In his Man, Economy, and State, Murray N. Rothbard investigates not only the role of the capitalist but also that of the entrepreneur in a market economy. Rothbard uses the theoretical concept of the evenly rotating economy (ERE) to compare the role of the capitalist to that of the entrepreneur. Entrepreneurs earn profits in so far as they successfully correct the maladjustments in the real economy and move it closer to the ERE without ever attaining that state. Evenly Rotating Economy (ERE) The function of the entrepreneur is analytically different from that of the capitalist. Because the real economy, different from the evenly rotating economy, is dynamic and therefore subject to constant change, entrepreneurs are required who are active in coping with the

Topics:

Antony P. Mueller considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In his Man, Economy, and State, Murray N. Rothbard investigates not only the role of the capitalist but also that of the entrepreneur in a market economy. Rothbard uses the theoretical concept of the evenly rotating economy (ERE) to compare the role of the capitalist to that of the entrepreneur. Entrepreneurs earn profits in so far as they successfully correct the maladjustments in the real economy and move it closer to the ERE without ever attaining that state.

In his Man, Economy, and State, Murray N. Rothbard investigates not only the role of the capitalist but also that of the entrepreneur in a market economy. Rothbard uses the theoretical concept of the evenly rotating economy (ERE) to compare the role of the capitalist to that of the entrepreneur. Entrepreneurs earn profits in so far as they successfully correct the maladjustments in the real economy and move it closer to the ERE without ever attaining that state.

Evenly Rotating Economy (ERE)

The function of the entrepreneur is analytically different from that of the capitalist. Because the real economy, different from the evenly rotating economy, is dynamic and therefore subject to constant change, entrepreneurs are required who are active in coping with the resulting maladjustments. In an ERE, there is no need for an entrepreneur, because there is no uncertainty. Although capitalists still earn interest as compensation for waiting according to time preference, there are neither profits nor losses in the ERE. Rothbard uses the idealization of the ERE as a contrast to the working of a real economy.

The concept of the ERE was developed by Ludwig von Mises. It describes a nonexistent system wherein the same market transactions happen repeatedly. As such, there is no need for entrepreneurial action, because the future prices will be the same as current prices. The ERE describes a condition in which the presently existing market data—valuations, technology, and resources—remain constant.

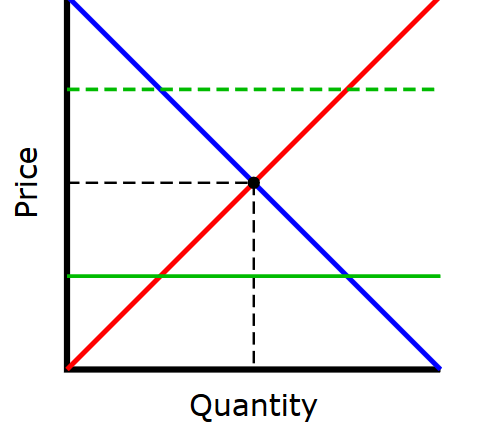

In the evenly rotating economy, there is neither uncertainty nor risk. Thus, the rate of net return is equal to the exchange ratio between the present and the future goods, which is the pure rate of interest. In the ERE, the factors of production receive their remuneration according to their discounted marginal value products. Because risk and uncertainty are absent in the ERE, the interest rate reflects pure time preference. Consequently, there will be no economic profits and losses:

In an evenly rotating economy, where all the market actions are repeated in an endless round and there is, therefore, no uncertainty, entrepreneurship

disappears. (Rothbard, Man Economy and State, p. 591)

Although the ERE would have capitalists, in it there would be no need for entrepreneurs. In the real economy, however, permanent change is going on, and a realistic view of the economy recognizes a world of action and change.

Individual value scales, technological ideas, and the quantities of means available are always changing. These changes continually impel the economy in various directions. Value scales change, and consumer demand shifts from one good to another. Technological ideas change, and factors are used in different ways. Both types of change have differing effects on prices. Time preferences change, with certain effects on interest and capital formation. The crucial point is this: before the effects of any one change are completely worked out, other changes intervene. (p. 321)

The evenly rotating economy as an imaginary construct depicts an economy without uncertainty. Consequently, there is no profit or loss. Entrepreneurship comes into play as a special function in order to deal with the uncertainty of the future in the real world. Entrepreneurs earn profit and suffer a loss when their businesses’ rate of return is either above or below the natural interest rate. Competitive markets eliminate businesses that make losses and leave room for those entrepreneurs who are better capable of foreseeing the future preferences of the consumers.

Capitalists and Entrepreneurs

Although entrepreneurs can also be capitalists, their function is very distinct.

