How do you spot a nation with high potential for economic growth? Look for countries with very low per-capita GDP and where both institutions and the workforce are undergoing a transformation. Important emerging markets such as China and India met these criteria in the past, paving the way for high growth rates for more than a decade for each. But growth in emerging markets has slowed considerably as of late, and investors looking for high potential growth are increasingly turning to frontier markets to find it. Smaller and less liquid than their emerging market counterparts, the 34 frontier markets in the S&P Dow Jones Indices Frontier Market Index have at least two of the following characteristics: a market capitalization greater than .5 billion, domestic trading that exceeds billion a year, or a market capitalization to GDP ratio of at least 5 percent. Credit Suisse’s Demographics Research team recently analyzed twelve frontier economies looking at demographic, economic and social factors that investors need to pay attention to if they want to turn to those markets. Population Growth. High population growth leads to a larger working-age population, which under the right circumstances can provide a powerful boost to GDP. Population growth rates have declined in all 12 markets since the early 1980s, but some are more robust than others.

Topics:

Alice Gomstyn considers the following as important: frontier markets, Investing: Features

This could be interesting, too:

Chris MacIntosh writes Are Emerging Markets Still “A Thing”?

Capitalist Exploits writes Are Emerging Markets Still “A Thing”?

Alice Gomstyn writes Debunking the Drug Pricing Scare

Ashley Kindergan writes What Are Activist Investors Looking For?

How do you spot a nation with high potential for economic growth? Look for countries with very low per-capita GDP and where both institutions and the workforce are undergoing a transformation. Important emerging markets such as China and India met these criteria in the past, paving the way for high growth rates for more than a decade for each. But growth in emerging markets has slowed considerably as of late, and investors looking for high potential growth are increasingly turning to frontier markets to find it.

Smaller and less liquid than their emerging market counterparts, the 34 frontier markets in the S&P Dow Jones Indices Frontier Market Index have at least two of the following characteristics: a market capitalization greater than $2.5 billion, domestic trading that exceeds $1 billion a year, or a market capitalization to GDP ratio of at least 5 percent. Credit Suisse’s Demographics Research team recently analyzed twelve frontier economies looking at demographic, economic and social factors that investors need to pay attention to if they want to turn to those markets.

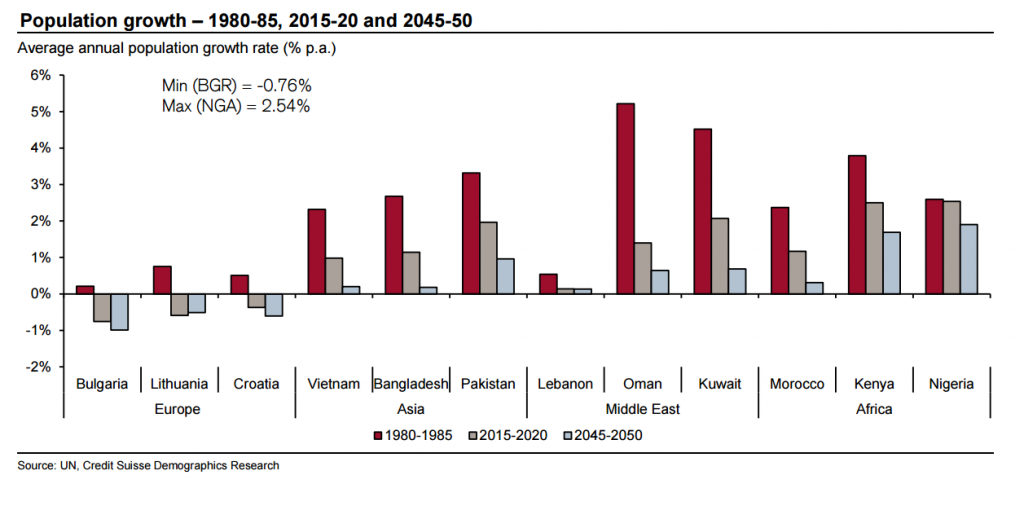

Population Growth. High population growth leads to a larger working-age population, which under the right circumstances can provide a powerful boost to GDP. Population growth rates have declined in all 12 markets since the early 1980s, but some are more robust than others. Nigeria and Kenya boast roughly 2 percent annual growth, while populations in Bulgaria, Croatia and Lithuania have been shrinking by as much as 1 percent a year. For every 100 working-age Bulgarians there are 30 people over the age of 65, a ratio similar to that of aging developed countries, while in Kuwait there are only 2.6 older people per 100 working-age persons.

