The drive for financial innovation shows no sign of slacking in 2020. (Keystone/ Valentin Flauraud) It was a busy 2019 for Swiss fintech and there is promise for more to come in 2020. Here’s a round-up of fintech past and my observations of how things may shape up in the coming months. Licenses The year 2019 started with the arrival of a new breed of Fintech banking license, designed to allow small financial players to accept up to CHF100 million in deposits, but with restrictions. One notable restriction so far, is that FINMA has yet to issue a single license. That’s something that will surely be rectified in the first quarter of 2020? Two blockchain banks, Sygnum and SEBA, were awarded full banking and securities dealer licenses last August. Sygnum followed this

Topics:

Matthew Allen considers the following as important: 3.) Swiss Info, 3) Swiss Markets and News, Featured, newsletter, Sci & Tech, Sci & Tech

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

It was a busy 2019 for Swiss fintech and there is promise for more to come in 2020. Here’s a round-up of fintech past and my observations of how things may shape up in the coming months.

Licenses

The year 2019 started with the arrival of a new breed of Fintech banking license, designed to allow small financial players to accept up to CHF100 million in deposits, but with restrictions. One notable restriction so far, is that FINMA has yet to issue a single license. That’s something that will surely be rectified in the first quarter of 2020?

Two blockchain banks, Sygnum and SEBA, were awarded full banking and securities dealer licenses last August. Sygnum followed this up with a capital markets service license in Singapore while SEBA opened its doors to clients from nine countries.

Bitcoin Suisse has also applied for a Swiss banking license while the likes of crypto marketplace platform Lykke have their eyes set on becoming fully regulated securities trader. Look out for a spate of newly licensed entities, along with the SIX Group’s SDX digital exchange that hopes to shake off its slow start by launching as a new trading platform.

New trading system

Much of the groundwork has already been laid for trading securities on Distributed Ledger Technology platforms. At least three separate projects in Switzerland are vying with each other to produce a blueprint for how small companies can more easily raise capital by issuing digital shares.

One of them recently conducted a proof of concept trade to prove that such equity can be legally transferred from one party to another. Expect a flurry of activity in January as another batch of companies announces that they have joined the party.

This DLT trading method is hardly re-inventing the wheel. While some trading venues hope to democratize the trading process beyond institutional players to the general public, several others are concentrating purely on speeding up the settlement and clearing process for the traditional trading players.

Digital franc?

The Swiss National Bank has teamed up with the Bank for International Settlements to create an Innovation Hub in Switzerlandexternal link. Top of the agenda for this hub is to look at the tokenization of assets and the possibility of creating a wholesale digital franc to settle trades at the SDX trading platform.

Many other countries are lining up their own digital currencies, not least China which appears to have stolen a lead over other states.

One of the most fascinating stories of 2019, the creation of Facebook’s Libra stablecoin project, could also produce a few more twists and turns in the coming year. The Geneva-based project was a minor sensation when it launched, but swiftly went on the defensive as governments around the world turned on the concept. Despite taking some serious hits, Libra has vowed to keep fighting on.

Spending your bitcoin

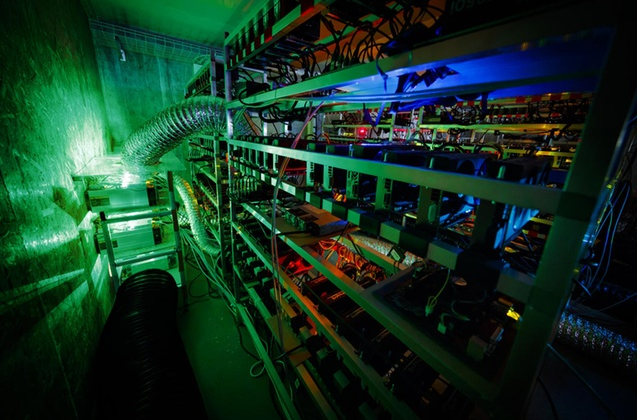

For those people more in tune with decentralised currencies, such as bitcoin, several projects have started to open up more possibilities to spend it in retail shops. Worldline, which provides payment card terminals in 85,000 Swiss retail outlets, teamed up with Bitcoin Suisse with the aim of allowing retailers to accept bitcoin without getting their hands dirty. Two other projects, Digitec Galaxus and Inapay, are also pursuing the same goal.

Regulation update

In December 2018, the Swiss government unveiled plans to update banking, company and market infrastructure laws to allow for DLT trading and cryptocurrencies to flourish. Twelve months later, following a consultation process, the finalised plan has been prepared for parliament to debate in 2020.

It remains to be seen whether both houses can agree swiftly enough for the Bill to be enacted into law in 2020.

In the meantime, the crypto industry has taken issue with the Swiss financial regulator FINMA, for insisting that Virtual Asset Service Providers (exchanges, banks and the like) have to pass on client detail for every crypto trade they make on behalf of clients. In the traditional finance sector, exceptions are made for very low transactions. Crypto players are developing a means to comply with FINMA’s tough Know-Your-Customer anti-money laundering requirements whilst retaining privacy for their clients. Watch this space.

Tags: Featured,newsletter,Sci & Tech