Different from the entrepreneurs, the capitalists

earn their interest income…by supplying the services of present goods to owners of factors in advance of the fruits of their production, acquiring their products by this purchase, and selling the products at the later date when they become present goods. Thus, capitalists supply present goods in exchange for future goods (the capital goods), hold the future goods, and have work done on them until they become present goods. (p. 352)

The capitalists maintain the production process whose value falls due finally and exclusively with the payment by consumers. Capitalists give up money in the present to gain a greater sum in the future. The interest that they earn this way is the agio or discount on future goods as compared with present goods. It is the premium on present goods over future goods. The rate between the present and the future goods represents the “social rate of time preference.” This is “the ‘price of time’ on the market as the resultant of all the individual valuations of that good” (p. 353).

Capitalists bear the burden of foregoing present consumption as they spend money now for the production of the goods the final remuneration from which will only come later, when the consumers pay the final product. Capitalists provide their saved money for the production of goods through the full range of the stages of production and up to the point where the goods are sold as consumer goods. It is not until the good has run through all stages of production and reached its endpoint that the consumers pay for it.

The worker (as an “ideal type”) does not need to save and forego present consumption, because capitalists pay wages during the whole period of production, while the final payment for good happens only in the future. The capitalist’s function is a time function. Capitalists advance present goods in return for future goods.

The capitalist’s contribution to the production process is saving and restricting their consumption. By doing this, they relieve the workers from the necessity of sacrificing present goods and from having to wait until the future goods become available. As the owners of the capital structure, the capitalists provide present goods to the workers. Thus, the workers receive their remuneration in the present while the capitalists have to wait until the good becomes a final consumer good.

Role of the Entrepreneur

While the capitalists extend funds in advance until the consumer pays for the final product, the function of the entrepreneur lies in dealing with uncertainty.

Different from risk, uncertainty is incalculable and therefore uninsurable. The entrepreneur adjusts the discrepancies that emerge in a market due to uncertainty about the future. Profit and loss—the entrepreneurial returns that are either above or below the pure rate of interest—result from the function of bearing uncertainty. Losses signal bad entrepreneurial judgment. In a competitive economy, the market forces work to eliminate the loss-making businesses in order to make room for those companies that are profitable due to better entrepreneurship. Entrepreneurial capitalism is not a “profit economy,” but a “profit and loss” economy. Losses are as essential to this economy as profits.

Different from the pure interest rate, which is the result of waiting, entrepreneurial profit is the result of successfully coping with uncertainty. The real world is dynamic. Future events and values are unknown. They must be estimated. “As a result of the arbitrage of the entrepreneurs, the tendency is always toward the ERE; in consequence of ever-changing reality, changes in value scales and resources, the ERE never arrives” (p. 510).

Profit and Loss

There is no “going rate of profit.” The profit rate is ephemeral and momentary, and any realized profit tends to disappear because of entrepreneurial action. In contrast, the rate of interest does not disappear, because it is based on the universality of time preference. In the real world, profits and losses are intertwined with interest returns. Separating profit and interest is an analytical device.

In the evenly rotating economy,

all factors of production are allocated to the areas where their discounted marginal value products are the greatest. These are determined by consumer demand schedules. In the modern world of specialization and division of labor, it is almost always the consumers alone who decide, and this in effect excludes the capitalists, who rarely consume more than a negligible amount of their own products….The consumers, through their buying and abstention from buying, decide how much of what will be produced, at the same time determining the incomes of all the participating factors. And every man is a consumer. (p. 514)

Entrepreneurs earn profits by superior foresight and judgment. In order to gain profit, the entrepreneur must uncover maladjustments that necessarily emerge in a world of change. The profit-maker readjusts the economy and brings it closer to the ERE. Losses, in contrast, are a sign that the entrepreneur has added to maladjustment. From this Rothbard concludes:

The greater a man’s profit has been, the more praiseworthy his role, for then the greater is the maladjustment that he alone has uncovered and is combatting. The greater a man’s losses, the more blameworthy he is, for the greater has been his contribution to maladjustment. (p. 515)

Competition ensures that those entrepreneurs who are prone to make losses are forced to disappear from the market. This is why the majority of active entrepreneurs make profits. Yet these profits only exist insofar as they are the counterpart to losses. Profits are “avoided losses,” so to speak. The paradoxical function of the entrepreneur is making a profit from adjusting maladjustments. Profits are the reward that goes to those entrepreneurs who rightly estimate future prices and accordingly adapt the capital structure.

Conclusion

Austrian economics includes the capitalist and the entrepreneur in its perspective, because the theory incorporates time. Capital has a structure and the arrangement of the capital goods happens in stages over time. Capital has a time structure in the Austrian perspective and therefore this approach can capture the functions of both, that of the capitalist and that of the entrepreneur.

The time function of the capitalist is to give an advance to those who are presently active in the preparation of future goods. In a certain sense, the capitalist’s arbitrage is that of the time preference between present and future goods, while the task of the entrepreneur exists in trying to foresee and to appraise the value of the future goods and rearrange the capital structure accordingly. The entrepreneur’s realm of action is the uncertainty that comes with change, and his remuneration in terms of profit comes as the result of correct anticipation.

Tags: Featured,newsletter