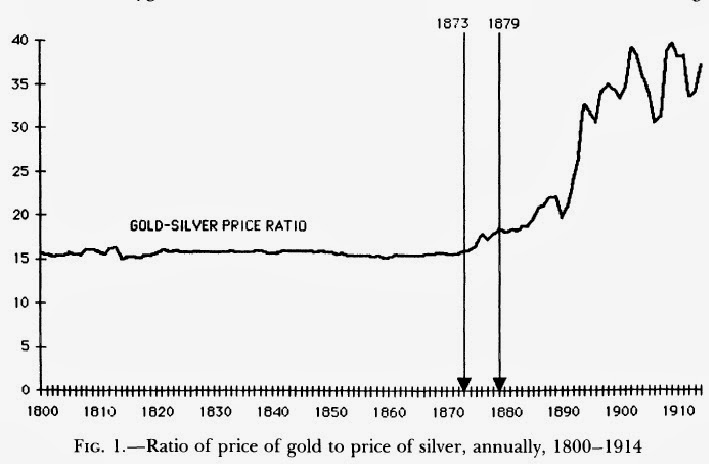

How We Got Used to Fiat Money Most false or irrational ideas about money are not new. For example, take the idea that government can just fix the price of one monetary asset against another. Some people think that we can have a gold standard by such a decree today. This idea goes back at least as far as the Coinage Act of 1792, when the government fixed 371.25 grains of silver to the same value as 24.75 grains of gold, or a ratio of 15 to 1. This caused problems because the market valued silver a bit lower than that. Gold-Silver Price Ratio, 1800-1914(see more posts on gold silver ratio, )The gold-silver ratio from 1800 to 1915. In the 1870s, numerous nations around the world dropped bimetallism in favor of a gold

Topics:

Keith Weiner considers the following as important: Chart Update, Featured, Gold and its price, gold silver ratio, newslettersent, Precious Metals, Virtual Currencies

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

How We Got Used to Fiat MoneyMost false or irrational ideas about money are not new. For example, take the idea that government can just fix the price of one monetary asset against another. Some people think that we can have a gold standard by such a decree today. This idea goes back at least as far as the Coinage Act of 1792, when the government fixed 371.25 grains of silver to the same value as 24.75 grains of gold, or a ratio of 15 to 1. This caused problems because the market valued silver a bit lower than that. |

Gold-Silver Price Ratio, 1800-1914(see more posts on gold silver ratio, ) The gold-silver ratio from 1800 to 1915. In the 1870s, numerous nations around the world dropped bimetallism in favor of a gold standard (France was a noteworthy exception). - Click to enlarge Thereafter it quickly became obvious that silver had been vastly overvalued at the official exchange ratio.It was essentially a subsidy for silver miners. Once a pure gold standard was adopted, mild consumer price deflation became the norm, as economic productivity grew faster than the supply of gold. Contrary to what virtually all central bankers nowadays assert, this had no negative effects on the economy whatsoever. On the contrary, the four decades following the adoption of the gold standard produced the biggest and most equitable real per capita growth the US has ever seen – such growth rates were never again recaptured. Of course, at the time government spending represented between 3% to 4% of total economic output, i.e., government was but a footnote in most people’s lives. The reason why governments subsequently sabotaged the gold standard was precisely that they wanted to grow without limit. |

| So people were happy to bring their silver to the U.S. Mint to be coined. Silver had a higher value as a coin than it did in the market, and it was the opposite for gold. Gresham’s Law teaches us that if two monies must be treated by law as the same value, then the one of lower value will circulate and the one of higher value will be hoarded. This put the fledgling America on a de facto silver standard. |

