New home sales were down sharply again in January 2018. For the second straight month, the level of purchase activity fell substantially despite what are otherwise always described as robust or even booming economic conditions. Like the sales of existing homes, the sales of newly constructed units should be both moving upward as well as being significantly more than stuck at this low level. Construction and sale activity isn’t really down big in December and January, of course. What has happened is little more than the anticipated (for anyone not obviously biased by the boom narrative) drawdown in transactions following the aftermath of the storm aftermath. Hurricanes Harvey and Irma produced undeniably large

Topics:

Jeffrey P. Snider considers the following as important: Construction, currencies, economy, Featured, Federal Reserve/Monetary Policy, home builders, Markets, NAHB, New Home Sales, newslettersent, resales, single family houses, supply, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

New home sales were down sharply again in January 2018. For the second straight month, the level of purchase activity fell substantially despite what are otherwise always described as robust or even booming economic conditions. Like the sales of existing homes, the sales of newly constructed units should be both moving upward as well as being significantly more than stuck at this low level.

Construction and sale activity isn’t really down big in December and January, of course. What has happened is little more than the anticipated (for anyone not obviously biased by the boom narrative) drawdown in transactions following the aftermath of the storm aftermath.

Hurricanes Harvey and Irma produced undeniably large disruptions; some economic activity was delayed by a few months, pushed by weather into largely October and November (with some recorded in September, too). Absent the anomaly, whatever data series including both representing home sales was always going to revisit the prior trend.

Prior to them in August and September, the real estate market was unusually weak. Leading up to August, there was a noticeable deceleration and even contraction (resales) in home buying. In terms of existing, that had manifested in reduced inventory; the reluctance to sell one’s existing home for the concern over paying out a higher mortgage moving into the next one.

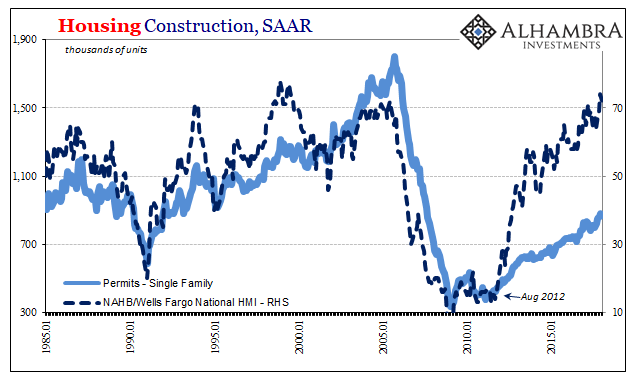

| But if there was robust demand for housing across-the-board, such a bottleneck in the supply of existing homes for sale should have been addressed by home builders. After all, rising prices and robust demand is about as close to a sweet spot, theoretically, as they may ever see again. With little immediate downside risk, there is no bubble in single family residences, just these distortions, you would think construction activity and therefore the sale of new homes would be off the charts where sentiment is. |

US Housing Construction, Jan 1985 - Jan 2018 |

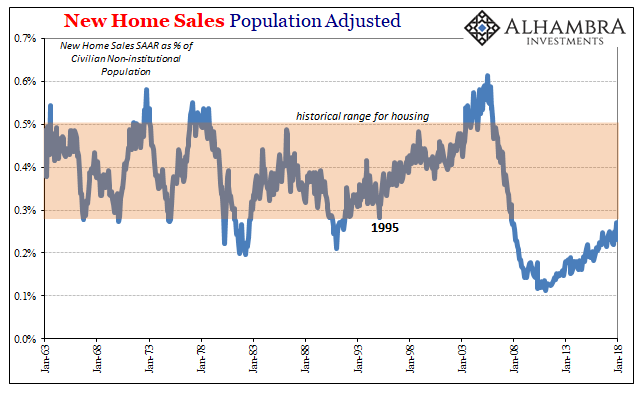

| The problem is that new home sales continue to be just that; off the charts, only in the other direction. Despite seven years of rising sales volume, the level remains underneath the historical range (adjusted for population growth). |

US New Home Sales Non-Institutional Population(see more posts on U.S. New Home Sales, ) |

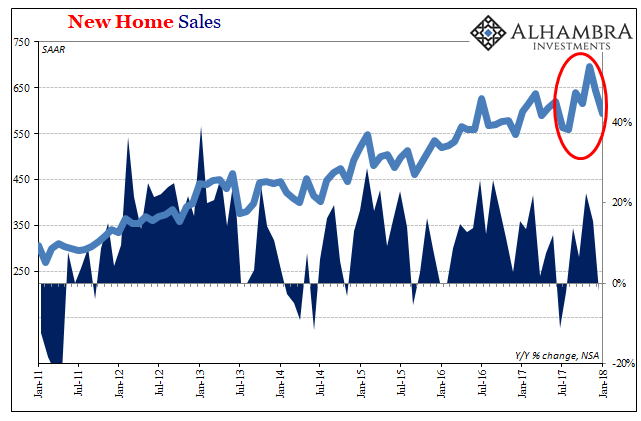

US New Home Sales, Jan 2011 - Jan 2018(see more posts on U.S. New Home Sales, ) |

|

| The latest monthly estimates continue to show that isn’t likely to change anytime soon. Though quite a bit was made out of those months in the aftermath of the hurricanes, constructing an economic boom narrative out of distortions, now in the period outside of it there is again the same clear lack of acceleration; and therefore leaving us with the same problems as before.

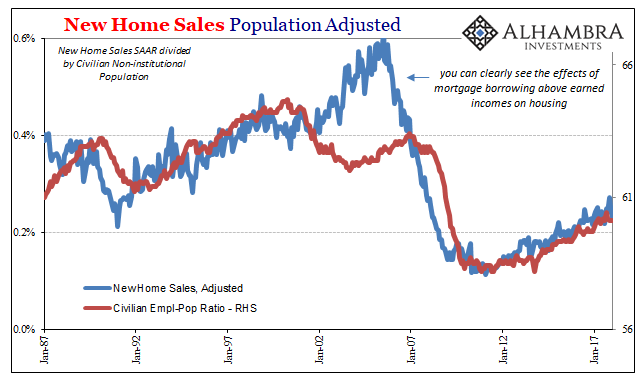

With rising prices and a 4.1% unemployment rate, not to mention dramatic wage growth that is just around the corner, why aren’t builders vastly accelerating their project schedules? The question answers itself, the familiar trend of an economy that is growing but still devoid of actual growth. The unemployment rate simply suggests of those looking for work there aren’t many who can’t find it. But of those who long ago stopped looking, they aren’t going to be buying a house, either; they can’t. And of those who own one and have continued to be employed, with the labor market after the 2015-16 downturn in its own clear slowdown there is the noticeable fear among them of falling into those same cracks. There continues to be no boom here. In housing, as in a great many other statistics, what we find instead is that there can’t be one. Somebody really should be selling a whole lot more houses than they are; either those who own one already, or, in their absence, the construction of millions more. The fact that they’re not, and nobody is getting ready to do so now into 2018, demonstrates the same problem; and it’s not Baby Boomer retirement nor the sudden disability of prime working age men in 2008. |

US New Home Sales Civilian Population Ratio, Jan 1987 - Jan 2018(see more posts on U.S. New Home Sales, ) |

Tags: Construction,currencies,economy,Featured,Federal Reserve/Monetary Policy,home builders,Markets,NAHB,New Home Sales,newslettersent,resales,single family houses,supply