See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Currency Debasement Doesn’t Make Anyone Richer The action favored bettors this holiday-shortened week (Monday was Martin Luther King day in the US), with the price of gold up 13 bucks and silver up 26 cents. We noticed a worrisome remark by newly inaugurated President Trump. The strong dollar of the past 20 years, he said, is not good for American competitiveness. Let’s just tackle this straight on. Actually, we will address three distinct issues. First, Trump said, “our companies can’t compete with China now because our currency is too strong.” Keith is old enough to remember long before the current scare about China, the scare was about Japan. Japan was going to bury American companies, and buy up America. Or so we were told. It would be interesting to look at the yen during this time, to see if it was falling and giving Japan some of the competitive advantage that Trump theorizes should occur. As it turns out, it is exactly backward. From a low of 0.33 cents in 1976, the yen rose to nearly 1.3 cents by the mid 1990’s. Of course, this makes sense to everyone but benighted economists.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newslettersent, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Currency Debasement Doesn’t Make Anyone RicherThe action favored bettors this holiday-shortened week (Monday was Martin Luther King day in the US), with the price of gold up 13 bucks and silver up 26 cents. We noticed a worrisome remark by newly inaugurated President Trump. The strong dollar of the past 20 years, he said, is not good for American competitiveness. Let’s just tackle this straight on. Actually, we will address three distinct issues. First, Trump said, “our companies can’t compete with China now because our currency is too strong.” Keith is old enough to remember long before the current scare about China, the scare was about Japan. Japan was going to bury American companies, and buy up America. Or so we were told. It would be interesting to look at the yen during this time, to see if it was falling and giving Japan some of the competitive advantage that Trump theorizes should occur. As it turns out, it is exactly backward. From a low of 0.33 cents in 1976, the yen rose to nearly 1.3 cents by the mid 1990’s. Of course, this makes sense to everyone but benighted economists. How could draining away the savings of people and businesses give any advantage? That is what currency devaluation really means. A loss of everyone’s savings. Poof. This brings us to the alleged strong dollar. On January 22, 1997—exactly 20 years ago—the dollar was worth about 89mg gold. Compare that to Friday, when it was just under 26mg, a loss of 71%. Orwell would be proud of this new meaning of the word strong! Of course, no one any more believes in any kind of objective standard. The dollar, they think, should be measured by the euro, pound, and yen. And they, in turn, are measured against the dollar. It is a neat little trick, a sleight of hand, to distract attention from wholesale theft. Finally, we have Trump advisor Anthony Scaramucci, who said the rising dollar will “have an impact internally in the US”. He spoke of “reaching out for lower-class families and middle-class families.” “Reaching for”… that is a good visual for this. The government will reach for their savings! Fortunately, under the current structure, the president does not have the power to push the dollar down. Heck, the Fed has been trying to do that for years, and has not been succeeding. However, this is a worrying development that bears close watching. Can anyone — including Trump — say what he might do? |

President Trump and his advisor Anthony Scaramucci apparently have discovered the “advantages” of currency devaluation. The only problem with that is that such advantages don’t exist, at least not for society at large. As is always the case when money is debased, there is a small group that will benefit to the detriment of everybody else in the economy. However, in the case of currency debasement, even this group (primarily the export sector) will enjoy only temporary benefits at best. Eventually, domestic prices will adjust to the devaluation, and then many exporters will find themselves in a worse situation than before [PT] Photo credit: AP - Click to enlarge |

Fundamental Developments – Gold Scarcity is Still RisingBelow, along with the fundamentals, we show a hint of what’s coming soon at Monetary Metals. But first, the price action. |