Eight Spanish silver reales, or “pieces of eight” which consisted of 387 grains of pure silver (the coin on the upper right is a Mexican piece of eight, with Chinese chop marks). - Click to enlarge These coins were minted by the Spanish Empire since 1598 and were of the same size and weight as the German Thaler, which in turn was standardized across all German territories since the 15th century. These coins were legal tender in the US until 1857 and for a long time were the by far most widely used coin.The Coinage Act of 1792 established that the new US dollar was to be equal in value to Spain’s pieces of eight, but people soon found out that the US Mint used a slightly different standard of fineness (0.9 instead of 0.8924), which meant that about 1% more silver was needed to mint a dollar. This made them reluctant to bring silver to the mint, hence the Spanish coins continued to dominate in daily life. Spanish reales were actually the first world currency, and it worked splendidly for almost 300 years (incidentally, over the time of its existence, this was the least debased coin in the Western world, which explains its popularity). People would cut the coin into 8 pieces (“bits”) of equal size for smaller transactions and to make change – prices on US stock exchanges were quoted in fractions based on these 8 bits for a very long time. The United States Assay Commission which kept an eye on the quality of the production of the US Mint was one of the few bureaucracies to ever be disbanded – in 1980. This is actually testament to the stickiness of bureaucracies – gold coins had been out of circulation since 1933 and silver coins since 1965 (a rudely debased half dollar existed until 1970) |

| Or, bad ideas have their roots in historical precedent but something is lost (or sabotaged) along the way. Back in 1792, there was no question that money meant gold and silver. There was no question that, when you deposited money at a bank, you had a right to get the same amount of money back. However, if each bank had a different unit of deposit, it would be hard to understand if someone said “I will pay you ten dollars”. Is that ten Road Runner Bank Dollars or ten Bank of Wile Coyote dollars?

The Coinage Act standardized the unit, but it did not change the rights of depositors or the obligations of banks. However, today, many people think that the government can, post hoc, change the definition of a unit and thereby change the value of everyone’s debt obligations and bank balances (and presumably cause a repricing of every extant asset). We see this in many discussions of China’s future monetary policy. Many gold bugs have said that China will announce a gold-backed yuan. No one can know what a government may do in the future, but we can say in principle that it is impossible to fix the price of gold in yuan (or dollars or anything else). We can say that it won’t work if they try to change the value of the yuan by simple changes of law. Another bad idea today traces itself back centuries. People use the paper bank note (and now electronic credit) as the equivalent of money for most situations, such as making a payment. Back in 1792, everyone understood that the paper note was redeemable for money. If you went to a bank, and pushed a twenty dollar bill over the counter, you would get just over 1 ounce in gold coins. |

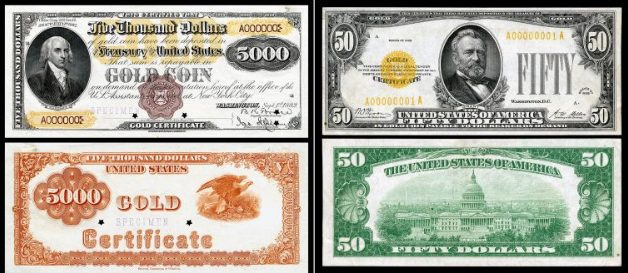

These bearer certificates were in use from 1882 to 1933 and were freely convertible into gold coins at a fixed rate of $20.67 per troy ounce. The treasury began to issue gold certificates in 1865 already, but before 1882 the depositor was identified on the certificate by name. The background to this is that US greenbacks, a fiat money used to finance the civil war, only came back into line with the gold value of the dollar at around 1879. Once the treasury started to redeem these so-called United States Notes in gold again, gold certificates were introduced for general circulation as well. |

| So long as the banks are trustworthy, few people have a reason to redeem their paper and withdraw their coins. So most become comfortable with the idea of paper bills. They may even begin to think of it as money. However, the concept of money cannot be entirely forgotten, so long as redemption occurs every day. If you redeem paper to get gold, can you call the paper “money”? If the paper is money, and you’re turning it in to get gold, then what is the word for the gold? In a system where redemption is possible, people are clear that the paper is currency and the gold is the money. No one would imagine redeeming money for … __________? (we literally cannot think of what word would go in the blank.) |

It is stated on them that the bearer will be paid the sum on the note in dollars on demand. In other words, it was crystal clear that the notes themselves were not money, but merely money substitutes. |

| Going further, another idea is that it’s OK if a bank note is not redeemable, so long as the backing is there. This idea became policy in 1933. The government redefined the dollar, from 1/20 ounce of gold to 1/35. Just like that, the people were left with bank notes but not money. Per the Stockholm Syndrome, they came to at last think of the paper as money. If paper bank notes worked as money previously, then no reason to worry if they will stop working.

