Investec Switzerland. A weak performance from Swiss pharma giants pulled the Swiss Market Index down again this week after investors dropped stocks in the sector on lackluster earnings reports. The peripheral European stocks and Japan managed to buck the trend this week, global stock markets remain under pressure in the run up to US election. © Fahrner78 | Dreamstime.com Italian and Spanish markets were this week’s winners among global equity markets. Spain’s main stock index hit a six-month high as the country looked set end a 10-month long political deadlock. Italian stocks received a boost after shares in Monte dei Paschi, the world’s oldest bank, soared 28% after the bank unveiled a new capital-boosting plan on Monday. Sentiment towards the financial sector has improved globally in recent weeks as financial giants continue to report better than expected earnings results while analysts predict a more profitable future if interest rates rise in the US as expected. In other economic news, third quarter GDP data from the United Kingdom showed that the British economy grew at a rate of 0.5%, expanding at a faster pace than expected. Analysts had expected growth of just 0.3% as the United Kingdom grapples with uncertainty around its decision to leave the European Union.

Topics:

Investec considers the following as important: Business & Economy, Investec Switzerland, SMI

This could be interesting, too:

Investec writes Swiss inflation falls further in January

Investec writes Swiss milk producers demand 1 franc a litre

Investec writes Swiss bankruptcies expected to rise sharply this year

Investec writes Switzerland to allow personal bankruptcy

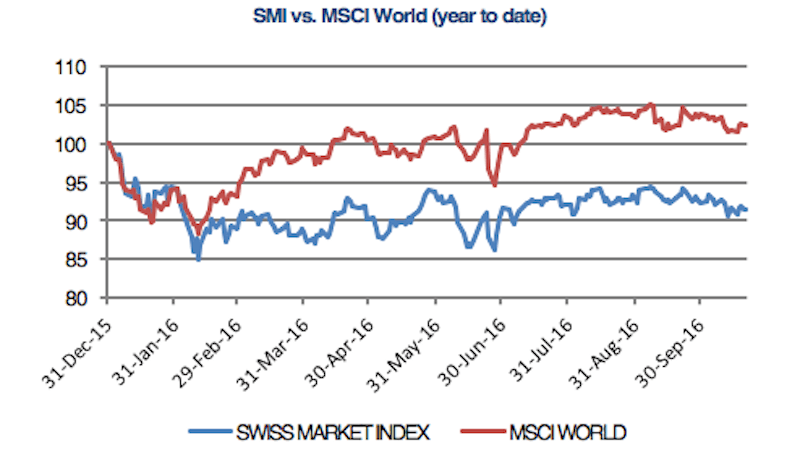

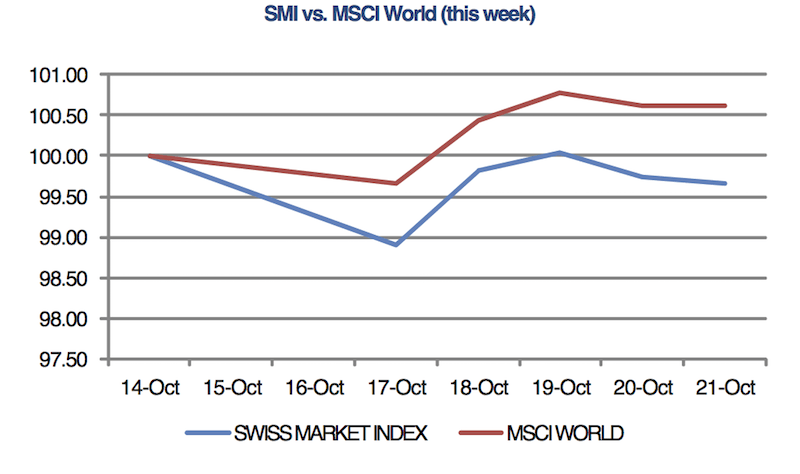

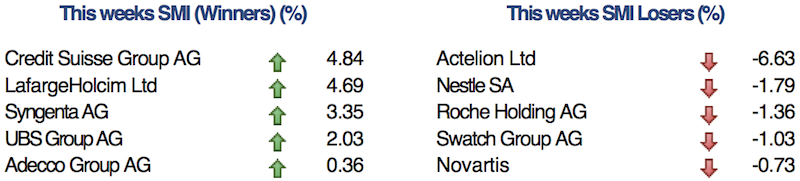

A weak performance from Swiss pharma giants pulled the Swiss Market Index down again this week after investors dropped stocks in the sector on lackluster earnings reports. The peripheral European stocks and Japan managed to buck the trend this week, global stock markets remain under pressure in the run up to US election.

© Fahrner78 | Dreamstime.com

Italian and Spanish markets were this week’s winners among global equity markets. Spain’s main stock index hit a six-month high as the country looked set end a 10-month long political deadlock. Italian stocks received a boost after shares in Monte dei Paschi, the world’s oldest bank, soared 28% after the bank unveiled a new capital-boosting plan on Monday. Sentiment towards the financial sector has improved globally in recent weeks as financial giants continue to report better than expected earnings results while analysts predict a more profitable future if interest rates rise in the US as expected.

In other economic news, third quarter GDP data from the United Kingdom showed that the British economy grew at a rate of 0.5%, expanding at a faster pace than expected. Analysts had expected growth of just 0.3% as the United Kingdom grapples with uncertainty around its decision to leave the European Union.

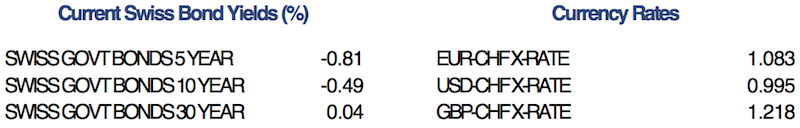

In Switzerland, the UBS Consumption Index strengthened in September, contrasting with weak official retail sales data released earlier this month. UBS reported that the climb in the measure, which reflects consumption trends in the Swiss economy, was driven by record high new vehicle registrations and an upsurge in domestic tourism.

In company news, ABB Ltd disappointed investors this week after the company reported that operational earnings fell 1% year on year. The robotics, power and technology company, however reported that steady revenues and diligent cost-saving initiatives have helped to maintain largely stable earnings despite headwinds from the tough macroeconomic and geopolitical conditions. Syngenta was also in the spotlight this week after the company said that gaining approval for its $43 billion takeover by China National Chemical Corp will be pushed back to the first quarter of 2017 due to a European Union antitrust review.