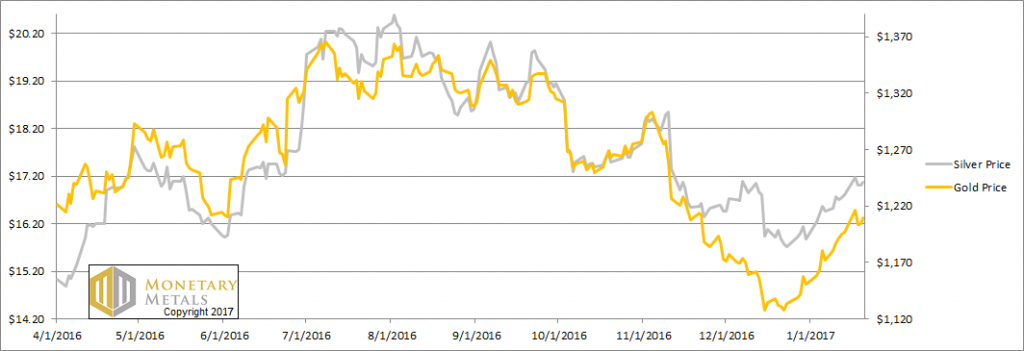

Gold and Silver price(see more posts on gold price, silver price, ) |

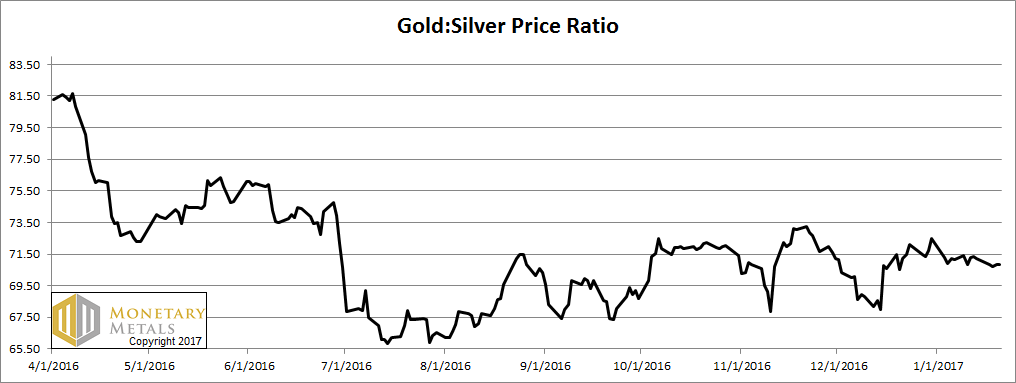

The gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It fell a bit this week. |

Gold-silver ratio(see more posts on gold silver ratio, ) |

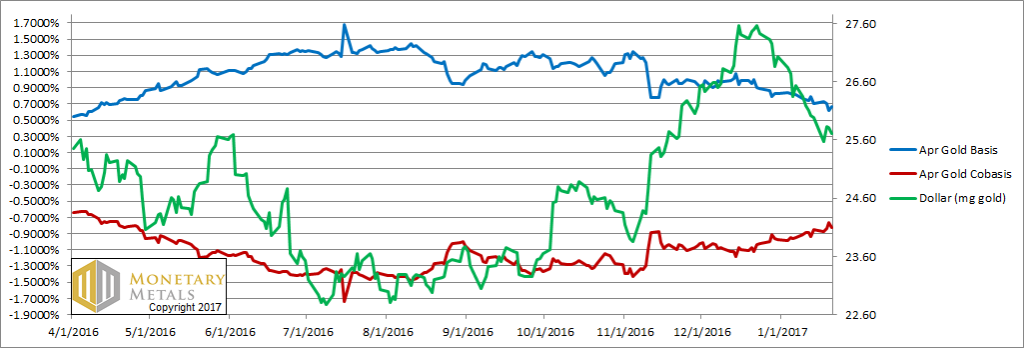

Gold basis and co-basis and the dollar priceHere is the gold graph. We have switched to the April contract. In a continuation of what seems to be the new pattern, we have a dollar that continues to slowly fall. But, unlike the previous mode, we have a rising scarcity of gold. That is, the price of gold is rising because buyers in the physical market are getting hungrier, while sellers in the physical market retreat. |

Gold basis and co-basis and the dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

| However, note that the slope of the red line is not steep. And, unlike the February contract, the April future is nowhere near backwardation. The cobasis is -0.8%.