At the same time, every creditor was made poorer and every debtor was made richer. That is what, in fact, decreeing a change in value does. As economist John Maynard Keynes wrote (citing Vladimir Lenin):

The bad guys 100 years ago understood something that most good guys today do not. Distort, pervert, undermine, and destroy the relationship between creditor and debtor at your peril. Whether you realize it, or not, the stakes are nothing less than capitalism. Lenin knew it, and hoped to use it to usher in his utopia where he could get away with mass murder on an unprecedented scale. |

|

Bitcoin – The Next Step?This point relates to our ongoing theme of bitcoin. Bitcoin’s value is, to say the least, fluctuating. Lenin aptly described it: “the process of wealth-getting degenerates into a gamble and a lottery.” With such value fluctuation, bitcoin is manifestly unsuitable for lending and borrowing. When instability comes to the legal tender paper currency, people are surprised and may not have an alternative. But with bitcoin, they can see it in advance. Checking back at Bitbond, we now see two bitcoin loan requests. Both are bitcoin miners, and the total between both loans is ฿9.3. And note the final and most important connection between the bad idea that bitcoin is money and ideas that recur in history. In 1933, the US government forced all citizens to treat irredeemable paper as if it were money. There was still some gold in the monetary system, though no longer moving, no longer deposited and redeemed. But in 1971, the government finished off gold. The dollar was declared to be purely irredeemable, and this rippled through to all other paper currencies. |

Daily Bitcoin in USD(see more posts on Bitcoin, ) Bitcoin, daily – after running to a high of nearly $4,500, bitcoin has corrected again. - Click to enlarge From a technical perspective the uptrend remains intact so far. An aside: we do not agree completely with Keith’s arguments regarding Bitcoin; we hope to soon get around to posting our 2 cents as well, or rather our 2 satoshis. |

| Bitcoin is carefully designed to appear just like an irredeemable government-issued currency. Which is carefully designed to appear just like a gold-redeemable government-issued currency. Which was carefully designed to appear just like a bank-issued gold-redeemable bank note. Each is a deliberate adulteration, to the final one with bitcoin today. |

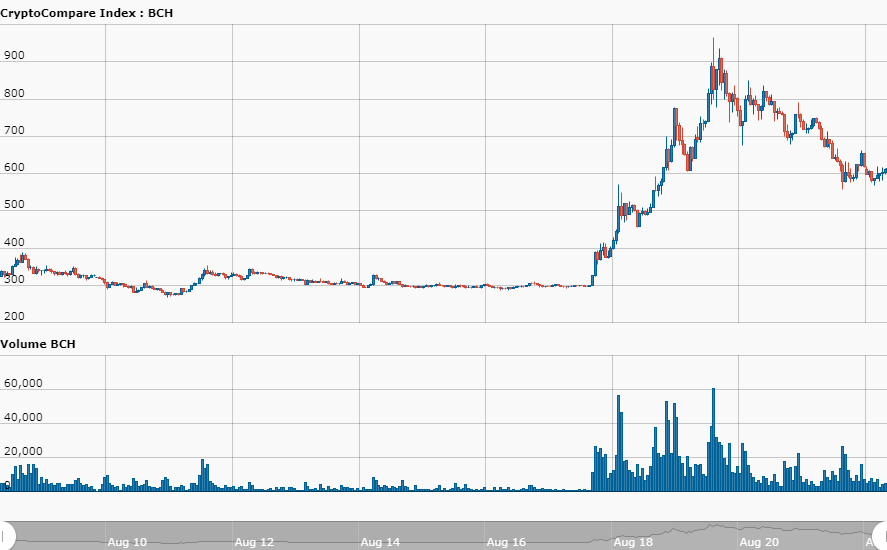

Crypto Compare Index Bitcoin Cash (BCH), which recently split off from BTC – as it became known that several large mining pools are dedicating a part of their hashpower to BCH, the spin-off currency rallied, while BTC corrected concurrently. - Click to enlarge Meanwhile, Segwit 2x and Core supporters continue to bicker. |