Youth Unemployment. In all the 12 frontier markets, youth unemployment rates are high relative to the general population, especially in Europe and the Middle East, where 44 percent of young Croatians and 22 percent of young Lebanese and Bulgarians are unemployed. While African and Asian frontier economies currently lag behind Europe and the Middle East in secondary and post-secondary school enrollment, Kenya, Morocco, and Vietnam are all spending more than 6 percent of GDP on education. Paradoxically, many of the twelve countries with the highest youth unemployment rates also have the highest levels of literacy and education.

Health. Good health is critical for productivity and growth. While Nigerians have a healthy life expectancy of only 47 years, in Croatia and Lebanon the average healthy life expectancy is close to 70. Many African and Asian frontier markets lack the access to sanitation facilities necessary to improve living conditions and bolster economic growth. Nearly 40 percent of people living in Bangladesh and Pakistan and more than two-thirds of those in Nigeria and Kenya lack access to proper sanitation facilities, making them more vulnerable to the spread of communicable diseases.

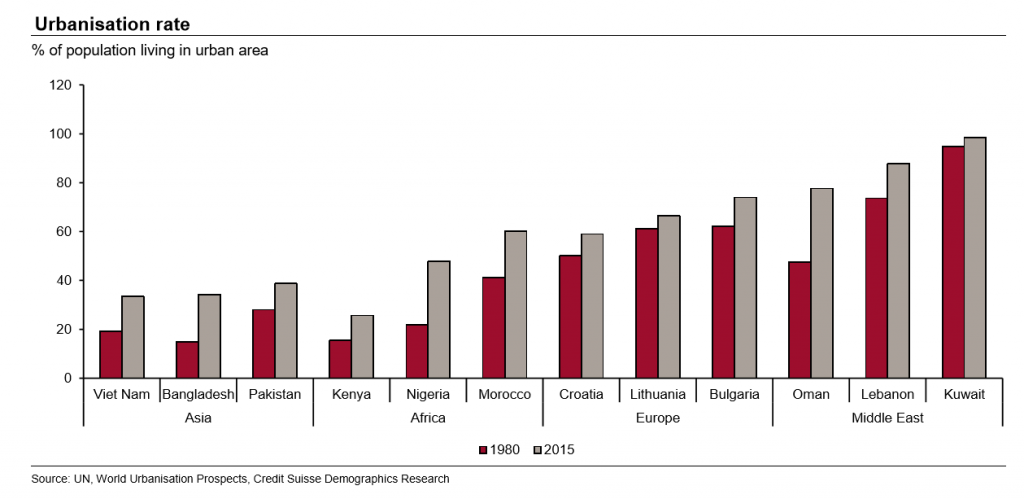

Urbanization. Urbanization can make frontier economies more productive, as cities encourage economies of scale in production and distribution, and firms tend to benefit from knowledge transfers and a larger, more diverse labor pool when they are surrounded by lots of other companies. Countries in the Middle East are the most urbanized, but the fastest urbanization is occurring in Asia and Africa. In Bangladesh and Pakistan, a significant portion of the population lives in so-called mega cities with more than 10 million residents.

Ease of Doing Business. Though Middle Eastern countries fare well on many measures of economic potential – in addition to their health and education advantages, they also have better food availability and lower crime rates than many other frontier markets – they fall behind in this area. Out of 189 countries, Kuwait and Lebanon were ranked 101st and 123rd in “ease of doing business” by the World Bank.

For all their collective potential, the many differences among frontier markets suggest varying opportunities, as well as challenges, for investors. In wealthier, more developed Middle Eastern and European frontier economies, well-educated and relatively healthy populations are major advantages, but officials must figure out how to put more young people to work. African and Asian countries have a significant amount of catching up to do in terms of health, education, and infrastructure, but investment in those areas could help them reap a demographic dividend from their young populations. Weighing each country’s potential strengths and weaknesses is critical to investing wisely. Investors who gloss over these differences and base their decisions on the “frontier markets” label alone do so at their own peril.