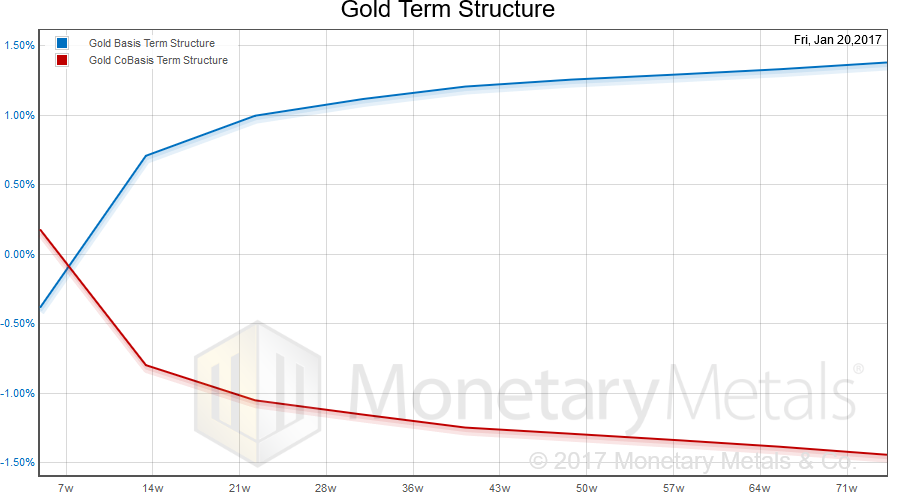

Let’s preview a chart that will be publishing on our site soon. interesting features. Just a nice gentle rise in the basis and fall in the co-basis, exactly what we would expect (other than the small backwardation in the Feb contract which is sliding off the left edge into oblivion). Needless to say, this is not a picture of any kind of shortage, imminent banking crisis, or magic trick by the UN or International Monetary Fund. While the market price of gold moved up a bit, our calculated fundamental price move up more. It’s now a bit over $1,300. Not crisis territory by any means, yet interesting in light of a market price at $1,210. The term structure shows the basis and co-basis for contracts going out a year and a half. This is generally where all the interesting features will be. Note the absence of any |

Gold term structure |

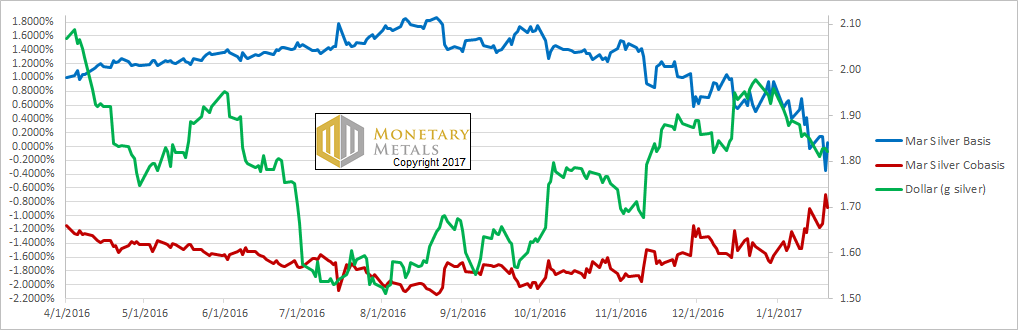

Silver basis and co-basis and the dollar priceNow let’s look at silver. In silver the co-basis is also rising, also slowly. Our calculated fundamental price moved up 50 cents from last week. It is now just about at the market price. Charts by Monetary Metals Image caption by PT |

Silver basis and co-basis and the dollar price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Tags: dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis,silver price