| Having indoctrinated people to accept irredeemable currency, the Fed has opened the door for bitcoin. In a way, bitcoin is a perfect denizen in the Fed’s worldwide regime of irredeemable currency. That is, a regime where each printed promise to pay has fine print saying “this promise will not be honored”. So why not substitute it with “this is not even a dishonored promise” and see how it flies.

The philosophy of postmodernism seeks to “deconstruct” truth. A fitting money of postmodernisn, would be “deconstructed” too. Like bitcoin. |

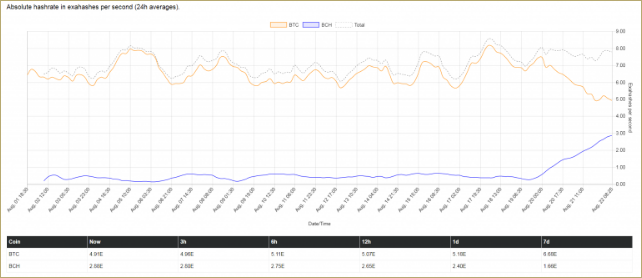

Absolute hashrate in exahashes per secondAt nearly 3 exahash it commands about 31% of the combined BTC & BCH blockchain hashrate. Since it is still more than 700 blocks behind the BTC chain. Miners are likely to switch back and forth between producing the two versions of the currency, depending on the prevailing combination of price and difficulty which determines the profitability of mining crypto-currencies. |

We have now had about two generations for this to seep into our culture, our souls, our sense of How Things Are. Money means irredeemable paper, and irredeemable paper is money. All Right-Thinking people know this. Try a Google Images search on the term money, to see what we mean.

With the idea of redemption of paper for money taken off the table, where next will people go? What new distortion can be manufactured for fun and profit?

The dollar is borrowed into existence. It is backed, but only by debt and that debt is payable only in dollars. There is something there, but it’s circular. The next logical progression is to remove the backing, which is what bitcoin is. To pugnaciously put a chip on one’s shoulder, daring anyone to knock it off — to say that a currency printed into existence, printed ex nihilo out of thin air (albeit at a metered rate and with a maximum limit) is money.

Bitcoin is a liability of its issuer, without any asset to balance it. It is a currency believed to be money because there is no asset. Many who rightly attack the dollar as debt-based money, seem happy with bitcoin because the debt backing it is removed.

The central banks have taught us well. They have trained us to think of money as the piece of paper which once redeemed for it, the electronic balance which once represented it. So why not experiment with removing all that?

If by now, you are picturing a cargo cult, that’s precisely right. The cargo cults that sprang up on Pacific islands after WWII would go through elaborate motions that they thought would bring the cargo just as they observed the US military do. Of course, they substituted coconut shells tied with vine for headsets, and tiki torches for flashlights. And they had no radios, and no airplanes to call on those radios they didn’t have. They simply had faith that appearances could cause the magic effect they wanted.

Addendum

P.S.: We have chosen to focus our case on the monetary theory of bitcoin. We do not want to rest our argument on the risks that its price will crash, its encryption algorithm will be cracked, or its user accounts will be embezzled. If we address price, it is not to equate “bitcoin is bad” with “price will fall”, but to observe that unstable value makes it unsuitable for saving and borrowing.

P.P.S.: However, it is worth saying something we have not seen elsewhere. Everyone knows that bitcoin has a strict limit of 21 million. However, this limit can of course be changed by a majority of the bitcoin miners. Miners, of course, profit by mining, so they may have an incentive to increase this limit. The way Congress has an incentive to increase the debt limit.

Charts by Milton Friedman, Cryptowatch, Cryptocompare, Bitcoin.com

Chart and image captions by PT

Tags: Chart Update,Featured,gold silver ratio,newslettersent,Precious Metals,Virtual Currencies