the central bank to prevent the bankruptcy of various companies. Should the government and the central bank provide support to various companies?

How the Free Market Would Handle the Coronavirus

In a proper free market economy with a total separation of the economy and state, every company is on its own. Every company would have to figure out how to survive the damage caused by the coronavirus.

In a free market environment, various businesses most likely would have savings for “difficult times” or they would have insurance for major shocks.

Furthermore, the free market environment is always subject to various shocks, either positive or negative. For instance, various new ideas once implemented and introduced as new products are likely to shock various businesses that were too slow to adapt to changes.

The introduction of electricity was a shock for the manufacturers of candles and gas lights. For them to survive they had to adjust to the new environment.

Likewise, the shock from the coronavirus has altered the environment in which most businesses were operating. In a free market, businesses would have to adjust to the new setup.

For instance, they would have to establish how to coexist with the virus. Various firms would emerge to counter the damaging effects of the virus on individuals. It is highly unlikely that businesses would practice passivity by introducing lockdowns. On the contrary, they would confront the new environment and would try to make the best of it—indeed, they would need to in order to survive.

In an unfree market economy, which is hampered by government and central bank interference, businesses are not allowed to effectively counter the side effects of the coronavirus. The lockdowns to counter the virus are in fact paralyzing businesses, preventing the generation of an effective way of countering the virus’s side effects.

Monetary and Fiscal Bailouts Won’t Help

Most commentators and most people are sympathetic to the idea that the government and the central bank should provide support to businesses in order to keep them alive.

But neither the government nor the central bank are real wealth generating entities.

Consequently, they do not have real wealth in their possession and thus are not in a position to provide any help. All that they can do is take from one individual and give it to another.

By what criteria is the government going to decide how much to take from A in order to give to B?

Whenever governments borrow the resources that they do not have, they in fact deprive some wealth generating business of these resources.

Likewise, when the central bank embarks on aggressive monetary pumping to reduce the liquidity difficulties of various businesses, it sets in motion the transfer of real savings from wealth generators to the holders of the newly injected money.

This undermines the process of real wealth generation and subsequently weakens the foundations of the economy.

Intervention Prevents Businesses’ Adaptation to the New Environment

Additionally, the government and central bank interference prevent businesses’ adjustment to the new environment caused by the coronavirus.

Thus, although governments and central banks intervene under the claim that their policies will help the economy, their intervention will actually do the exact opposite.

These policies support various activities that cannot survive in the new environment. By keeping them alive, central authorities are generating a buffer of inefficiency, which drains wealth generators and undermines the well-being of individuals.

By means of decrees and monetary pumping central authorities are in fact forcefully transferring real wealth to unproductive activities—a violation of individual property rights.

What we have here is the weakening of the private sector’s ability to cope with the dynamics of the new environment.

What Does All This Mean for the American and Other Economies?

It is unlikely that governments will reduce their interference. On the contrary, if a new wave of virus infections emerges, we can rest assured that we will experience a greater amount of monetary pumping and more lockdowns.

The pool of real savings is likely to be further damaged, which in turn could lead to a prolonged economic recession.

While massive monetary pumping is likely to result in an increase in price inflation toward the end of 2021, we also suggest that at some stage, as a result of banks’ reluctance to continue to push lending out of “thin air,” we could experience a sharp fall in money supply growth. This could in fact lead to price deflation.

As long as the pool of real savings is growing, the central bank monetary pumping is likely to be bullish for the stock markets.

But once it becomes clear that the process of real wealth generation is in trouble, the stock markets will likely enter a phase of a protracted underperformance, and any attempts by authorities to further increase the monetary pumping will likely make things much worse.

Hence the only reasonable solution is for authorities to do nothing—and as soon as possible.

Instead of the government presenting us with “Stay Home” advice, we should be presenting them with “Do Nothing” advice.

This would allow businesses to revive the process of real wealth generation that will strengthen the pool of real savings.

Tags: Featured,newsletter