The Crash Of A Lifetime Everything Has Fallen Jeff Snider | Treasury Bills #jeffsnider#treasurybills#economy#useconomy# DISCLAIMER : I am not a financial advisor. The ideas presented in this video are for entertainment purposes only. You (and only you) are responsible for the financial decisions that you make. This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the internet. All information is meant for public...

Read More »War on cash” update: A brighter outlook

Part I of II, by Claudio Grass, Switzerland For years, I’ve been following very closely all the relevant updates on the State’s war on cash. I’ve read and written a lot about all the direct and indirect efforts to restrict the citizens’ choices and make sure they shift all their transactions and savings to the digital realm, where they can be better monitored, controlled and if need be, confiscated, by central authorities. For some time now, the...

Read More »Turn Around Tuesday Began Yesterday, Likely Ends before Wednesday

Overview: Corrective pressures were evident yesterday and they extended today in Asia and Europe but seem to be running their course now. Market participants should view these developments as countertrend and be wary of waning risk appetites in North America today. Most Asia Pacific equities rallied earlier today, save China and Hong Kong. Europe’s Stoxx 600 has retraced most of yesterday’s losses and US futures are trading higher. Benchmark bond yields are softer...

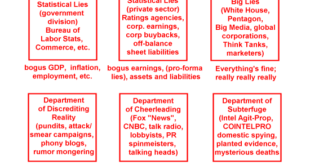

Read More »Make Sure You Download the Latest Ministry of Propaganda Updates

While it’s fun to sort all the propaganda into various boxes, we would do well to look for what all the marketers / MoP players seek to mystify. It’s time once again to check for Ministry of Propaganda updates, which like Windows and iOS is constantly being updated to counter new threats and enhance the user experience (heh). Much like the other operating systems that underpin our daily lives, the core functions of the MoP don’t change much.My chart from 2007...

Read More »Are You Attending the RPI Conference This Saturday?

The Ron Paul Institute is holding its annual conference at the Westin Washington Dulles Airport this Saturday, September 3. It stands to be another outstanding one. I have the honor and pleasure of again speaking at it. I will also be speaking at the conference’s program for young scholars the day before. The theme of this year’s conference is “Anatomy of a Police State.” As the conference’s web page states, “Authoritarianism on the march. The police state advances....

Read More »Healthcare and pensions top Swiss worry list

Health doesn’t come cheap: and the Swiss are worried about it. © Keystone / Gaetan Bally Healthcare costs, the pension system and climate change are the top three burning issues for the Swiss, according to a survey published by the Tamedia group. Covid has slipped out of sight and mind. The cost of healthcare was most pressing for over two-thirds (67%) of the 26,000 respondents, while pensions and the climate were cited by 60% and 56% respectively, wrote Tamedia...

Read More »Investment Team Addition

[embedded content] [embedded content] Tags: Featured,Markets,newsletter

Read More »Your views on female conscription

By the end of this decade, the Swiss army expects to have trouble recruiting enough personnel. So the defence department is studying the option of drafting women alongside men for military service or an alternative civilian service. We recently asked readers to send in their views on gender-neutral conscription. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international...

Read More »Swiss National Bank President Jordan warned of persistently higher inflationary pressure

Swiss National Bank President Thomas Jordan spoke at the Federal Reserve’s annual Jackson Hole symposium on Saturday. “Structural factors such as the transition to a greener economy, rising sovereign debt worldwide, the demographic transition and ultimately also the fact that globalization appears to have peaked — at least temporarily — could lead to persistently higher inflationary pressure in the coming years” “There are signs that inflation is increasingly...

Read More »Why is Inflation in USA Higher than across World? [Ep. 281, Eurodollar University]

The San Francisco Fed reveals why US consumer prices accelerated more than other nations (i.e. stimulus checks). Also, the SF Fed explains why and when prices accelerated during 2020-22 (i.e. demand collapse and surge; supply shocks). At no point was it the Fed 'money printer go brr'. ****EP. 281 REFERENCES**** Why Is U.S. Inflation Higher than in Other Countries?: https://bit.ly/3CJZgt3 How Much Do Supply and Demand Drive Inflation?: https://bit.ly/3Riu9IZ RealClear Markets Essays:...

Read More » SNB & CHF

SNB & CHF