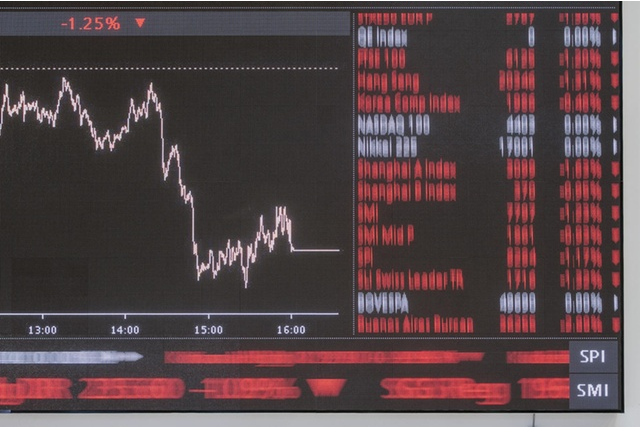

Blockchain is tipped to bring efficiencies to the financial system – and beyond. (© Keystone / Ennio Leanza) Proposed updates to the banking, corporate and financial infrastructure laws to accommodate Distributed Ledger Technology (DLT) have been broadly welcomed by Switzerland’s growing blockchain industry. Parliament is now set to debate the wide-ranging set of proposals presented by the governmentexternal link on Wednesday. The government’s intentions were first laid out last December, presented for consultation in March and are now complete in amended form having taken into account arguments from interested parties. If enacted, they would allow for new ways to create, store and transact purely digital assets. “The development of DLT is predicted to have

Topics:

Matthew Allen considers the following as important: 6a.) Bitcoin&Blockchain, Business, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Blockchain is tipped to bring efficiencies to the financial system – and beyond. (© Keystone / Ennio Leanza)

Proposed updates to the banking, corporate and financial infrastructure laws to accommodate Distributed Ledger Technology (DLT) have been broadly welcomed by Switzerland’s growing blockchain industry.

Parliament is now set to debate the wide-ranging set of proposals presented by the governmentexternal link on Wednesday. The government’s intentions were first laid out last December, presented for consultation in March and are now complete in amended form having taken into account arguments from interested parties.

If enacted, they would allow for new ways to create, store and transact purely digital assets.

“The development of DLT is predicted to have significant potential for innovation and efficiency gains in the financial sector as well as other sectors of the economy,” read a government statement. For example, by creating digital-only company shares without a paper copy and allowing instant settlement of trades, as opposed to a few days.

But the new digital technology is sufficiently different from traditional platforms to require changes to the law that both protects consumers and allows for new forms of transactions and companies.

Blockchain industry bodies welcomed the broad thrust of the proposed legislation, which sets out to amend existing laws rather than create a new legal framework just for blockchain. The consultation process has ironed out any major problems presented in the initial proposals, said Jacques Iffland, chairman of the Capital Markets and Technology Associationexternal link.

“One of the key concerns with the earlier version was the treatment of digital assets in the case of bankruptcy of custodians,” he told swissinfo.ch in a written statement. “If implemented, the initial proposal would have seriously compromised the development of digital assets in Switzerland.”

Growing ecosystem

The Swiss Blockchain Federationexternal link also applauded the “significantly improved” final draft of the proposals. “Switzerland will have the most advanced private legal framework for token-based business models in the world,” it stated.

The body welcomed the extension of a new fintech license to cover some blockchain financial services but had some minor niggles about the proposed treatment of DLT trading platforms.

Switzerland has built up a global reputation as a “Crypto Nation” that serves as a hub for the cryptocurrency and blockchain industries. The number of start-ups and supporting companies (legal, consulting and academic) had grown to around 600external link by the end of September, including representative offices of some of the largest global firms.

“In recent years, a remarkable ecosystem with innovative fintech and blockchain companies has developed in Switzerland, especially in the financial sector,” the government statement read.

Tags: Business,Featured,newsletter