Summary:

Keep an eye on the system’s buffers. They look fine until they suddenly collapse. The doom-and-gloomers among us who have been predicting the unraveling of an inherently unstable financial system appear to have been disproved by the reflation of yet another credit-asset bubble. But inherently unstable / imbalanced systems can stumble onward for years or even decades, making fools of all who warn of an eventual reset. Destabilizing systems can cling on for decades, as the inevitable crisis doesn’t necessarily resolve the instability. History shows that when systems had enough inherent wealth to draw upon, they could survive for centuries, thinning their resources, adaptability and buffers until their reservoirs were

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Keep an eye on the system’s buffers. They look fine until they suddenly collapse. The doom-and-gloomers among us who have been predicting the unraveling of an inherently unstable financial system appear to have been disproved by the reflation of yet another credit-asset bubble. But inherently unstable / imbalanced systems can stumble onward for years or even decades, making fools of all who warn of an eventual reset. Destabilizing systems can cling on for decades, as the inevitable crisis doesn’t necessarily resolve the instability. History shows that when systems had enough inherent wealth to draw upon, they could survive for centuries, thinning their resources, adaptability and buffers until their reservoirs were

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

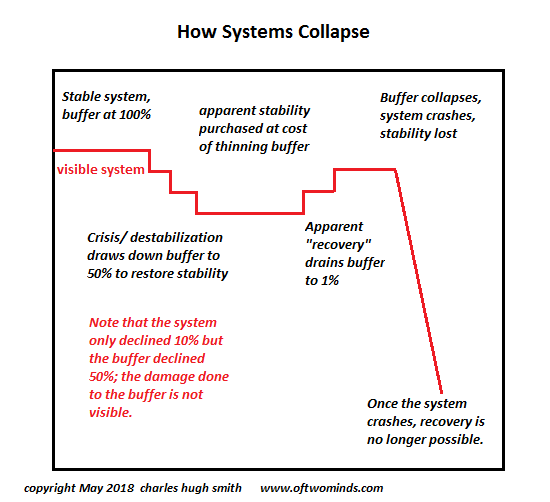

Keep an eye on the system’s buffers. They look fine until they suddenly collapse.

The doom-and-gloomers among us who have been predicting the unraveling of an inherently unstable financial system appear to have been disproved by the reflation of yet another credit-asset bubble. But inherently unstable / imbalanced systems can stumble onward for years or even decades, making fools of all who warn of an eventual reset.

Destabilizing systems can cling on for decades, as the inevitable crisis doesn’t necessarily resolve the instability. History shows that when systems had enough inherent wealth to draw upon, they could survive for centuries, thinning their resources, adaptability and buffers until their reservoirs were finally drained. Until then, they simply did more of what’s failed to maintain the sclerotic, self-serving elites at the top of the Imperial food chain.

If we want to trace back the systemic instabilities and imbalances that culminated in China’s revolution in 1949, we can start in 1900 with the Boxer Rebellion, which was itself a reaction to the Opium Wars of the 1840s that established Western influence and control in China.

But is this far enough back in time to understand the Communist Revolution in the 1940s? If we want a comprehensive understanding, we must go back to 1644 and the demise of the Ming Empire, and perhaps even farther back to the Mongol victory over the Song dynasties in the late 1200s.

In the same fashion, we can trace the current crisis of global-finance Capitalism back to the expansion of globalization, affordable fossil fuels and credit in the early 1900s. Affordable fossil fuels enabled rapid industrialization and the growth of transportation and communication networks. Add the expansionary effects of globalization and credit, and the consumer-finance economy took off like a rocket until the inevitable consequences of providing leverage and credit to marginal producers, buyers and speculators led to the Great Depression.

And so here we are in 2018, 25 years into an unprecedented technological and financial boom which is once again the result of cheap, abundant energy and credit and the global arbitrage of labor, yields, currencies and risk. And once again, the “solution” to every crisis is to do more of what’s failed because that’s the only option that doesn’t require sacrifices from the elites and a painful reshuffling of power relations.

Those of us who saw the 2008-09 Global Financial Meltdown as the inevitable flowering of systemic instability have been marginalized by an epic 10-year boom, much like the Roaring Twenties seemed to “prove” all was not just well, it was terrific.

The seeds of the next financial crisis–or a series of crises which never quite dissipate– were planted decades ago in the globalization of the 1970s, the financialization of the 1980s and the promise of an enduring energy abundance due to fracking technologies in the early 2000s.

Economic booms are relatively easy to understand and launch: flood an economy limited by constraints on production and consumption with cheap energy and limitless credit at low rates of interest, and you reliably get a boom.

But flooding an economy with cheap, limitless credit inevitably leads to systemic excesses of leverage, risk and debt, and a systemic reliance on marginal borrowers and lenders for “growth”– a credit-based “growth” which is destabilizing and unsustainable.

The boom turns to bust and asset bubbles pop, laying waste to fortunes and the confidence that bubble-based prosperity is our endless birthright.

The crisis of 2008-09 was averted for a decade, but at what cost? To buy that extra decade of illusory stability, the system has been pushed to extremes that cannot be unwound or reversed painlessly. Beneath the surface illusion of stability, its buffers have been thinned to the point that a relatively modest-sized crisis will trigger a domino cascade that will bring down the entire system.

History has many examples of destabilizing systems “saved” by a stroke of extraordinary good luck (discovery of gold, the unexpected collapse of a geopolitical rival, the rise of a competent leader, etc.), and destabilizing systems not so blessed that were nudged into collapse by a crisis that could have been weathered with relative ease in bygone eras.

Doom-and-gloomers reckon we’ve finally depleted our run of “saves” while the immoderately cheery techno-enthusiasts reckon technology always conjures up another “save” when we need one. (Delivery of consumer goods by drone, paid for by Universal Basic Income–yippee, problem solved!)

The path ahead narrows to a binary option: the status quo either enters a crisis that can no longer be pushed forward with financial trickery or another systemic “save” emerges by 2024 – 2025. The buffers have been thinned to the point that the global financial system has at best 6 or 7 years before the present era is subsumed by a systemic crisis that cannot be resolved with more of the same, or is rescued by another systemic “save”: scalable fusion power, emergency “spaceship money” delivered by the Martian Central Bank, etc.

|

The system has been “saved” multiple times since the slow-motion crises and anomie of the 1970s. The technological candidates for the next “save” are many, but at this late date, questions of scalability and cost arise. Can the new whiz-bang “save” be scaled up fast enough to make a difference, and will it be cheap enough that a debt-riddled system can pay for it without tipping the system into collapse?

Keep an eye on the system’s buffers. They look fine until they suddenly collapse. For a real-world, real-time example of this, look at Venezuela.

|

Systems Collapse |

Summer Book Sale: 30% off Kindle editions, 25% off print editions. If you’re interested in real solutions, check these out:

My new book is Money and Work Unchained. For more, please visit the book's website.

Tags: Featured,newsletter