[unable to retrieve full-text content]In a speech to the nation just ahead of Bastille Day on July 14 celebrating the French Revolution, President Emmanuel Macron delivered a paradoxical blow to the Republic’s famous slogan: Liberté, égalité, fraternité. He announced a series of measures to speed up the pace of covid-19 vaccinations which undermine individual liberties and threaten a strong political and economic backlash.

Read More »Just Spoke To Jeff Snider About Reverse Repo! Here’s What He Said…

Check out the next Rebel Capitalist Live event at https://rebelcapitalistlive.com

Read More »90: What is that Thing’s Value Today?

Professor Sam Williamson, economic historian, explains why the value of commodities, projects and income/wealth should be properly measured across time AND IT IS NOT WITH A CPI INDEX! Otherwise, like a recent NY Times article, your worth may be off by a factor of 20!!!! --------REFERENCES-------- Measuring Worth: https://bit.ly/36TfZZD Measuring Worth Twitter: https://bit.ly/3BuZotf Measuring Worth Blog: https://bit.ly/3rqyz4R NY Times Tulsa Article: https://nyti.ms/3eKKDIR National...

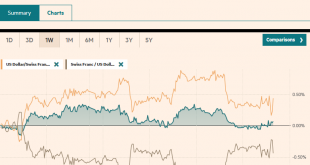

Read More »FX Daily, July 22: Enguard Lagarde

Swiss Franc The Euro has risen by 0.08% to 1.0828 EUR/CHF and USD/CHF, July 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally in US shares yesterday, ostensibly fueled by strong earnings reports, is helping to encourage risk appetites today. The MSCI Asia Pacific Index is posting its biggest gain in around two weeks, though Japan’s markets are closed today and tomorrow. The Dow Jones Stoxx 600 is...

Read More »Honey production collapses in Switzerland

A Zurich apiarist checks her bees in April © Keystone / Gaetan Bally The short spring and wet summer means Swiss bees have produced ten times less honey than usual. As a result the price of honey is set to increase. After last year’s exceptional harvest, 2021 is looking very meagre: while a hive normally produces 15-20 kilos of honey, the current figure is 0-3 kilos, Swiss public radio, RTS, reportedExternal link on Thursday. “The scarcity of honey is mainly due to...

Read More »Have We Reached “Peak Self-Glorifying Billionaire”?

Perhaps we should update Marie Antoinette’s famous quip of cluelessness to: “Let them eat space tourism.” As billionaires squander immense resources on self-glorifying space flights, the corporate media is nothing short of worshipful. Millions of average citizens, on the other hand, wish the self-glorifying billionaires had taken themselves and all the other parasitic, tax-avoiding, predatory billionaires with them on a one-way trip into space. Have we reached Peak...

Read More »Ask Bob: Withholding Taxes From Social Security

[embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation is there, CHF must Rise 2021-07-19 Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars. RRP No Collateral Coincidences As Bills Quirk, Too 2021-07-12 So much going on this week in the bond market, it actually...

Read More »Episode 22: Reimagining Physical Gold with Adam Trexler of Valaurum

Can there be innovation in physical gold? Absolutely! In our increasingly digital reality, innovation in the material world may seem a bit passé, but not to Dr. Adam Trexler, founder and President of Valaurum. Valaurum produces the Aurum® – the smallest verifiable unit of gold for investment available on the market today. Adam joined Keith and John for an invigorating discussion on what the future of gold is going to look like. “We’re at the tip of the iceberg in...

Read More »Portrait of an Evil Man: Karl Marx

In the “German Democratic Republic” they tell the story about a weary old man who tries to gain entrance into the Red Paradise. A Communist Archangel holds him up at the gate and severely cross-questions him: “Where were you born?” “In an ancient bishopric.” “What was your citizenship?” “Prussian.” “Who was your father?” “A wealthy lawyer.” “What was your faith?” “I converted to Christianity.” “Not very good. Married? Who was your wife?” “The daughter of an...

Read More »SNB-Gewinn von 5 Mrd. Franken im zweiten Quartal erwartet

Am 30. Juli publiziert die Schweizerische Nationalbank (SNB) ihr provisorisches Finanzergebnis für das zweite Quartal 2021. Die SNB dürfte nach Berechnungen der UBS für diesen Zeitraum fast 5 Mrd. CHF und für das erste Halbjahr 2021 fast 45 Mrd. CHF Gewinn ausweisen. Das Eigenkapital der SNB betrug Ende März 221 Mrd. CHF und dürfte auch Mitte Jahr im selben Bereich liegen, denn der Gewinn im zweiten Quartal entspricht in etwa den Ausschüttungen an Bund und Kantone...

Read More » SNB & CHF

SNB & CHF